St 5 Form Virginia

What is the St 5 Form Virginia

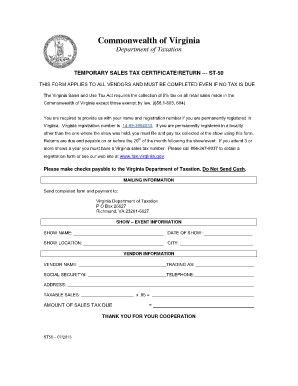

The St 5 Form Virginia is a tax document used primarily by businesses in the state of Virginia. This form serves as a declaration for sales and use tax exemption, allowing eligible entities to purchase goods or services without incurring sales tax. The St 5 Form is essential for organizations that qualify for tax-exempt status, such as non-profits, government entities, or certain educational institutions. Understanding the purpose and requirements of this form is crucial for compliance with Virginia tax laws.

Steps to Complete the St 5 Form Virginia

Completing the St 5 Form Virginia involves several key steps to ensure accuracy and compliance. First, gather necessary information, including the name and address of the purchaser, as well as the nature of the exemption. Next, accurately fill in the details regarding the type of goods or services being purchased. It is important to sign and date the form to validate the exemption claim. Finally, provide the completed form to the seller at the time of purchase to avoid sales tax charges.

Legal Use of the St 5 Form Virginia

The legal use of the St 5 Form Virginia is governed by state tax regulations. To be valid, the form must be filled out completely and accurately, reflecting the purchaser's eligibility for tax exemption. Misuse of the form, such as claiming exemptions without proper qualification, can result in penalties. It is essential for businesses to understand the legal implications of using the St 5 Form to avoid potential compliance issues with the Virginia Department of Taxation.

How to Obtain the St 5 Form Virginia

The St 5 Form Virginia can be obtained directly from the Virginia Department of Taxation's website or through authorized tax professionals. The form is typically available in a downloadable PDF format, making it easy for users to print and complete. Additionally, businesses may request physical copies from local tax offices if needed. Ensuring that you have the most current version of the form is vital for compliance.

Form Submission Methods

The St 5 Form Virginia can be submitted in various ways, including in-person, by mail, or electronically, depending on the seller's policies. When submitting in person, the form should be presented at the point of sale. For mail submissions, ensure that the form is sent to the appropriate address provided by the seller. Some businesses may also accept electronic submissions, which can streamline the process and enhance efficiency.

Key Elements of the St 5 Form Virginia

Key elements of the St 5 Form Virginia include the purchaser's name, address, the type of exemption claimed, and a description of the goods or services being purchased. Additionally, the form requires the purchaser's signature and the date of the transaction. These elements are crucial for validating the tax-exempt status and ensuring compliance with state regulations.

Quick guide on how to complete st 5 form virginia

Effortlessly prepare St 5 Form Virginia on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for standard printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, change, and eSign your documents swiftly without delays. Manage St 5 Form Virginia on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign St 5 Form Virginia with ease

- Acquire St 5 Form Virginia and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant parts of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Develop your eSignature using the Sign tool, which takes moments and carries the same legal significance as a traditional ink signature.

- Review all the information and click the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Alter and eSign St 5 Form Virginia and ensure optimal communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 5 form virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 5 form Virginia?

The ST 5 form Virginia is a sales and use tax exemption certificate that allows qualifying purchasers to buy goods without paying sales tax. This form is essential for organizations and businesses that meet specific criteria and want to save on tax expenses. By utilizing the ST 5 form Virginia, you can streamline your purchasing process and ensure compliance with state regulations.

-

How can airSlate SignNow help with the ST 5 form Virginia?

airSlate SignNow provides an easy-to-use eSigning solution that simplifies the process of completing and submitting the ST 5 form Virginia. With the platform, you can quickly fill out, sign, and send this important tax exemption form electronically, saving both time and resources. Its user-friendly interface makes it ideal for businesses of any size looking to manage their documentation efficiently.

-

Are there any costs associated with using airSlate SignNow for the ST 5 form Virginia?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, which include access to features for managing the ST 5 form Virginia and other documents. While there may be a subscription fee, many users find the cost-effective solution worth the investment due to time savings and increased efficiency. Detailed pricing information is available on the airSlate SignNow website.

-

What features does airSlate SignNow offer for managing the ST 5 form Virginia?

airSlate SignNow includes features such as template creation, real-time tracking, and secure cloud storage, making it easy to manage the ST 5 form Virginia and other documents. These features are designed to enhance your workflow, allowing you to send, sign, and store forms efficiently. Additionally, the platform supports document collaboration, enabling teams to work together seamlessly.

-

Can airSlate SignNow integrate with other software for managing the ST 5 form Virginia?

Absolutely! airSlate SignNow offers integrations with popular software applications such as Salesforce, Google Drive, and Dropbox, facilitating the management of the ST 5 form Virginia and enhancing your workflow. These integrations allow businesses to streamline their processes and maintain a cohesive tech ecosystem. This ensures that all necessary documents can be accessed and handled in one place.

-

Is airSlate SignNow compliant with Virginia's regulations for the ST 5 form?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that your use of the ST 5 form Virginia meets all necessary legal requirements. The platform employs secure encryption and other best practices to protect sensitive information, which is vital for tax-related documents. Users can have peace of mind knowing they are using a compliant solution for their documentation needs.

-

How does airSlate SignNow improve the process of completing the ST 5 form Virginia?

By utilizing airSlate SignNow, businesses can signNowly improve the efficiency of completing the ST 5 form Virginia through electronic signature capabilities and automated workflows. This reduces manual errors, speeds up processing time, and allows for better tracking of document status. The ease of use and mobile accessibility also empower users to manage their forms on the go.

Get more for St 5 Form Virginia

- Form fv16 claimantamp39s certification of out of pocket expenses veteransaidbenefit

- Membership ledger form

- Contractor annual authorization brevard county form

- Form 401 a

- Cbp form 7523 2014

- Kaiser cal cobra form

- Selleramp39s property disclosure statement buyandsellwithbillcom form

- Introduction to sports medicine and athletic training google cdc form

Find out other St 5 Form Virginia

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple