Kentucky Form 720s 2019

What is the Kentucky Form 720s

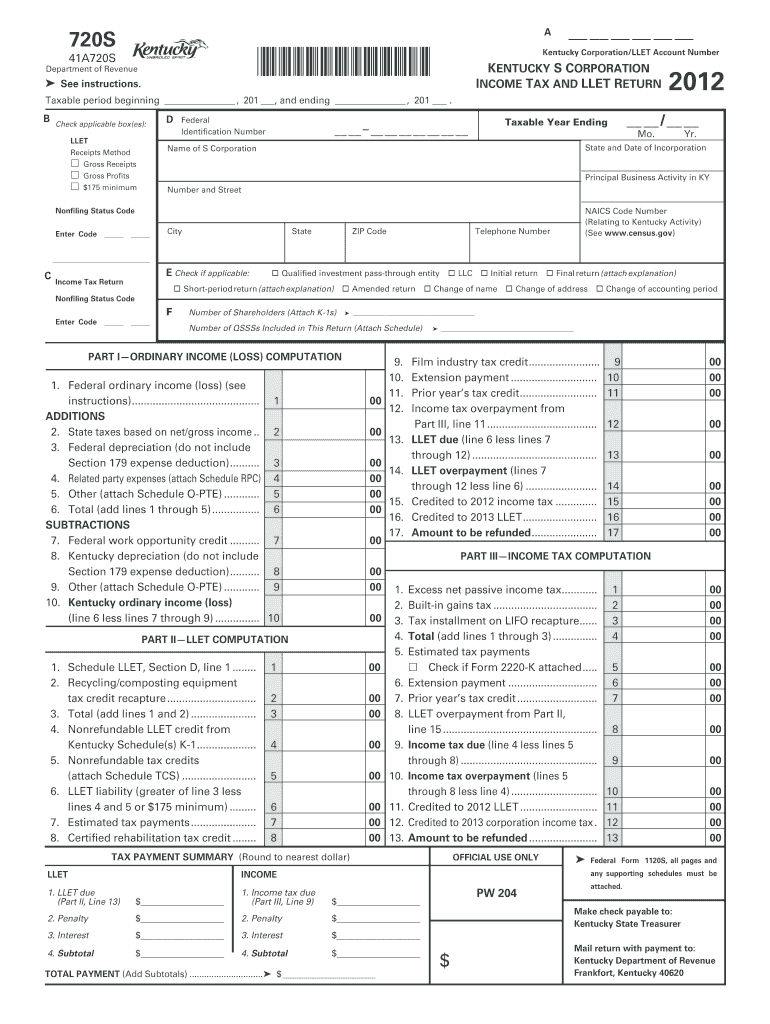

The Kentucky Form 720s is a tax document used by corporations and certain business entities to report their income and calculate their tax liability in the state of Kentucky. This form is specifically designed for S corporations, which are entities that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The form is essential for ensuring compliance with state tax regulations and for the accurate reporting of income generated within Kentucky.

How to use the Kentucky Form 720s

Using the Kentucky Form 720s involves several steps to ensure that all necessary information is accurately reported. First, gather all financial documents related to the corporation's income, expenses, and any applicable deductions. Next, complete the form by entering the required details such as total income, deductions, and credits. After filling out the form, review it for accuracy before submitting it to the Kentucky Department of Revenue. It is important to follow the specific instructions provided with the form to avoid errors that could lead to penalties.

Steps to complete the Kentucky Form 720s

Completing the Kentucky Form 720s requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Kentucky Form 720s from the Kentucky Department of Revenue website or a trusted source.

- Fill in the corporation's name, address, and federal employer identification number (EIN).

- Report total income from all sources, including sales and services.

- List all allowable deductions, such as business expenses and credits.

- Calculate the total tax due based on the provided tax rates.

- Sign and date the form, ensuring that the person signing has the authority to do so.

Legal use of the Kentucky Form 720s

The Kentucky Form 720s is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, the form must be signed by an authorized representative of the corporation, and all information must be accurate and truthful. Failure to comply with the legal requirements can result in penalties, including fines or additional tax liabilities. It is advisable to keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Form 720s are crucial for maintaining compliance with state tax laws. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances, but they must be requested in advance.

Form Submission Methods

The Kentucky Form 720s can be submitted through various methods to accommodate different preferences. Corporations have the option to file the form electronically through the Kentucky Department of Revenue's online portal, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address provided in the filing instructions. In-person submissions may also be possible at designated state offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete 2012 kentucky form 720s

Complete Kentucky Form 720s effortlessly on any gadget

Web-based document administration has become favored among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct template and securely keep it online. airSlate SignNow equips you with all the resources required to produce, adjust, and eSign your documents rapidly without hold-ups. Manage Kentucky Form 720s on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Kentucky Form 720s with ease

- Obtain Kentucky Form 720s and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new versions. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your preference. Adjust and eSign Kentucky Form 720s and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 kentucky form 720s

Create this form in 5 minutes!

How to create an eSignature for the 2012 kentucky form 720s

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is Kentucky Form 720s?

Kentucky Form 720s is a tax document used by S corporations to report income, deductions, and tax credits. It is essential for filing state taxes in Kentucky, ensuring compliance with local regulations. Understanding how to fill out Kentucky Form 720s can help businesses avoid penalties and maintain good standing.

-

How can airSlate SignNow help with Kentucky Form 720s?

airSlate SignNow simplifies the process of completing and eSigning Kentucky Form 720s. With built-in templates and user-friendly tools, businesses can efficiently fill out and send this form electronically. This not only saves time but also enhances the accuracy of your filing process.

-

What is the pricing for using airSlate SignNow for Kentucky Form 720s?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Users can choose between monthly or annual subscriptions, each designed to provide value for managing documents like Kentucky Form 720s. The cost-effective solution ensures that users can manage their tax documents efficiently without breaking the bank.

-

Is airSlate SignNow secure for signing Kentucky Form 720s?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, ensuring that your Kentucky Form 720s is safe. The platform complies with industry standards, providing peace of mind when sharing sensitive tax information. You can confidently eSign your documents knowing they are protected.

-

Can I integrate airSlate SignNow with other tools while handling Kentucky Form 720s?

Certainly! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow when managing Kentucky Form 720s. You can connect it with CRM systems, cloud storage providers, and more to create a streamlined process for document management and eSigning.

-

What are the benefits of using airSlate SignNow for Kentucky Form 720s?

Using airSlate SignNow for Kentucky Form 720s offers numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The user-friendly interface allows for quick document completion, lowering the chances of errors. Additionally, eSigning speeds up the approval process, so businesses can meet deadlines promptly.

-

Do I need technical skills to use airSlate SignNow for Kentucky Form 720s?

No, you do not need technical skills to utilize airSlate SignNow for Kentucky Form 720s. The platform is designed to be intuitive and user-friendly, allowing anyone to navigate and complete their documents with ease. Comprehensive support and resources are available to guide users through the process.

Get more for Kentucky Form 720s

Find out other Kentucky Form 720s

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now