Mortgage Application Intake Form Citi

What is the Mortgage Application Intake Form Citi

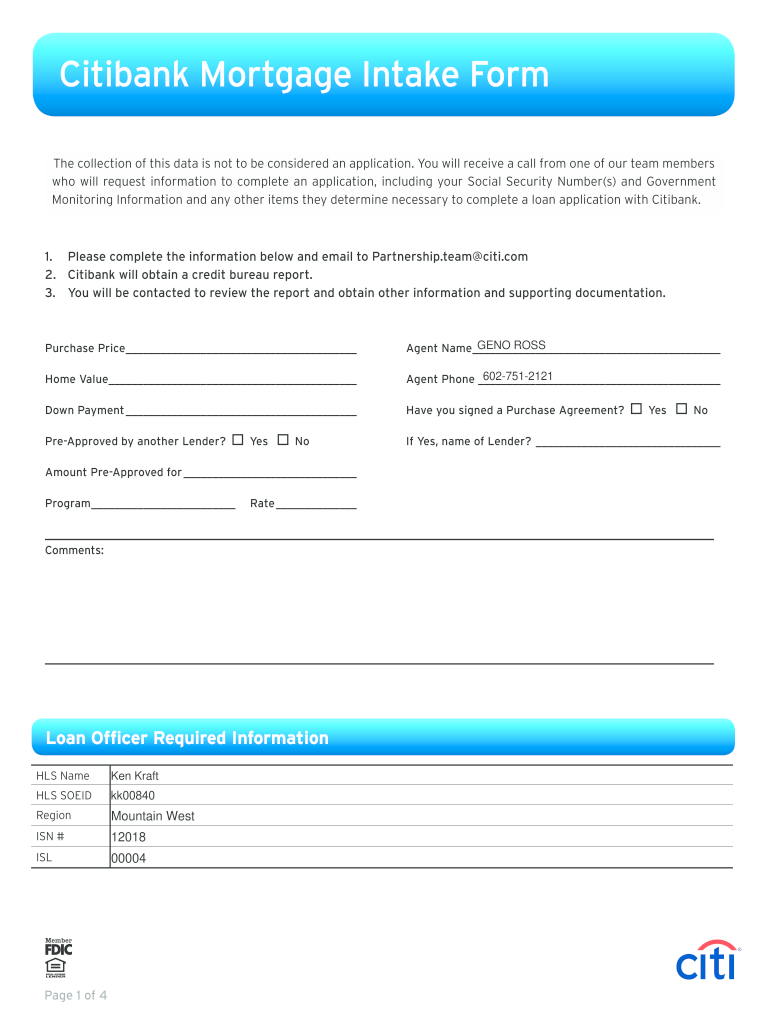

The Mortgage Application Intake Form Citi is a crucial document used by individuals seeking to apply for a mortgage through Citi. This form collects essential information about the applicant's financial status, employment history, and property details. By providing accurate and comprehensive information, applicants can facilitate the mortgage approval process. The form is designed to ensure that all necessary data is gathered to assess the applicant's eligibility for a mortgage loan.

Steps to Complete the Mortgage Application Intake Form Citi

Completing the Mortgage Application Intake Form Citi involves several key steps:

- Gather Necessary Documents: Collect financial documents such as pay stubs, tax returns, and bank statements.

- Fill Out Personal Information: Provide your name, address, and contact details accurately.

- Detail Employment History: Include your current and previous employment information, including job titles and duration of employment.

- Disclose Financial Information: Report your income, debts, and assets to give a complete picture of your financial situation.

- Review and Submit: Carefully review the completed form for accuracy before submitting it to Citi.

Legal Use of the Mortgage Application Intake Form Citi

The Mortgage Application Intake Form Citi is legally binding when completed correctly. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal issues or denial of the mortgage application. The use of electronic signatures on this form is recognized under U.S. law, provided that the signer has consented to use electronic records and signatures. Compliance with applicable laws, such as the ESIGN Act and UETA, ensures that the form is valid and enforceable.

Key Elements of the Mortgage Application Intake Form Citi

Several key elements are essential to the Mortgage Application Intake Form Citi:

- Personal Information: Name, address, Social Security number, and contact information.

- Employment Details: Current and past employment information, including employer names and job titles.

- Financial Information: Income sources, monthly debts, and assets, such as bank accounts and investments.

- Property Information: Details about the property being purchased or refinanced, including address and estimated value.

- Declarations: Questions regarding legal issues, such as bankruptcy or foreclosure history.

How to Obtain the Mortgage Application Intake Form Citi

The Mortgage Application Intake Form Citi can be obtained through various channels. Applicants can visit the official Citi website to download the form or access it through their online banking portal. Additionally, individuals can request a physical copy by contacting a local Citi branch or customer service representative. It is advisable to ensure that the most current version of the form is used to avoid any potential issues during the application process.

Form Submission Methods for the Mortgage Application Intake Form Citi

Once the Mortgage Application Intake Form Citi is completed, it can be submitted through several methods:

- Online Submission: Applicants can upload the completed form directly through the Citi online portal.

- Mail: The form can be printed and mailed to the designated address provided by Citi.

- In-Person: Applicants may also choose to visit a local Citi branch to submit the form in person.

Quick guide on how to complete mortgage application intake form citi

Effortlessly Prepare Mortgage Application Intake Form Citi on Any Device

Web-based document management has become quite popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Mortgage Application Intake Form Citi on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Mortgage Application Intake Form Citi effortlessly

- Obtain Mortgage Application Intake Form Citi and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or redact sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, laborious form searching, or errors requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Mortgage Application Intake Form Citi and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage application intake form citi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the citimortgage app and how does it work?

The citimortgage app is a user-friendly platform that allows you to securely manage your mortgage documents. It enables users to eSign documents and send them efficiently through airSlate SignNow, streamlining the mortgage process.

-

What features does the citimortgage app offer?

The citimortgage app includes features such as document eSigning, real-time tracking of document status, and advanced security measures. These features help ensure a smooth and secure process when handling your mortgage paperwork.

-

Is the citimortgage app cost-effective?

Yes, the citimortgage app is designed to be cost-effective, providing excellent value for managing your mortgage documentation. With airSlate SignNow, you can reduce costs associated with paper printing and mailing.

-

How can I integrate the citimortgage app with other tools?

The citimortgage app easily integrates with various software solutions like CRM systems and cloud storage services. This enables seamless workflow management, ensuring you can access all your tools in one place.

-

What are the benefits of using the citimortgage app for eSigning?

Using the citimortgage app for eSigning provides signNow benefits, including increased efficiency and reduced turnaround time for document approvals. It also enhances security, ensuring that your sensitive information is protected.

-

Can I use the citimortgage app on mobile devices?

Yes, the citimortgage app is compatible with mobile devices, allowing you to manage your mortgage documents anytime, anywhere. This flexibility helps you stay connected and on top of your mortgage tasks.

-

What types of documents can I manage with the citimortgage app?

With the citimortgage app, you can manage various mortgage-related documents, including loan agreements, disclosure forms, and tax documents. This comprehensive approach helps keep all your necessary paperwork organized.

Get more for Mortgage Application Intake Form Citi

- City of fowler business license application the city of fowler fowlercity form

- Pay business tax certificate form

- Dan mckenzie community garden form

- Business license tax appl pg 1 revised 2013 city of lawndale form

- Modesto fire explorer program form

- Stanislaus foundation dental insurance form

- Glen eira busking permit form

- Suicide and self harm risk assessment form

Find out other Mortgage Application Intake Form Citi

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent