Ilife Mileage Log Form

What is the ilife mileage log

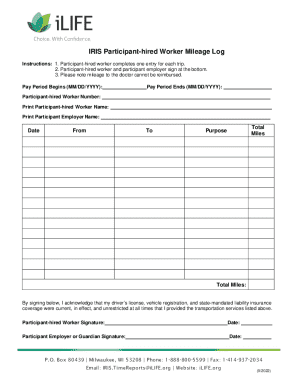

The ilife mileage log is a documentation tool used to record business-related vehicle use for tax purposes. This log helps individuals and businesses track their mileage accurately, ensuring compliance with IRS regulations. It captures essential details such as the date of travel, starting and ending odometer readings, purpose of the trip, and the total distance traveled. Maintaining a precise mileage log can lead to significant tax deductions, making it a valuable resource for self-employed individuals and businesses alike.

Steps to complete the ilife mileage log

Completing the ilife mileage log involves several straightforward steps to ensure accuracy and compliance. Start by gathering necessary information, including the date of each trip, starting and ending odometer readings, and the purpose of travel. Next, record this information systematically in the log. It is essential to update the log regularly, ideally after each trip, to prevent missing any details. Finally, review the completed log for accuracy before submitting it with your tax documents.

Legal use of the ilife mileage log

To ensure the ilife mileage log is legally compliant, it must adhere to IRS guidelines. The log should be maintained contemporaneously, meaning it should be updated in real-time rather than retroactively. Accurate records help substantiate any mileage deductions claimed on tax returns. It is also important to keep the log for at least three years, as the IRS may request it for verification during an audit. By following these guidelines, users can ensure their mileage log is legally sound.

IRS Guidelines

The IRS provides specific guidelines for maintaining a mileage log, which are crucial for taxpayers seeking deductions. According to IRS Publication 463, taxpayers must keep a detailed record that includes the date, mileage, and purpose of each trip. The IRS also recommends using a reliable method for tracking mileage, whether through a physical logbook or digital applications. Adhering to these guidelines can help taxpayers maximize their deductions and avoid potential disputes with the IRS.

Examples of using the ilife mileage log

There are various scenarios in which the ilife mileage log can be beneficial. For instance, a self-employed consultant may use the log to track travel between client meetings, ensuring they can claim deductions for business-related mileage. Similarly, a small business owner might record trips to purchase supplies or attend networking events. Each entry in the log serves as documentation to support tax deductions, making it an essential tool for effective financial management.

Form Submission Methods (Online / Mail / In-Person)

Submitting the ilife mileage log can be done through various methods, depending on the user's preference and requirements. For online submissions, many tax software programs allow users to input mileage directly into their tax returns. Alternatively, users may choose to print the log and submit it via mail along with their tax documents. In-person submissions are also an option, particularly for those who prefer to discuss their filings with a tax professional. Each method has its advantages, allowing users to select the one that best fits their needs.

Quick guide on how to complete ilife mileage log

Manage Ilife Mileage Log effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Ilife Mileage Log across any platform with airSlate SignNow’s Android or iOS applications and enhance your document-related processes today.

How to alter and eSign Ilife Mileage Log effortlessly

- Find Ilife Mileage Log and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Ilife Mileage Log while ensuring excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ilife mileage log

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ilife forms and how do they work with airSlate SignNow?

ilife forms are customizable digital forms that allow businesses to collect information efficiently. With airSlate SignNow, these forms can be easily integrated into your workflow, enabling seamless data collection and document signing. This streamlines your processes and enhances overall productivity.

-

Can I integrate ilife forms with other platforms?

Yes, airSlate SignNow allows for integrations with a variety of platforms, making it easy to connect ilife forms with your existing tools. This ensures a smooth flow of data across different applications, enhancing your operational efficiency. You can integrate with popular CRMs, email services, and more.

-

What features do ilife forms offer in airSlate SignNow?

ilife forms include features such as customizable fields, conditional logic, and automated notifications. These functionalities enhance user experience and ensure that you collect all necessary information without hassle. airSlate SignNow makes it easy to create and manage these forms.

-

Is there a free trial available for airSlate SignNow with ilife forms?

Yes, airSlate SignNow offers a free trial that allows you to explore the functionality of ilife forms. This trial period helps you understand how the tool can benefit your business without any financial commitment. You can experience firsthand the ease of sending and signing documents using ilife forms.

-

What are the pricing options for airSlate SignNow with ilife forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Each plan includes access to ilife forms along with eSigning and document management features. You can choose a plan that fits your budget and meets your business needs.

-

How do ilife forms improve document management?

By using ilife forms within airSlate SignNow, businesses can signNowly enhance their document management processes. The forms streamline data collection and automatically organize information in your system. This minimizes manual error and makes retrieval of information quick and easy.

-

Are ilife forms secure in airSlate SignNow?

Yes, airSlate SignNow ensures that ilife forms are secure, providing encryption and compliance with industry standards. Your data is protected throughout the signing and submission process, ensuring confidentiality and integrity. Security features are a top priority for us to keep your information safe.

Get more for Ilife Mileage Log

Find out other Ilife Mileage Log

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF