Ohio Form D5

What is the Ohio Form D5

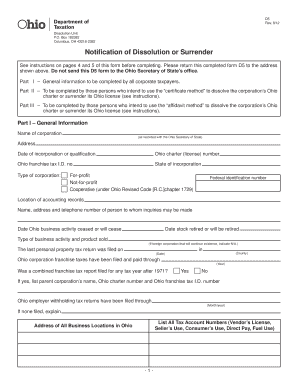

The Ohio Form D5 is a tax document used primarily for individuals and businesses to report specific financial information to the Ohio Department of Taxation. This form is essential for those who need to declare their income, deductions, and credits accurately. It plays a crucial role in determining the tax liability for residents and non-residents engaged in business activities within Ohio. Understanding the purpose and requirements of the D5 form is vital for compliance with state tax laws.

How to use the Ohio Form D5

Using the Ohio Form D5 involves several key steps. First, you must gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form by entering your financial information in the designated sections. It is important to double-check all entries for accuracy to avoid potential issues with the Ohio Department of Taxation. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the guidelines provided by the state.

Steps to complete the Ohio Form D5

Completing the Ohio Form D5 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Download the Ohio Form D5 from the official state website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions in the appropriate sections of the form.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically through the Ohio Department of Taxation website or mail it to the designated address.

Legal use of the Ohio Form D5

The legal use of the Ohio Form D5 is governed by state tax laws. To ensure that your form is legally binding, it must be completed accurately and submitted within the prescribed deadlines. The form serves as a declaration of your financial activities and must comply with the regulations set forth by the Ohio Department of Taxation. Failure to adhere to these legal requirements may result in penalties or audits, making it essential to understand the implications of the information provided on the form.

Key elements of the Ohio Form D5

Key elements of the Ohio Form D5 include various sections that capture essential financial data. These elements typically consist of:

- Personal identification information, such as name and address.

- Income reporting sections for wages, self-employment income, and other earnings.

- Deductions and credits that may apply to your tax situation.

- Signature and date fields to validate the submission.

Each section must be filled out accurately to ensure compliance with state tax regulations.

Form Submission Methods

The Ohio Form D5 can be submitted through various methods, providing flexibility for taxpayers. The available submission options include:

- Electronic submission via the Ohio Department of Taxation's online portal, which offers a streamlined process.

- Mailing a physical copy of the completed form to the designated address provided by the state.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help ensure timely processing of your tax information.

Quick guide on how to complete ohio form d5

Effortlessly Prepare Ohio Form D5 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without hassles. Manage Ohio Form D5 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Method to Edit and eSign Ohio Form D5 Without Stress

- Obtain Ohio Form D5 and then click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize signNow sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Ohio Form D5 and ensure optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio form d5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio form d5 and how can airSlate SignNow help?

The ohio form d5 is a document used for specific legal processes in Ohio. airSlate SignNow allows you to easily send and electronically sign the ohio form d5, streamlining your workflow and ensuring compliance with state regulations.

-

Is airSlate SignNow affordable for businesses needing to manage the ohio form d5?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes needing to manage the ohio form d5. Our pricing plans are designed to meet the needs of both small and large businesses, offering scalability without compromising on features.

-

What features does airSlate SignNow offer for completing the ohio form d5?

airSlate SignNow provides a range of features for the ohio form d5, including customizable templates, secure eSigning, and document tracking. These features make it easy to manage and complete your documents efficiently.

-

Can I integrate airSlate SignNow with other software to manage the ohio form d5?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enabling you to manage the ohio form d5 more efficiently. You can connect with tools like Google Drive, Dropbox, and others for enhanced productivity.

-

How does airSlate SignNow ensure the security of the ohio form d5?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication measures to protect your documents, including the ohio form d5, ensuring that your data remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the ohio form d5?

Using airSlate SignNow for the ohio form d5 offers numerous benefits, such as faster processing times, reduced paper waste, and improved collaboration among teams. Our user-friendly platform simplifies the signing process and enhances overall efficiency.

-

Is there customer support available for issues related to the ohio form d5?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues related to the ohio form d5. Our knowledgeable team is available to guide you through the process and ensure a smooth experience.

Get more for Ohio Form D5

- Fisheries related tax forms alaska department of revenue

- May 1 to april 30 form

- Fall 2018 revenue sources book alaska department of revenue form

- Alaska income tax education credit alaska department of form

- Alaska veteran employment tax credit as 43 form

- 2018 instructions for form 4136 internal revenue service

- It 511 individual income tax 500 and 500ez forms efile

- Alaska qualified oil and gas service industry form

Find out other Ohio Form D5

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract