Ky Accounts Form 2020

What is the Ky Accounts Form

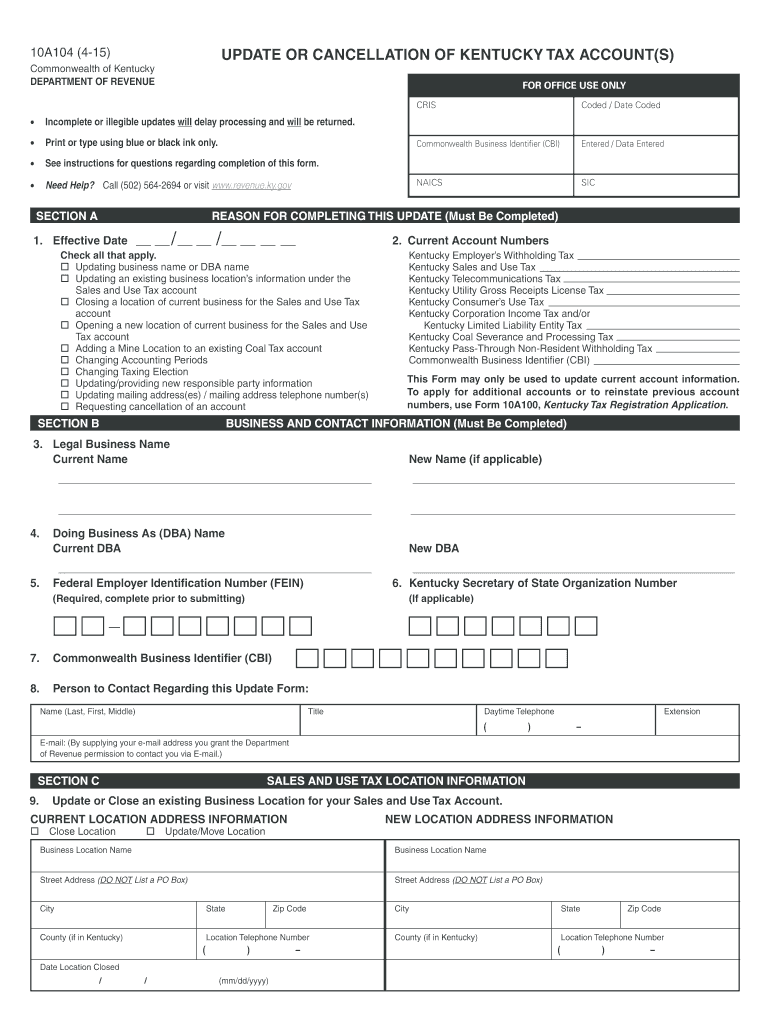

The Ky Accounts Form is a document utilized by individuals and businesses in Kentucky for various financial and accounting purposes. This form is essential for reporting income, expenses, and other financial activities to ensure compliance with state regulations. It serves as a standardized method for collecting necessary information, making it easier for both the filer and the authorities to process financial data efficiently.

How to use the Ky Accounts Form

Using the Ky Accounts Form involves several steps to ensure accurate completion and submission. Begin by gathering all relevant financial documents, including income statements and expense receipts. Carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate state agency. This process helps maintain compliance and avoid potential penalties.

Steps to complete the Ky Accounts Form

Completing the Ky Accounts Form requires attention to detail. Follow these steps:

- Gather necessary documentation, such as financial statements and identification.

- Fill out personal information, including name, address, and contact details.

- Report income sources and amounts accurately.

- Detail any expenses, ensuring to categorize them correctly.

- Review the form for completeness and accuracy.

- Submit the form electronically or via mail, depending on the submission options available.

Legal use of the Ky Accounts Form

The Ky Accounts Form is legally binding when completed correctly and submitted to the appropriate authorities. To ensure its legal standing, filers must adhere to state regulations regarding financial reporting. This includes providing accurate information and maintaining compliance with deadlines. Utilizing a reliable electronic signature service can further enhance the legal validity of the form by providing a secure method of signing and submitting documents.

Required Documents

To complete the Ky Accounts Form, specific documents are necessary. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Identification documents, like a driver's license or Social Security number.

- Previous year’s tax returns, if applicable.

Form Submission Methods

The Ky Accounts Form can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission through a secure portal.

- Mailing a physical copy to the designated state office.

- In-person submission at local government offices.

Quick guide on how to complete ky accounts 2015 form

Complete Ky Accounts Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Manage Ky Accounts Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Ky Accounts Form without hassle

- Find Ky Accounts Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds precisely the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Adjust and eSign Ky Accounts Form to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ky accounts 2015 form

Create this form in 5 minutes!

How to create an eSignature for the ky accounts 2015 form

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is the Ky Accounts Form and how does it work?

The Ky Accounts Form is a digital document designed to streamline the process of creating and managing accounts in Kentucky. With airSlate SignNow, users can easily fill out, sign, and send the Ky Accounts Form electronically, ensuring quick and secure transactions.

-

Is there a cost associated with using the Ky Accounts Form?

Yes, using the Ky Accounts Form through airSlate SignNow comes with flexible pricing options. You can choose from various subscription plans that fit your business needs and budget, offering a cost-effective solution to manage your documents.

-

What features does airSlate SignNow offer for the Ky Accounts Form?

airSlate SignNow provides several features for the Ky Accounts Form, including intuitive templates, electronic signature capabilities, and document tracking. These features empower users to manage their forms effectively and efficiently.

-

How can the Ky Accounts Form benefit my business?

Using the Ky Accounts Form can enhance your business efficiency by reducing paperwork and speeding up the account creation process. With airSlate SignNow, you can ensure greater accuracy and compliance, ultimately saving time and resources.

-

Can I integrate the Ky Accounts Form with other software?

Yes, airSlate SignNow allows seamless integration with various software applications, enhancing the usability of the Ky Accounts Form. You can connect it with your CRM, ERP, or other essential tools to streamline your workflows.

-

Is it secure to use the Ky Accounts Form through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security when managing the Ky Accounts Form. With advanced encryption and secure cloud storage, your sensitive information remains protected throughout the signing process.

-

What kind of support is available for users of the Ky Accounts Form?

airSlate SignNow offers comprehensive customer support for users of the Ky Accounts Form. You can access tutorials, FAQs, and live support to ensure you maximize the benefits of our electronic signing solutions.

Get more for Ky Accounts Form

Find out other Ky Accounts Form

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation