Tax Forms 214 and 210

What is the Tax Forms 214 And 210

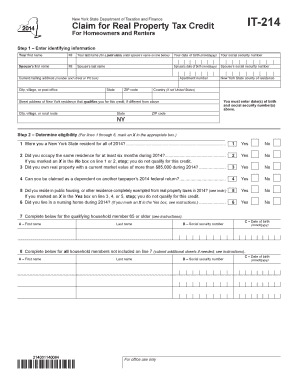

Tax Forms 214 and 210 are essential documents used in various tax-related processes in the United States. Form 214 is typically associated with claims for certain tax credits or deductions, while Form 210 is often used for reporting specific income types. Understanding the purpose and requirements of these forms is crucial for taxpayers to ensure compliance with IRS regulations and to maximize their potential tax benefits.

How to use the Tax Forms 214 And 210

Using Tax Forms 214 and 210 involves a series of steps to ensure accurate completion and submission. First, gather all necessary documentation related to your income, deductions, or credits. Next, carefully fill out the forms, ensuring that all information is accurate and complete. It is advisable to review the IRS guidelines specific to each form to avoid errors. Once completed, the forms can be submitted electronically or via mail, depending on the specific requirements associated with each form.

Steps to complete the Tax Forms 214 And 210

Completing Tax Forms 214 and 210 involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and any supporting documentation for deductions or credits.

- Download the forms from the IRS website or use a reliable tax software that includes these forms.

- Fill out the forms accurately, ensuring all fields are completed as required.

- Review the completed forms for any errors or omissions.

- Submit the forms electronically through an e-filing service or mail them to the appropriate IRS address.

Legal use of the Tax Forms 214 And 210

The legal use of Tax Forms 214 and 210 is governed by IRS regulations. These forms must be completed accurately and submitted within the designated time frames to avoid penalties. Using these forms incorrectly or failing to submit them can lead to legal consequences, including fines or audits. It is essential to ensure that all information provided is truthful and substantiated by supporting documents to comply with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Tax Forms 214 and 210 can vary based on the specific tax year and the taxpayer's situation. Generally, most individual tax returns are due by April 15. However, extensions may be available under certain conditions. It is important to stay informed about any changes to deadlines announced by the IRS, as these can impact the timely submission of your forms.

Form Submission Methods (Online / Mail / In-Person)

Tax Forms 214 and 210 can be submitted through various methods. Taxpayers have the option to file electronically through approved e-filing services, which can expedite the processing of returns. Alternatively, forms can be mailed to the IRS using the addresses specified in the form instructions. In-person submission is generally not available for these forms, but taxpayers can visit IRS offices for assistance if needed.

Quick guide on how to complete tax forms 214 and 210

Effortlessly Prepare Tax Forms 214 And 210 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Handle Tax Forms 214 And 210 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Tax Forms 214 And 210 with Ease

- Obtain Tax Forms 214 And 210 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Forms 214 And 210 and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax forms 214 and 210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Tax Forms 214 and 210?

Tax Forms 214 and 210 are essential documents often required for tax reporting and compliance. Form 214 is typically associated with certain benefits, while Form 210 pertains to deductions and credits. Understanding the specifics of these forms is crucial for accurate tax filing.

-

How can airSlate SignNow help with Tax Forms 214 and 210?

airSlate SignNow provides a streamlined, user-friendly interface for managing Tax Forms 214 and 210. With our eSignature capabilities, you can gather necessary approvals quickly and securely. This not only saves time but also ensures that your tax documents are correctly completed and submitted.

-

Is there a cost associated with using airSlate SignNow for Tax Forms 214 and 210?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers to suit different business needs. Our pricing is competitive and designed to provide a cost-effective solution for managing Tax Forms 214 and 210. You can choose a plan that aligns with your volume of document needs.

-

What features does airSlate SignNow offer for Tax Forms 214 and 210?

With airSlate SignNow, you get features such as customizable templates for Tax Forms 214 and 210, real-time tracking, and automated reminders. These features enhance your document workflow, making it easier to manage tax compliance efficiently. The platform also supports team collaboration for seamless document handling.

-

Can I integrate airSlate SignNow with other tools for handling Tax Forms 214 and 210?

Absolutely! airSlate SignNow integrates with various popular tools and platforms to streamline your workflow for Tax Forms 214 and 210. Whether you use CRMs, cloud storage, or other applications, our integrations enable you to manage your documents efficiently without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for Tax Forms 214 and 210 enhances efficiency and security. Our eSigning solution ensures that your documents are signed quickly and can be securely stored, reducing manual errors. Additionally, you can access your documents from anywhere, making tax filing a hassle-free process.

-

Is electronic signing of Tax Forms 214 and 210 legally binding?

Yes, electronic signatures gathered through airSlate SignNow for Tax Forms 214 and 210 are legally binding. Our solution complies with international electronic signature laws, providing you with confidence in the legality and validity of your signed documents. This is vital for ensuring compliance with tax regulations.

Get more for Tax Forms 214 And 210

- Schools criminal background check and live scan instructions form

- Safeway donation form

- Hawaiian falls donation request form amp procedures

- Motion continuance clermont county court of common pleas domesticcourt form

- Nfpa fire pump testing forms

- 2014 wyldlife bowlathon sponsor letter delta young life form

- Transfer midlothian isd form

- Scr carrier packet scr air form

Find out other Tax Forms 214 And 210

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form