1065 Form Instruction 2020

What is the 1065 Form Instruction

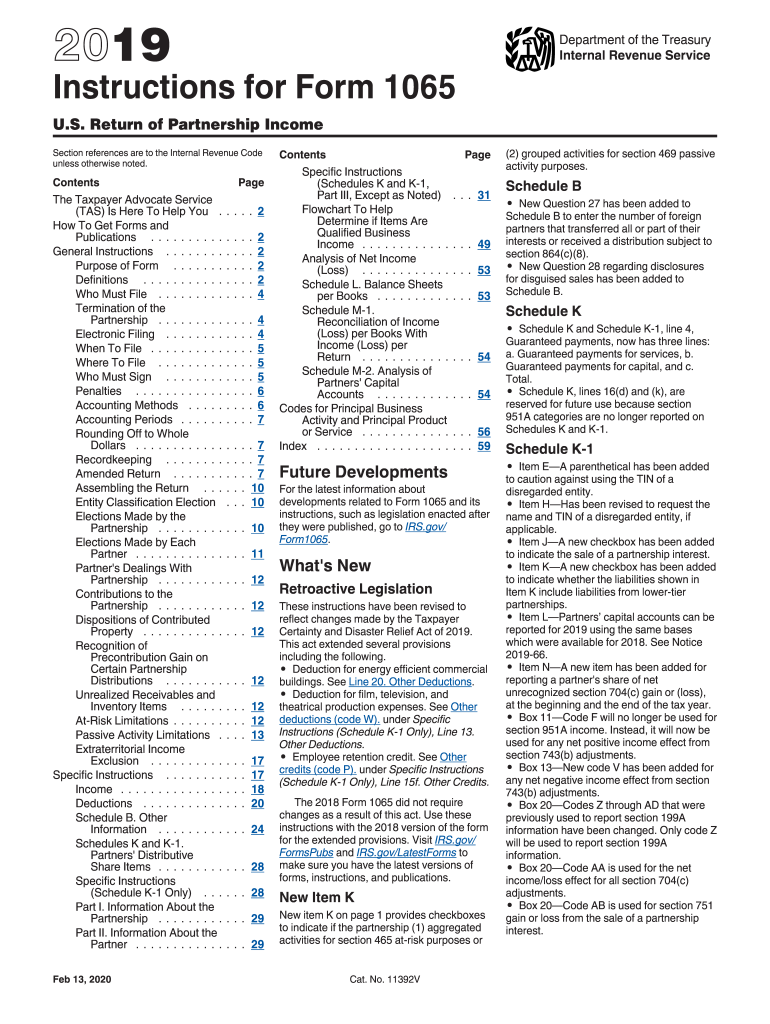

The 1065 form instruction provides guidance on how to complete IRS Form 1065, which is used by partnerships to report income, deductions, gains, and losses from the operation of a partnership. This form is essential for partnerships to accurately report their financial activities to the Internal Revenue Service (IRS). The instructions detail the necessary information required, including how to report each partner's share of income and deductions, and the specific schedules that may need to be attached to the form.

Steps to Complete the 1065 Form Instruction

Completing the 1065 form instruction involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and previous tax returns.

- Identify the partnership's tax year and ensure that all income and deductions are reported for that period.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report the partnership's income and deductions on the appropriate lines of the form, ensuring accuracy and completeness.

- Complete any required schedules, such as Schedule K and Schedule K-1, to report each partner's share of the income and deductions.

- Review the completed form for accuracy before submission.

Legal Use of the 1065 Form Instruction

The legal use of the 1065 form instruction ensures compliance with federal tax laws. Partnerships must file this form annually to report their financial activities accurately. Failure to submit the form or inaccuracies in reporting can lead to penalties and interest charges from the IRS. The instructions also clarify the legal obligations of partnerships regarding record-keeping and reporting, which helps to maintain transparency and accountability in financial reporting.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the 1065 form. Generally, the form is due on the fifteenth day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for partnerships to be aware of these deadlines to avoid late filing penalties.

Required Documents

To complete the 1065 form instruction accurately, partnerships must gather various documents, including:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Previous years' tax returns, if applicable, to ensure consistency in reporting.

- Partner information, including Social Security numbers or EINs for each partner.

Form Submission Methods (Online / Mail / In-Person)

The 1065 form can be submitted through multiple methods, providing flexibility for partnerships. Options include:

- Online filing through the IRS e-file system, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate IRS address, which varies based on the partnership's location.

- In-person submission at designated IRS offices, though this method is less common and may require an appointment.

Quick guide on how to complete 1065 form instruction

Complete 1065 Form Instruction seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without disruptions. Handle 1065 Form Instruction on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign 1065 Form Instruction effortlessly

- Find 1065 Form Instruction and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Highlight crucial sections of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1065 Form Instruction and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 form instruction

Create this form in 5 minutes!

How to create an eSignature for the 1065 form instruction

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What are the key features of airSlate SignNow related to the 2019 1065 instruction?

airSlate SignNow provides features that simplify document management, including automated eSigning and document generation. These features are particularly useful for filing the 2019 1065 instruction, enabling seamless collaboration among partners. With customizable templates, users can ensure that their forms align with IRS requirements.

-

How can airSlate SignNow help with completing the 2019 1065 instruction?

By using airSlate SignNow, businesses can easily manage and sign the essential documents necessary for the 2019 1065 instruction. The platform allows for real-time editing and updates, ensuring the latest information is always available. This facilitates compliance with IRS regulations and reduces the chances of errors in your submissions.

-

What pricing options does airSlate SignNow offer for handling the 2019 1065 instruction?

airSlate SignNow offers various pricing plans that cater to different business needs for managing the 2019 1065 instruction. Whether you are a small firm or a large organization, there is a plan that provides optimal features at competitive rates. You can choose a plan based on the number of users and the features required for efficient document management.

-

Is airSlate SignNow compliant with regulations for the 2019 1065 instruction?

Yes, airSlate SignNow is designed to comply with the highest security standards applicable to electronic signatures and document management, including those relevant to the 2019 1065 instruction. This ensures that your documents are not only signed but also securely stored. Compliance with industry regulations is a top priority to maintain the integrity of your sensitive information.

-

Can I integrate airSlate SignNow with other software for managing the 2019 1065 instruction?

Absolutely! airSlate SignNow offers integrations with various platforms, including accounting and tax software. This capability facilitates the efficient management of all necessary documents for the 2019 1065 instruction, allowing for seamless workflows and data synchronization across multiple applications.

-

What benefits do users gain from airSlate SignNow when handling the 2019 1065 instruction?

Users of airSlate SignNow experience a streamlined process for handling the 2019 1065 instruction. The platform reduces turnaround time for document approvals and allows for easier tracking of changes. Enhanced accessibility means that team members can collaborate effectively from anywhere, which is crucial for timely submissions.

-

How does airSlate SignNow ensure document security for the 2019 1065 instruction?

Security is a paramount concern for airSlate SignNow, especially when dealing with sensitive information related to the 2019 1065 instruction. The platform employs encryption protocols and secure servers to protect your documents. This guarantees that only authorized personnel can access and sign your important tax documents.

Get more for 1065 Form Instruction

Find out other 1065 Form Instruction

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free