Form CT 1 Employer's Annual Railroad Retirement Tax Return 2016

What is the Form CT 1 Employer's Annual Railroad Retirement Tax Return

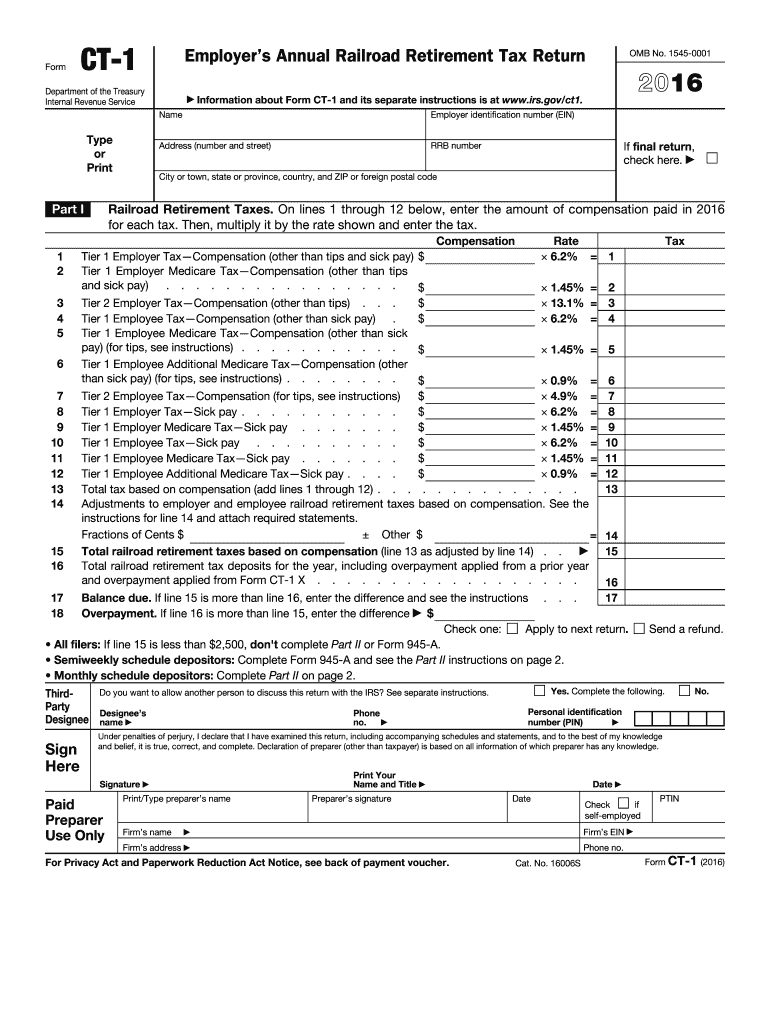

The Form CT 1 Employer's Annual Railroad Retirement Tax Return is a crucial document required by the Railroad Retirement Board (RRB) for employers in the railroad industry. This form is used to report the employer's share of railroad retirement taxes, which fund various benefits for railroad workers. It includes information about wages paid, taxes withheld, and any adjustments necessary for the reporting period. Understanding this form is essential for compliance with federal regulations and ensuring that employees receive their entitled benefits.

How to use the Form CT 1 Employer's Annual Railroad Retirement Tax Return

Using the Form CT 1 involves several steps to ensure accurate reporting. Employers must gather all necessary payroll information, including total wages and taxes withheld for the year. The form requires detailed entries, such as the number of employees and the total amount of railroad retirement taxes owed. After completing the form, employers must review it for accuracy before submitting it to the RRB. Utilizing digital tools can simplify this process, allowing for easier data entry and error checking.

Steps to complete the Form CT 1 Employer's Annual Railroad Retirement Tax Return

Completing the Form CT 1 involves a systematic approach:

- Gather payroll records for the reporting year, including wages and taxes.

- Fill out the form with accurate employee counts and tax amounts.

- Double-check all entries for accuracy to avoid penalties.

- Sign and date the form, ensuring that it is completed by an authorized representative.

- Submit the form electronically or via mail to the appropriate RRB office.

Legal use of the Form CT 1 Employer's Annual Railroad Retirement Tax Return

The legal use of the Form CT 1 is governed by federal regulations that mandate accurate reporting of railroad retirement taxes. Employers must ensure compliance with these regulations to avoid potential legal repercussions, including fines or audits. The form serves as a legal document that can be referenced in case of disputes regarding tax liabilities or employee benefits. Proper completion and timely submission are essential to uphold the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 1 are typically set by the Railroad Retirement Board. Employers must submit the form annually, with specific due dates that may vary each year. It is crucial to keep track of these deadlines to avoid late fees or penalties. Generally, the form is due by the end of January following the tax year. Staying informed about these important dates helps ensure compliance and timely processing of the form.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 1 can be submitted through various methods, offering flexibility for employers. Options include:

- Online Submission: Many employers prefer to submit the form electronically through the RRB's online portal, which streamlines processing.

- Mail Submission: Employers can also print the completed form and send it via postal service to the designated RRB office.

- In-Person Submission: For those who prefer direct interaction, submitting the form in person at an RRB office is an option.

Quick guide on how to complete 2016 form ct 1 employers annual railroad retirement tax return

Effortlessly Prepare Form CT 1 Employer's Annual Railroad Retirement Tax Return on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as it allows you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents quickly and without delays. Handle Form CT 1 Employer's Annual Railroad Retirement Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Form CT 1 Employer's Annual Railroad Retirement Tax Return with Ease

- Find Form CT 1 Employer's Annual Railroad Retirement Tax Return and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact confidential information with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or shareable link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing out new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form CT 1 Employer's Annual Railroad Retirement Tax Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form ct 1 employers annual railroad retirement tax return

Create this form in 5 minutes!

How to create an eSignature for the 2016 form ct 1 employers annual railroad retirement tax return

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form CT 1 Employer's Annual Railroad Retirement Tax Return?

Form CT 1 Employer's Annual Railroad Retirement Tax Return is a federal tax form used by employers in the railroad industry to report taxes related to employee retirement. It is essential for employers to accurately complete and submit this form to maintain compliance with federal tax regulations and ensure the proper funding of retirement benefits.

-

How can airSlate SignNow assist with the completion of Form CT 1 Employer's Annual Railroad Retirement Tax Return?

airSlate SignNow simplifies the process of preparing Form CT 1 Employer's Annual Railroad Retirement Tax Return by providing an intuitive platform for document management and eSigning. Users can easily create, send, and sign the form digitally, which helps streamline the submission process and improve efficiency.

-

Is there a cost associated with using airSlate SignNow for Form CT 1?

Yes, airSlate SignNow offers various pricing plans that are competitive and tailored to different business needs. This affordability allows businesses of all sizes to utilize the platform for managing Form CT 1 Employer's Annual Railroad Retirement Tax Return and other essential documents without incurring high costs.

-

What features does airSlate SignNow provide for handling Form CT 1?

Key features of airSlate SignNow include customizable templates, a user-friendly interface, and advanced security measures. These features enhance the processing of Form CT 1 Employer's Annual Railroad Retirement Tax Return, making it easier to create, fill out, and send the form securely.

-

Are there any integrations available for airSlate SignNow related to Form CT 1?

airSlate SignNow offers integrations with various third-party applications and software, enhancing its functionality for handling Form CT 1 Employer's Annual Railroad Retirement Tax Return. This means users can seamlessly connect with their existing systems, ensuring a smooth workflow and data management.

-

What benefits can businesses expect when using airSlate SignNow for Form CT 1?

Businesses can expect a more streamlined and efficient process when using airSlate SignNow for Form CT 1 Employer's Annual Railroad Retirement Tax Return. The platform reduces the time spent on paperwork, minimizes the risk of errors, and facilitates quick document exchange through secure eSigning.

-

Can airSlate SignNow help ensure compliance with the submission of Form CT 1?

Absolutely! By using airSlate SignNow, businesses can ensure compliance with the requirements for Form CT 1 Employer's Annual Railroad Retirement Tax Return through automated reminders and auditing features. This helps keep track of deadlines and ensures that all necessary information is accurately submitted on time.

Get more for Form CT 1 Employer's Annual Railroad Retirement Tax Return

- Florida seller form

- Fl purchaser form

- Limited power of attorney where you specify powers with sample powers included florida form

- Limited power of attorney for stock transactions and corporate powers florida form

- Special durable power of attorney for bank account matters florida form

- Florida small business startup package florida form

- Florida property 497303434 form

- Florida annual corporation form

Find out other Form CT 1 Employer's Annual Railroad Retirement Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors