Form 540

What is the Form 540

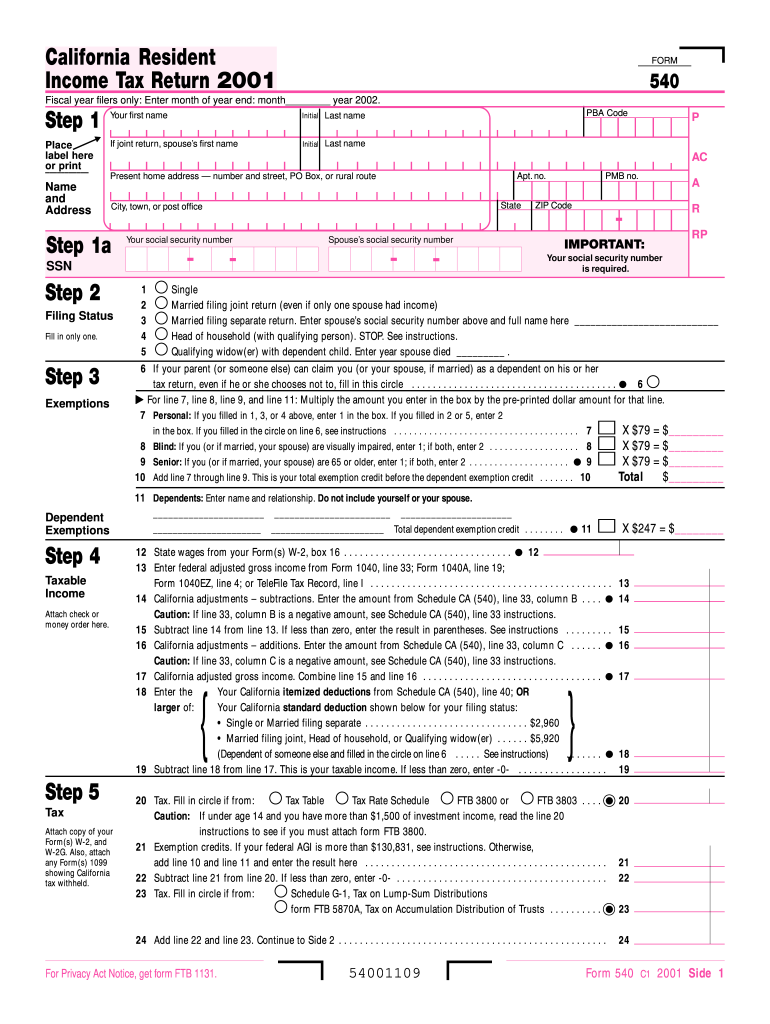

The Form 540 is a tax form used by residents of California to report their income and calculate their state income tax liability. This form is essential for individuals and families who earn income within the state, allowing them to claim deductions and credits applicable to their financial situation. The Form 540 is typically used by single filers, married couples filing jointly, and heads of household.

How to obtain the Form 540

To obtain the Form 540, taxpayers can visit the California Franchise Tax Board's official website, where the form is available for download in PDF format. Additionally, physical copies can be requested by contacting the tax board directly or visiting local tax offices. It is important to ensure that the correct version of the form is used for the applicable tax year.

Steps to complete the Form 540

Completing the Form 540 involves several key steps:

- Gather necessary documents: Collect all relevant financial information, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately report all sources of income, including wages, dividends, and interest.

- Claim deductions and credits: Identify and apply any eligible deductions or credits that may reduce your taxable income.

- Calculate tax liability: Use the tax tables provided in the instructions to determine the amount of tax owed.

- Sign and date: Ensure that the form is signed and dated before submission.

Legal use of the Form 540

The Form 540 is legally recognized when it is completed accurately and submitted in compliance with California tax laws. Electronic filing is permitted and often encouraged, as it can streamline the process and reduce errors. To ensure the form's legal validity, it is essential to follow all instructions and provide truthful information.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Form 540 to avoid penalties. Generally, the deadline for filing is April 15 of each year, unless it falls on a weekend or holiday, in which case it may be extended. Extensions may be available, but any tax owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 540 can be submitted through various methods:

- Online: Taxpayers can e-file their Form 540 using approved tax software or through the California Franchise Tax Board's online portal.

- Mail: Completed forms can be mailed to the appropriate address specified in the form instructions, depending on whether a refund is expected or taxes are owed.

- In-Person: Taxpayers may also choose to file in person at designated tax offices, where assistance may be available.

Quick guide on how to complete form 540 6027454

Complete Form 540 effortlessly on any device

Online document management has gained popularity among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without interruptions. Manage Form 540 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 540 with ease

- Obtain Form 540 and then click Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Forget about missing or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 540 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 6027454

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 540?

Form 540 is the California Resident Income Tax Return form used by individuals to report their income, deductions, and credits to the state of California. Completing Form 540 accurately is crucial for ensuring compliance with state tax regulations and optimizing your tax liabilities.

-

How can airSlate SignNow help with Form 540?

airSlate SignNow provides a seamless solution for electronically signing and sending Form 540 documents. With user-friendly tools, you can quickly gather signatures, track changes, and ensure that your tax return is submitted accurately and on time.

-

Is there a cost to use airSlate SignNow for Form 540?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. The cost-effective solutions make it affordable to manage the signing and sending of important documents like Form 540 without breaking your budget.

-

What features does airSlate SignNow offer for Form 540 handling?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage to enhance your experience with Form 540. These tools help streamline document management and ensure efficient processing of your tax forms.

-

Can I integrate airSlate SignNow with other software for Form 540 processing?

Absolutely! airSlate SignNow integrates with various platforms, including CRMs and document management systems, allowing for a smooth workflow when processing Form 540. This connectivity enhances productivity and ensures all your tools work seamlessly together.

-

How does airSlate SignNow ensure the security of my Form 540 documents?

Security is a top priority at airSlate SignNow. We use advanced encryption, secure access controls, and compliance with industry standards to protect your Form 540 documents from unauthorized access and bsignNowes, ensuring your sensitive information remains safe.

-

Can I use airSlate SignNow for multiple Form 540 submissions?

Yes, airSlate SignNow allows users to manage multiple Form 540 submissions efficiently. You can send, sign, and track multiple documents simultaneously, ensuring that your tax filing process is quick and organized.

Get more for Form 540

Find out other Form 540

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document