8938 Form 2011

What is the 8938 Form

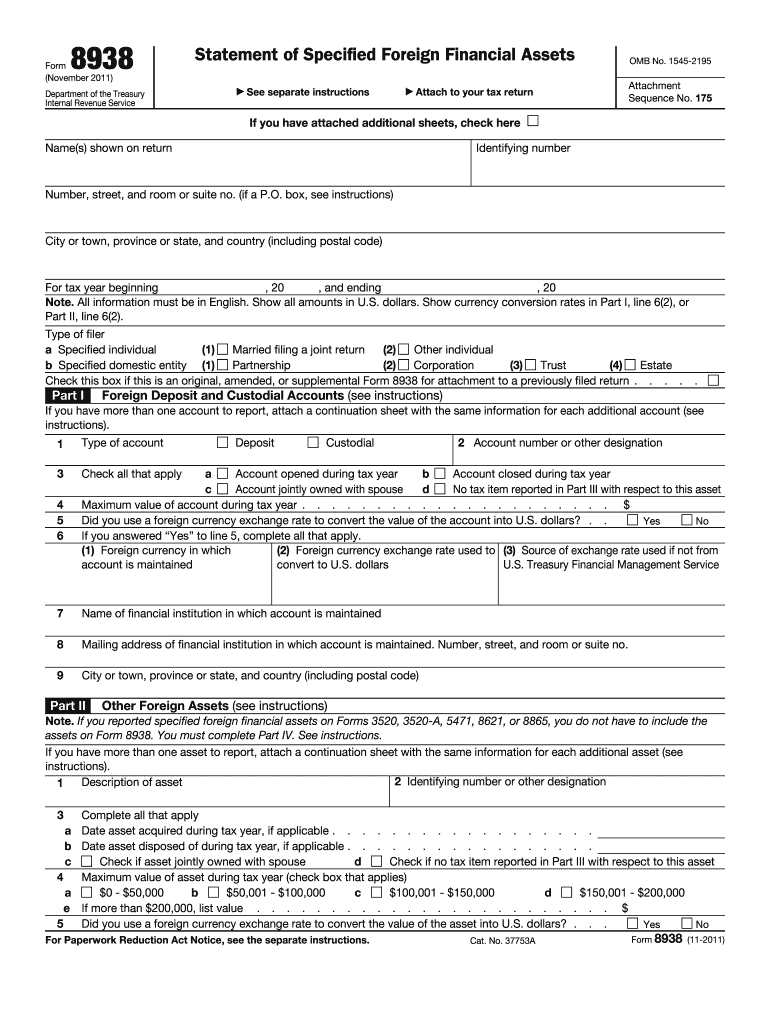

The 8938 Form, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is used to report specified foreign financial assets if the total value exceeds certain thresholds. It is essential for individuals who have foreign bank accounts, investment accounts, or other foreign assets to ensure compliance with U.S. tax laws. The form is part of the IRS's efforts to combat tax evasion and ensure transparency regarding foreign financial holdings.

How to use the 8938 Form

Using the 8938 Form involves several steps to ensure accurate reporting of foreign financial assets. Taxpayers must first determine if they meet the reporting requirements based on their filing status and the total value of their specified foreign financial assets. If required to file, taxpayers will need to complete the form by providing detailed information about each asset, including the type of asset, the maximum value during the tax year, and the income generated from these assets. It is crucial to provide accurate information to avoid penalties for non-compliance.

Steps to complete the 8938 Form

Completing the 8938 Form involves a systematic approach:

- Determine your filing obligation based on your total foreign financial assets.

- Gather necessary information about each specified foreign financial asset, including account numbers and financial institution details.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- File the completed form with your annual tax return.

Legal use of the 8938 Form

The legal use of the 8938 Form is governed by U.S. tax laws, specifically under the provisions of the Foreign Account Tax Compliance Act (FATCA). Taxpayers must file this form to disclose their foreign financial assets to the IRS, ensuring compliance with U.S. tax regulations. The form serves as a legal document that can be used by the IRS to assess tax liabilities and enforce penalties for non-compliance. Properly completing and filing the form is essential for maintaining legal standing with the IRS.

Filing Deadlines / Important Dates

The filing deadline for the 8938 Form generally aligns with the annual tax return deadline, which is typically April 15th for most taxpayers. However, if additional time is needed, taxpayers can file for an extension, which may extend the deadline to October 15th. It is important to keep track of these deadlines to avoid late filing penalties. Additionally, taxpayers residing outside the U.S. may have different deadlines based on their circumstances.

Penalties for Non-Compliance

Failure to file the 8938 Form when required can result in significant penalties. The IRS imposes a penalty of $10,000 for failure to disclose foreign financial assets, with additional penalties accruing for continued non-compliance. If the IRS determines that the failure to file was due to willful neglect, penalties can escalate to 40 percent of the unpaid tax liability associated with the undisclosed assets. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete 2011 8938 form

Effortlessly complete 8938 Form on any device

The management of documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily access the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle 8938 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Steps to modify and eSign 8938 Form effortlessly

- Locate 8938 Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools offered by airSlate SignNow specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether it be via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 8938 Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 8938 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 8938 form

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 8938 Form and why is it necessary?

The 8938 Form is required by the IRS for U.S. taxpayers to report their foreign financial assets. It is part of the Foreign Account Tax Compliance Act (FATCA) and helps ensure compliance with U.S. tax laws. Properly filing the 8938 Form is essential to avoid penalties and ensure transparent reporting of foreign investments.

-

How can airSlate SignNow help with the 8938 Form?

airSlate SignNow streamlines the process of completing and submitting your 8938 Form electronically. By providing easy access to eSignatures, it simplifies gathering signatures from necessary parties. This efficiency can save time and reduce the stress often associated with tax filing.

-

Is there a cost associated with using airSlate SignNow for the 8938 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there may be a nominal fee, the benefits of expedited eSigning and document management often outweigh the costs, especially for crucial filings like the 8938 Form.

-

What features of airSlate SignNow are beneficial for completing the 8938 Form?

Key features of airSlate SignNow include customizable templates, secure document storage, and easy eSigning capabilities. These tools allow users to efficiently manage their 8938 Form filings while ensuring compliance and protecting sensitive information.

-

Can airSlate SignNow integrate with other tax software for filing the 8938 Form?

Yes, airSlate SignNow can seamlessly integrate with various tax software programs. This integration facilitates a smoother workflow for users needing to complete the 8938 Form, as it allows for easy transfer of data between platforms.

-

How does airSlate SignNow ensure the security of my 8938 Form information?

airSlate SignNow prioritizes security by implementing strong encryption protocols and secure user authentication. This ensures that all sensitive information related to the 8938 Form is safeguarded throughout the eSigning process.

-

What kind of support does airSlate SignNow provide for 8938 Form users?

airSlate SignNow offers extensive customer support, including live chat, email assistance, and thorough documentation. Users filling out the 8938 Form can obtain guidance and clarification, helping them navigate the complexities of the form.

Get more for 8938 Form

Find out other 8938 Form

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later