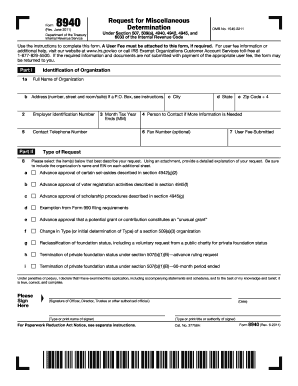

Form 8940

What is the Form 8940

The Form 8940, officially known as the IRS Form 8940, is a tax document used primarily by organizations to request a tax exemption under section 501(c)(3) of the Internal Revenue Code. This form is essential for nonprofits seeking to establish their tax-exempt status and is a critical step in ensuring compliance with federal regulations. By submitting Form 8940, organizations can demonstrate their eligibility for tax exemptions, which can significantly impact their fundraising capabilities and operational costs.

How to use the Form 8940

Using Form 8940 involves several key steps to ensure proper completion and submission. First, organizations should gather all necessary information, including details about their mission, activities, and financial data. Next, they will need to accurately fill out the form, ensuring that all sections are completed according to IRS guidelines. It's crucial to review the form for accuracy before submission, as any errors could delay the approval process. Once completed, the form can be submitted electronically or via mail, depending on the organization’s preference and the specific instructions provided by the IRS.

Steps to complete the Form 8940

Completing the Form 8940 requires careful attention to detail. Here are the steps to follow:

- Gather all required documents, including financial statements and organizational bylaws.

- Fill out the form, starting with basic information about the organization, such as its name and address.

- Provide detailed descriptions of the organization's activities and how they align with tax-exempt purposes.

- Include financial information, such as income and expenses, to demonstrate the organization's operational status.

- Review the completed form for accuracy and completeness.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Form 8940

The legal use of Form 8940 is governed by IRS regulations, which stipulate that the form must be used by organizations seeking tax-exempt status under section 501(c)(3). To ensure legal compliance, organizations must accurately represent their activities and financial status on the form. Misrepresentation or failure to comply with IRS requirements can lead to penalties, including the revocation of tax-exempt status. Therefore, it is vital for organizations to understand the legal implications of their submissions and maintain accurate records to support their claims.

Filing Deadlines / Important Dates

Filing deadlines for Form 8940 can vary based on the organization's fiscal year. Generally, organizations must submit the form by the 15th day of the fifth month after the end of their fiscal year. For those operating on a calendar year, this typically means a deadline of May 15. It is essential to be aware of these deadlines to avoid late fees or penalties. Organizations should also keep track of any changes in IRS regulations that may affect filing dates.

Required Documents

When completing Form 8940, several documents are required to support the application for tax-exempt status. These include:

- Organizational bylaws and articles of incorporation.

- Financial statements for the previous three years.

- A detailed description of the organization's activities and programs.

- Any relevant contracts or agreements that pertain to the organization's operations.

Having these documents ready can streamline the completion process and help ensure that the form is submitted correctly.

Quick guide on how to complete form 8940

Complete Form 8940 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without issues. Manage Form 8940 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 8940 with ease

- Locate Form 8940 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your PC.

Don't worry about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Form 8940 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8940

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8940 and why do I need it?

Form 8940 is a request for the waiver of the filing requirement for certain exemptions. It is important for organizations seeking to simplify their tax processes. By using airSlate SignNow to complete and submit form 8940, you can ensure compliance with all IRS requirements efficiently.

-

How can airSlate SignNow help me with completing form 8940?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out form 8940. With easy document preparation, you can quickly gather the necessary information and complete the form electronically, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow to handle form 8940?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you're a small business or a large organization, you can choose a plan that allows you to efficiently manage documents like form 8940 without exceeding your budget.

-

Is it easy to integrate airSlate SignNow with my existing systems for form 8940?

Yes, airSlate SignNow is designed for seamless integrations with various applications, making it easy to access and manage form 8940 within your current workflow. Our integration options streamline your processes, ensuring that you can send and sign forms without disruptions.

-

Are there any features in airSlate SignNow specifically for managing form 8940?

Absolutely! airSlate SignNow includes features such as customizable templates, collaboration tools, and tracking capabilities specifically designed to assist in managing form 8940. These features help ensure that your documentation is accurate and submitted on time.

-

Can I track the status of my submitted form 8940 using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features for monitoring the status of your submitted form 8940. This allows you to stay informed about progress and ensures that all necessary approvals are secured promptly.

-

What are the benefits of using airSlate SignNow for form 8940 over traditional methods?

Using airSlate SignNow for form 8940 offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security features. This modern approach minimizes the risk of errors and simplifies the entire process, making it easier for your organization to remain compliant.

Get more for Form 8940

- Office of us senator marco rubio form

- Mttb strategy session document senior coach tiji thomas form

- Kairos check request form

- Generic employment application 2016 2019 form

- General instructions for state form 13342 indiana adoption medical history registry

- Material submittal form aldot dot state al

- Westchester prep request form

- Rmv of mass 2014 2019 form

Find out other Form 8940

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT