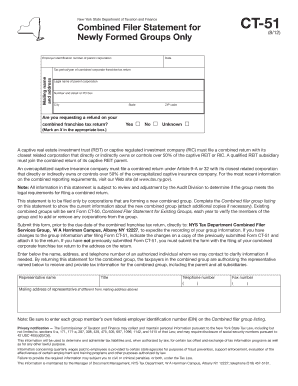

Form Ct51

What is the Form Ct51

The Form Ct51 is a specific document used in the United States for various administrative purposes, often related to tax filings or regulatory compliance. It serves as an official record that individuals or businesses must complete to provide necessary information to government agencies. Understanding the purpose and requirements of this form is essential for ensuring compliance and avoiding potential penalties.

How to use the Form Ct51

Using the Form Ct51 involves several straightforward steps. First, gather all required information, including personal or business details relevant to the form's purpose. Next, fill out the form accurately, ensuring that all fields are completed as per the guidelines. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set forth by the issuing agency.

Steps to complete the Form Ct51

Completing the Form Ct51 requires careful attention to detail. Follow these steps for a smooth process:

- Review the form instructions to understand the required information.

- Gather necessary documentation, such as identification or financial records.

- Fill out each section of the form, ensuring accuracy and clarity.

- Double-check all entries for completeness and correctness.

- Submit the form according to the specified method, whether online or by mail.

Legal use of the Form Ct51

The legal use of the Form Ct51 is governed by specific regulations that dictate how it must be filled out and submitted. Compliance with these regulations ensures that the form is considered valid and binding. It is crucial to understand the legal implications of the information provided, as inaccuracies or omissions may lead to legal consequences or penalties.

Filing Deadlines / Important Dates

Timely submission of the Form Ct51 is critical to avoid penalties. Each year, specific deadlines are established for filing this form, which may vary based on the type of entity or the purpose of the filing. It is advisable to keep track of these important dates and plan accordingly to ensure compliance.

Key elements of the Form Ct51

The Form Ct51 contains several key elements that must be accurately completed. These elements typically include:

- Identification information of the individual or business.

- Details regarding the purpose of the form.

- Signature and date fields to validate the submission.

- Any additional documentation or information as required by the issuing agency.

Quick guide on how to complete form ct51

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Annotate important sections of your documents or hide sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form Ct51

Create this form in 5 minutes!

How to create an eSignature for the form ct51

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Ct51 and how does it work?

Form Ct51 is a specific form used for various business documentation needs. With airSlate SignNow, you can easily create, send, and eSign Form Ct51 digitally, streamlining your workflow. This ensures that all parties can sign the document quickly and securely from anywhere, enhancing your business efficiency.

-

How can I get started with Form Ct51 using airSlate SignNow?

To get started with Form Ct51, simply sign up for an account on airSlate SignNow. Once registered, you can upload your Form Ct51 template or create one from scratch. Our platform provides step-by-step guidance, so you can quickly begin sending eSignatures and managing your documents.

-

Is there a cost associated with using airSlate SignNow for Form Ct51?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. The cost for using the service to handle Form Ct51 varies based on the number of users and features required. You can choose a plan that suits your budget and business needs to access all functionalities, including eSigning.

-

What features does airSlate SignNow offer for Form Ct51?

airSlate SignNow provides a range of features for managing Form Ct51, including customizable templates, document tracking, and automatic reminders for signers. Our intuitive interface allows users to easily edit and share documents. This enhances collaboration and ensures that your Form Ct51 is completed efficiently.

-

Can I integrate airSlate SignNow with other applications when using Form Ct51?

Yes, airSlate SignNow supports integrations with various applications to enhance your workflow. Whether you're using CRM software, cloud storage services, or project management tools, you can seamlessly connect them to manage Form Ct51 efficiently. This integration simplifies your document management process.

-

What are the benefits of using airSlate SignNow for Form Ct51?

Using airSlate SignNow for Form Ct51 offers numerous benefits, including increased efficiency, faster turnaround times, and cost savings on paper and printing. The electronic signature feature ensures legal compliance and security, making it a smart choice for businesses of all sizes. You'll also save time and reduce errors thanks to our streamlined processes.

-

How secure is the eSignature process for Form Ct51?

The eSignature process for Form Ct51 through airSlate SignNow is highly secure. We utilize encryption protocols and comply with industry standards to ensure the integrity of your documents. With robust authentication methods, you can trust that your Form Ct51 will be handled securely throughout the signing process.

Get more for Form Ct51

Find out other Form Ct51

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy