Personal Property Tax Form 2020

What is the Personal Property Tax Form

The Personal Property Tax Form is a document used by individuals and businesses in the United States to report personal property to local tax authorities. This form typically includes information about tangible personal property such as vehicles, machinery, and equipment. The purpose of this form is to assess the value of personal property for taxation purposes, ensuring that property owners meet their tax obligations. Understanding the specifics of this form is crucial for compliance with local tax laws.

How to use the Personal Property Tax Form

Using the Personal Property Tax Form involves several steps. First, gather all necessary information regarding the personal property you own. This may include descriptions, values, and purchase dates. Next, accurately fill out the form, ensuring that all details are correct and complete. After completing the form, review it for accuracy before submission. Finally, submit the form according to your local tax authority's guidelines, which may include options for online submission, mailing, or in-person delivery.

Steps to complete the Personal Property Tax Form

Completing the Personal Property Tax Form requires careful attention to detail. Follow these steps for a successful submission:

- Collect information about all personal property owned, including descriptions and values.

- Obtain the appropriate Personal Property Tax Form from your local tax authority.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for any errors or omissions.

- Submit the form by the designated deadline, following your local authority's submission methods.

Legal use of the Personal Property Tax Form

The legal use of the Personal Property Tax Form is essential for compliance with tax regulations. When properly completed and submitted, this form serves as a legal declaration of personal property ownership and value. It is important to adhere to local laws regarding the accuracy and timeliness of submissions to avoid penalties. Additionally, the form must be signed and dated as required, ensuring that it meets all legal standards for documentation.

Filing Deadlines / Important Dates

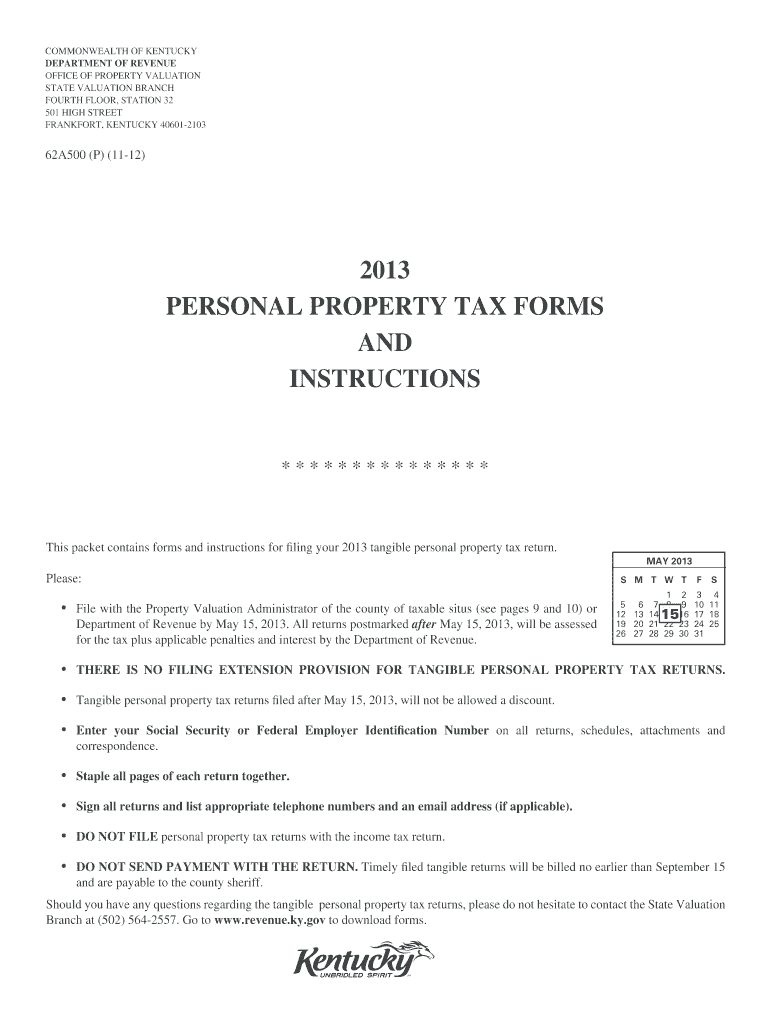

Filing deadlines for the Personal Property Tax Form vary by state and local jurisdiction. It is crucial to be aware of these dates to avoid late fees or penalties. Most jurisdictions require the form to be submitted annually, with deadlines typically falling on specific dates in the spring. Check with your local tax authority for the exact deadlines applicable to your area to ensure timely compliance.

Required Documents

When completing the Personal Property Tax Form, certain documents may be required to support your submission. Commonly required documents include:

- Proof of ownership for the personal property, such as purchase receipts or titles.

- Previous tax returns that may include personal property information.

- Any local tax authority guidelines or instructions related to the form.

Having these documents ready can facilitate a smoother filing process and help ensure accuracy in your submission.

Quick guide on how to complete 2013 personal property tax form

Effortlessly Prepare Personal Property Tax Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to quickly create, modify, and electronically sign your documents without any delays. Manage Personal Property Tax Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to Modify and Electronically Sign Personal Property Tax Form with Ease

- Find Personal Property Tax Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Personal Property Tax Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 personal property tax form

Create this form in 5 minutes!

How to create an eSignature for the 2013 personal property tax form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is a Personal Property Tax Form?

A Personal Property Tax Form is a document used to report personal property ownership for taxation purposes. It outlines the assets owned by an individual or business, which helps in determining the amount of taxes owed. Utilizing airSlate SignNow makes it easy to complete and eSign this form efficiently.

-

How can airSlate SignNow help me with my Personal Property Tax Form?

airSlate SignNow simplifies the process of completing your Personal Property Tax Form by allowing you to fill it out online and eSign it securely. Our user-friendly interface ensures that you can quickly navigate through the form fields, making the tax submission process seamless. Plus, you can save and resend forms as needed.

-

Is there a cost to using airSlate SignNow for the Personal Property Tax Form?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit different business needs. With flexible pricing, you can choose a plan that provides you with access to features specifically for handling forms like the Personal Property Tax Form. It's a cost-effective solution for individuals and businesses alike.

-

What features does airSlate SignNow offer for managing Personal Property Tax Forms?

airSlate SignNow offers several features for managing your Personal Property Tax Form, including customizable templates, secure storage, and real-time tracking of document status. You can also integrate with various applications, streamlining your workflow and ensuring all tax documents are easily accessible.

-

Can I get reminders to submit my Personal Property Tax Form on time?

Yes, airSlate SignNow allows you to set reminders for submitting your Personal Property Tax Form. By using our notification features, you can receive timely alerts to ensure that you never miss a deadline, helping you avoid late fees and compliance issues.

-

Does airSlate SignNow integrate with other financial software for tax processing?

Absolutely! airSlate SignNow integrates seamlessly with many accounting and financial software tools, making it easier to manage your Personal Property Tax Form. This integration helps ensure that your data flows smoothly between platforms, enhancing your overall tax processing experience.

-

Is my information secure when using airSlate SignNow for Personal Property Tax Forms?

Yes, security is a top priority at airSlate SignNow. We utilize encryption and secure servers to protect your data when filling out and submitting your Personal Property Tax Form. You can trust that your sensitive information is safe and compliant with data protection regulations.

Get more for Personal Property Tax Form

Find out other Personal Property Tax Form

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed