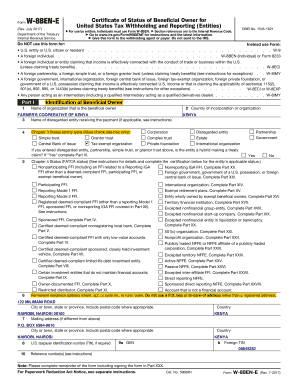

Form W 8BEN E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

What is the Form W-8BEN-E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

The Form W-8BEN-E Rev July is a crucial document used by foreign entities to certify their status as beneficial owners for U.S. tax withholding and reporting purposes. This form is essential for entities that receive income from U.S. sources, as it helps establish their eligibility for reduced withholding rates under applicable tax treaties. By providing this certificate, foreign entities can avoid higher withholding tax rates that may apply to non-resident aliens and foreign corporations.

Steps to Complete the Form W-8BEN-E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

Completing the Form W-8BEN-E requires careful attention to detail to ensure compliance with IRS regulations. Here are the steps to follow:

- Obtain the Form: Download the latest version of the form from the IRS website to ensure you are using the correct version.

- Provide Entity Information: Fill in the name of the organization, country of incorporation, and address. Ensure that the information matches official documents.

- Claim Tax Treaty Benefits: If applicable, indicate the country of residence and the specific tax treaty provisions that apply.

- Provide Certification: Ensure that an authorized representative of the entity signs and dates the form to validate it.

- Submit the Form: Send the completed form to the withholding agent or financial institution requesting it, not directly to the IRS.

Legal Use of the Form W-8BEN-E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

The legal use of the Form W-8BEN-E is vital for foreign entities to comply with U.S. tax laws. This form serves as a declaration of the entity's status and ensures that the appropriate withholding tax rates are applied. By accurately completing and submitting this form, entities can protect themselves from excessive tax liabilities and potential penalties for non-compliance. It is important to keep a copy of the submitted form for record-keeping and future reference.

IRS Guidelines for the Form W-8BEN-E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

The IRS provides specific guidelines for completing the Form W-8BEN-E. These guidelines outline the necessary information required, including the entity's classification and the purpose of the form. It is essential to adhere to these guidelines to ensure the form is accepted and to minimize the risk of audits or inquiries from the IRS. Entities should regularly review IRS publications and updates regarding the form to remain compliant with any changes in tax regulations.

Required Documents for the Form W-8BEN-E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

To complete the Form W-8BEN-E, certain documents may be required to support the information provided. These may include:

- Proof of entity status, such as articles of incorporation or partnership agreements.

- Tax identification numbers from the entity's home country.

- Documentation supporting claims for reduced withholding rates under tax treaties.

Having these documents ready can facilitate the completion process and ensure accuracy in the information submitted.

Examples of Using the Form W-8BEN-E Rev July Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities

Foreign entities may use the Form W-8BEN-E in various scenarios, such as:

- Receiving dividends from U.S. corporations.

- Engaging in business transactions with U.S. companies.

- Collecting royalties from U.S. intellectual property.

In each case, the form serves to establish the entity's beneficial ownership and eligibility for tax treaty benefits, thus reducing the withholding tax rate that would otherwise apply.

Quick guide on how to complete form w 8ben e rev july certificate of status of beneficial owner for united states tax withholding and reporting entities

Complete Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities with ease

- Obtain Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben e rev july certificate of status of beneficial owner for united states tax withholding and reporting entities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of status of beneficial owner?

A certificate of status of beneficial owner is an official document that certifies the individuals or entities holding the beneficial ownership of a company. It is essential for businesses to verify ownership details for compliance and regulatory purposes. With airSlate SignNow, you can easily create, send, and eSign this certificate, streamlining your documentation process.

-

How does airSlate SignNow facilitate obtaining a certificate of status of beneficial owner?

airSlate SignNow simplifies the process of obtaining a certificate of status of beneficial owner by allowing users to create customizable document templates. You can send these templates to relevant parties for eSignature, ensuring a quick turnaround. This eliminates the need for cumbersome paper-based processes and enhances efficiency.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers a range of pricing plans to accommodate businesses of varying sizes and needs. Our plans include features for securely sending and eSigning documents, including the certificate of status of beneficial owner. You can choose a plan that suits your budget and requirements, ensuring great value for your investment.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow supports numerous integrations with popular software tools. Whether you're using CRM systems, cloud storage platforms, or project management tools, you can seamlessly integrate them to enhance the document signing process. This includes the ability to manage your certificate of status of beneficial owner alongside other essential documents.

-

What benefits does airSlate SignNow provide for handling the certificate of status of beneficial owner?

Using airSlate SignNow to handle the certificate of status of beneficial owner provides several benefits, including improved security, faster processing times, and reduced paperwork. Our platform offers robust encryption for document security and allows multiple users to eSign documents from anywhere. This can signNowly accelerate your compliance processes.

-

Is airSlate SignNow user-friendly for those unfamiliar with e-signature solutions?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for individuals who are unfamiliar with e-signature solutions. Our intuitive interface guides users through the process of creating and sending a certificate of status of beneficial owner effortlessly, ensuring a smooth experience.

-

How long does it take to obtain a signed certificate of status of beneficial owner?

The time it takes to obtain a signed certificate of status of beneficial owner can vary depending on the signers' availability. However, with airSlate SignNow, the process is usually expedited signNowly. Most documents can be signed within hours, allowing you to meet your deadlines efficiently.

Get more for Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities

Find out other Form W 8BEN E Rev July Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online