Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne 2010

What is the Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne

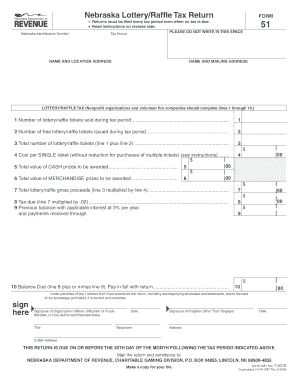

The Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne, is a specific tax form used by organizations in Nebraska that conduct lottery or raffle activities. This form is essential for reporting the income generated from such activities and ensuring compliance with state tax regulations. It is designed to help organizations accurately report their earnings and any applicable taxes owed to the state of Nebraska.

How to use the Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne

Using the Form 51 involves several steps. First, organizations must gather all relevant financial information regarding their lottery or raffle activities. This includes total ticket sales, expenses incurred, and any prizes awarded. Once this information is compiled, it can be entered into the appropriate sections of the form. After completing the form, organizations must ensure that it is signed by an authorized representative before submission to the Nebraska Department of Revenue.

Steps to complete the Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne

Completing the Form 51 requires careful attention to detail. Follow these steps:

- Collect all financial records related to the lottery or raffle.

- Fill out the form with accurate figures, including total income and expenses.

- Review the form for any errors or omissions.

- Obtain the necessary signatures from authorized individuals.

- Submit the completed form to the Nebraska Department of Revenue by the designated deadline.

Legal use of the Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne

The legal use of Form 51 is crucial for compliance with Nebraska tax laws. Organizations must file this form to report their lottery and raffle income accurately. Failure to do so can result in penalties or fines. It is important for organizations to understand the legal implications of the information they report and to ensure that all data is truthful and complete.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Form 51. Typically, the form is due on or before the 15th day of the month following the end of the organization’s fiscal year. It is advisable to check for any specific state announcements regarding deadlines, as these can vary based on legislative changes or specific events.

Required Documents

When completing the Form 51, organizations should prepare several documents to support their filing. Required documents may include:

- Financial statements detailing lottery or raffle income and expenses.

- Records of ticket sales and prize distributions.

- Any previous tax returns related to lottery or raffle activities.

Who Issues the Form

The Form 51 is issued by the Nebraska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among organizations conducting lottery or raffle activities. Organizations should refer to the Department of Revenue for any updates or changes to the form and its requirements.

Quick guide on how to complete form 51 nebraska lotteryraffle tax return revenue ne

Accomplish Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The most efficient way to edit and electronically sign Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne effortlessly

- Locate Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 51 nebraska lotteryraffle tax return revenue ne

Create this form in 5 minutes!

How to create an eSignature for the form 51 nebraska lotteryraffle tax return revenue ne

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne, is a tax return form specifically designed for reporting raffle and lottery income in Nebraska. It helps organizations comply with state tax regulations while managing their raffle activities effectively. Filing this form accurately is crucial for any organization conducting raffles in Nebraska.

-

How can airSlate SignNow help with Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

airSlate SignNow simplifies the process of completing and submitting Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne, by providing an easy-to-use eSignature platform. Our solution allows you to securely sign, send, and manage your tax documents efficiently. This ensures that you meet all deadlines and comply with tax requirements seamlessly.

-

What are the pricing options for using airSlate SignNow for Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

airSlate SignNow offers several pricing plans tailored to fit different organizational needs and budgets. Whether you're a small non-profit or a large organization, we have a cost-effective solution to help you manage Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne, and other documents. Visit our website for detailed pricing information and find the plan that suits you best.

-

Are there any features specifically designed for managing Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

Yes, airSlate SignNow includes features such as customizable templates and document tracking that can be particularly beneficial for managing Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne. These tools help ensure that your tax returns are completed accurately and filed on time. Additionally, our platform includes reminders and notifications to keep you updated on the status of your submissions.

-

Can I integrate airSlate SignNow with other tools for managing Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

Absolutely! airSlate SignNow offers integrations with various tools and software to enhance your workflow. You can connect your document management systems, CRMs, and cloud storage services, making it easier to handle Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne, alongside your other tasks and data.

-

What are the benefits of using airSlate SignNow for tax returns like Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

Using airSlate SignNow for tax forms, including Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne, streamlines the signing and submission process. Our platform ensures compliance, reduces paperwork, and saves time, allowing your organization to focus on its raffle initiatives. The security features also guarantee that your sensitive information remains protected.

-

Is it easy to learn how to use airSlate SignNow for Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to use our platform for Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne. We provide comprehensive resources, including tutorials and customer support, to help you get started quickly. You'll be able to sign and manage your tax documents in no time.

Get more for Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne

Find out other Form 51, Nebraska LotteryRaffle Tax Return Revenue Ne

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form