Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus 2021-2026

Understanding the Nebraska Form 51

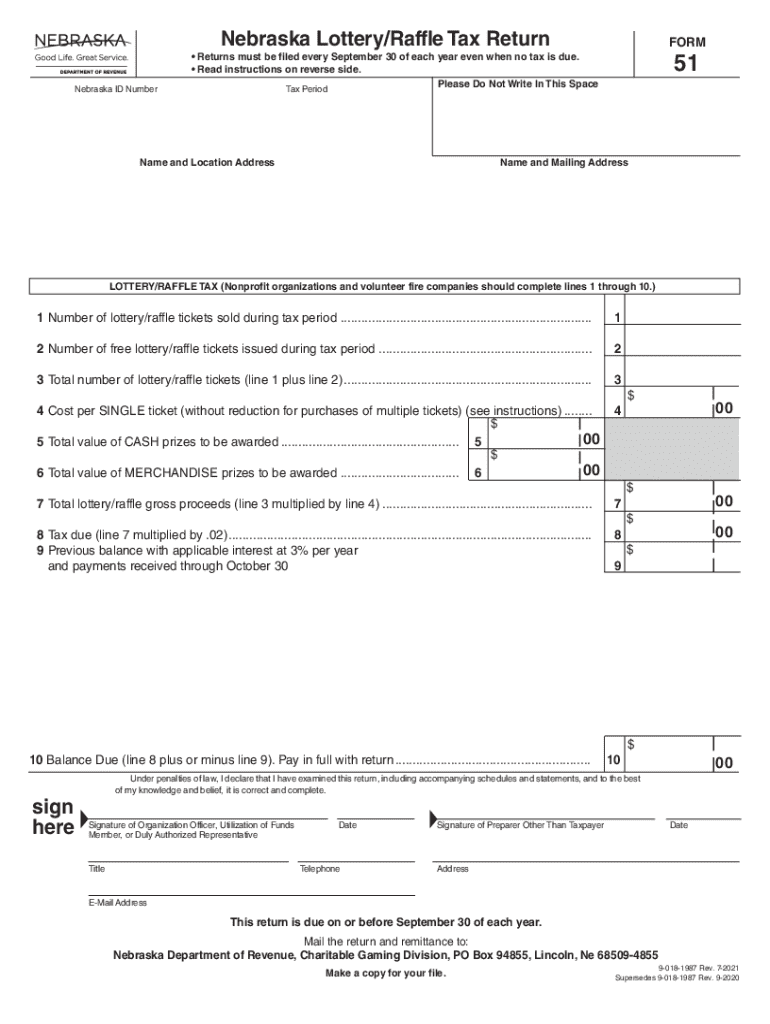

The Nebraska Form 51, also known as the Nebraska LotteryRafe Tax Return, is a crucial document for individuals who have received lottery winnings in the state of Nebraska. This form is specifically designed to report income derived from lottery prizes. It is essential for taxpayers to accurately complete this form to ensure compliance with state tax regulations.

Steps to Complete the Nebraska Form 51

Filling out the Nebraska Form 51 involves several straightforward steps:

- Gather necessary information, including your Social Security number, details of the lottery winnings, and any other income sources.

- Obtain the Nebraska Form 51 from the Nebraska Department of Revenue website or other official sources.

- Carefully fill out the form, ensuring all required fields are completed accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated filing deadline, either online, by mail, or in person.

Filing Deadlines for Nebraska Form 51

It is important to be aware of the filing deadlines associated with the Nebraska Form 51. Typically, the form must be submitted by April 15 of the year following the lottery winnings. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should always verify the specific deadline for the tax year in question to avoid penalties.

Required Documents for Nebraska Form 51

When preparing to file the Nebraska Form 51, certain documents are necessary:

- Proof of lottery winnings, such as tickets or payment statements.

- Personal identification, including your Social Security number.

- Any relevant tax documents that may affect your overall tax situation.

Having these documents ready will streamline the process and ensure accurate reporting of your lottery income.

Legal Use of the Nebraska Form 51

The Nebraska Form 51 is legally required for reporting lottery winnings. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their obligations under Nebraska law and to use this form to maintain compliance with state tax regulations.

Who Issues the Nebraska Form 51

The Nebraska Department of Revenue is responsible for issuing the Nebraska Form 51. This state agency provides guidelines and resources for taxpayers to ensure that they can complete and submit the form accurately. It is advisable to consult their official website for any updates or changes to the form or filing procedures.

Examples of Using the Nebraska Form 51

Taxpayers may encounter various scenarios where the Nebraska Form 51 is applicable:

- A resident who wins a substantial lottery prize and needs to report the income on their tax return.

- An individual who has received multiple smaller lottery winnings throughout the year.

- A taxpayer who has questions about how their lottery winnings affect their overall tax liability.

Understanding these examples can help individuals recognize when it is necessary to use the Nebraska Form 51.

Quick guide on how to complete nebraska lotteryrafe tax returnform51 returns mus

Complete Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus effortlessly on any gadget

Online document management has gained traction among companies and individuals. It offers a flawless eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, adjust, and eSign your documents rapidly without delays. Manage Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus with ease

- Obtain Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Adjust and eSign Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska lotteryrafe tax returnform51 returns mus

Create this form in 5 minutes!

How to create an eSignature for the nebraska lotteryrafe tax returnform51 returns mus

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Nebraska Form 51?

Nebraska Form 51 is a crucial document used for various legal and administrative purposes in the state of Nebraska. It is essential for businesses and individuals to understand its requirements and how to complete it accurately. airSlate SignNow simplifies the process of filling out and eSigning Nebraska Form 51, ensuring compliance and efficiency.

-

How can airSlate SignNow help with Nebraska Form 51?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning Nebraska Form 51. With its user-friendly interface, you can easily fill out the form, add necessary signatures, and manage the document workflow seamlessly. This saves time and reduces the risk of errors in the submission process.

-

What are the pricing options for using airSlate SignNow for Nebraska Form 51?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. You can choose a plan that best fits your requirements for managing Nebraska Form 51 and other documents. The cost-effective solution ensures you get the best value while streamlining your document processes.

-

Is airSlate SignNow secure for handling Nebraska Form 51?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Nebraska Form 51. The platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently eSign and manage your documents without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other applications for Nebraska Form 51?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow for Nebraska Form 51. Whether you use CRM systems, cloud storage, or other productivity tools, you can seamlessly connect them with airSlate SignNow to streamline your document management process.

-

What features does airSlate SignNow offer for Nebraska Form 51?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for Nebraska Form 51. These tools help you manage your documents more efficiently and ensure that all necessary steps are completed. The platform is designed to enhance productivity and reduce turnaround times.

-

How does eSigning Nebraska Form 51 work with airSlate SignNow?

eSigning Nebraska Form 51 with airSlate SignNow is a straightforward process. After filling out the form, you can invite signers to review and sign electronically. The platform ensures that all signatures are legally binding and securely stored, making it easy to manage your signed documents.

Get more for Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus

- Tenant landlord with form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles washington form

- Motion declaration form

- Letter from tenant to landlord about landlords failure to make repairs washington form

- Notice motion order form

- Wa landlord rent form

- Misdemeanor 497429601 form

- Statutory warranty deed with representative acknowledgment washington form

Find out other Nebraska LotteryRafe Tax ReturnFORM51 Returns Mus

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement