Puerto Rico Section 106203 Form

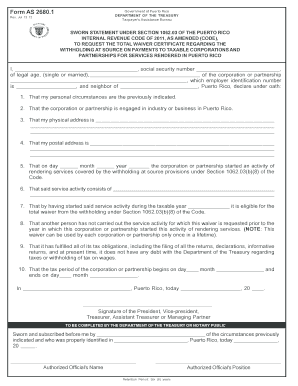

What is the Puerto Rico Section 106203 Form

The Puerto Rico Section 106203 Form is a specific document required for various administrative purposes within the jurisdiction of Puerto Rico. This form is often associated with tax reporting or compliance requirements and is essential for individuals and businesses operating in Puerto Rico. Understanding its purpose and the context in which it is used is crucial for ensuring compliance with local regulations.

How to use the Puerto Rico Section 106203 Form

Using the Puerto Rico Section 106203 Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and any relevant financial data. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled, it may need to be printed, signed, and submitted according to the specific instructions provided by the issuing authority.

Steps to complete the Puerto Rico Section 106203 Form

Completing the Puerto Rico Section 106203 Form requires attention to detail. Follow these steps:

- Review the form's instructions thoroughly to understand the requirements.

- Collect all necessary documentation and information needed to fill out the form.

- Fill in the required fields, ensuring accuracy and completeness.

- Double-check the information for any errors or omissions.

- Sign the form where indicated, if required.

- Submit the form as instructed, either electronically or by mail.

Legal use of the Puerto Rico Section 106203 Form

The Puerto Rico Section 106203 Form holds legal significance and must be used in compliance with applicable laws. It is essential to ensure that the form is filled out correctly and submitted on time to avoid potential legal issues. The form may be subject to scrutiny by tax authorities or other regulatory bodies, making accurate completion vital for legal validity.

Key elements of the Puerto Rico Section 106203 Form

Key elements of the Puerto Rico Section 106203 Form include personal identification information, financial data, and specific declarations required by the local tax authority. Each section of the form serves a distinct purpose, contributing to the overall compliance process. Understanding these elements can help users navigate the form more effectively and ensure all necessary information is provided.

Form Submission Methods

The Puerto Rico Section 106203 Form can typically be submitted through various methods, including:

- Online submission via the designated government portal.

- Mailing the completed form to the appropriate tax office.

- In-person submission at local government offices, if applicable.

Choosing the right submission method can help ensure timely processing and compliance with local regulations.

Quick guide on how to complete puerto rico section 106203 form

Easily Prepare [SKS] on Any Device

Digital document management is increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your files quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-oriented processes today.

Effortlessly Modify and eSign [SKS]

- Obtain [SKS] and click Get Form to kick things off.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Puerto Rico Section 106203 Form

Create this form in 5 minutes!

How to create an eSignature for the puerto rico section 106203 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Puerto Rico Section 106203 Form?

The Puerto Rico Section 106203 Form is a specific document used for various legal and administrative purposes within Puerto Rico. It is crucial for ensuring compliance with local regulations. Using airSlate SignNow, you can seamlessly manage and eSign this form electronically.

-

How can airSlate SignNow help me manage the Puerto Rico Section 106203 Form?

airSlate SignNow provides tools to easily create, send, and eSign the Puerto Rico Section 106203 Form. The platform's user-friendly interface allows you to track document status and ensure that all parties can manage their signatures efficiently. This streamlines the entire process and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for the Puerto Rico Section 106203 Form?

Yes, there are various pricing plans available for using airSlate SignNow to facilitate the signing of the Puerto Rico Section 106203 Form. Each plan offers different features to meet your specific business needs. You can choose a plan that fits your budget while benefiting from a cost-effective eSigning solution.

-

What features does airSlate SignNow offer for the Puerto Rico Section 106203 Form?

airSlate SignNow offers a range of features for handling the Puerto Rico Section 106203 Form, including customizable templates, secure eSigning, and comprehensive tracking. Additionally, the platform allows for document storage and seamless collaboration among parties. These features help to simplify the management of legally binding documents.

-

Can I integrate airSlate SignNow with other applications when managing the Puerto Rico Section 106203 Form?

Yes, airSlate SignNow supports integration with various applications, which can enhance your workflow when dealing with the Puerto Rico Section 106203 Form. This includes integrations with popular tools like Google Drive, Dropbox, and CRM systems. Such integrations help in centralizing your document management processes.

-

What are the benefits of using airSlate SignNow for the Puerto Rico Section 106203 Form?

Using airSlate SignNow for the Puerto Rico Section 106203 Form offers numerous benefits, including time savings, improved accuracy, and enhanced security. The electronic signing process minimizes the risk of errors and speeds up document turnaround times. Additionally, the platform ensures that your documents are securely stored and easily accessible.

-

How do I get started with airSlate SignNow for the Puerto Rico Section 106203 Form?

Getting started with airSlate SignNow for the Puerto Rico Section 106203 Form is easy. Simply sign up for an account on our website, choose a suitable pricing plan, and begin uploading and managing your documents. The user-friendly setup guides you through the steps to start sending and eSigning forms.

Get more for Puerto Rico Section 106203 Form

Find out other Puerto Rico Section 106203 Form

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now