Arkansas State Income Tax Forms 2019

What are the Arkansas State Income Tax Forms

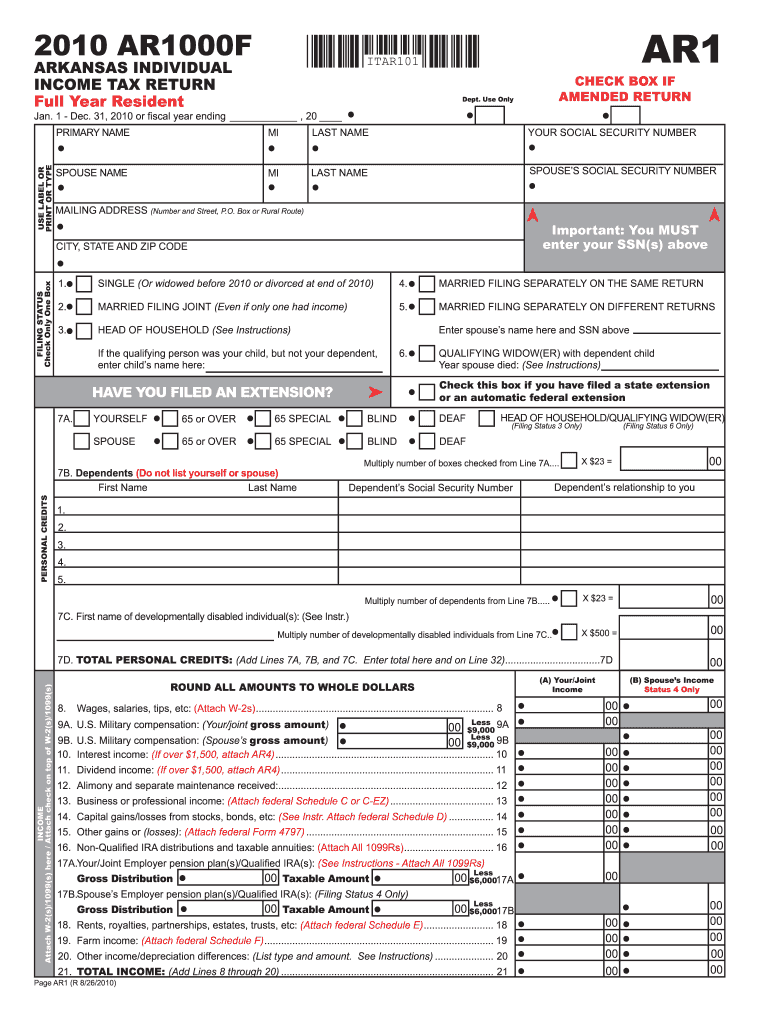

The Arkansas State Income Tax Forms are official documents required for individuals and businesses to report their income and calculate their tax obligations to the state. These forms are essential for ensuring compliance with Arkansas tax laws and must be completed accurately to avoid penalties. The primary form for individual taxpayers is the AR1000F, while businesses may use forms like the AR1100 for corporate income tax. Each form serves specific purposes, detailing income sources, deductions, and credits applicable under Arkansas tax regulations.

How to use the Arkansas State Income Tax Forms

Using the Arkansas State Income Tax Forms involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and records of deductions. Next, select the appropriate form based on your filing status and income type. Complete the form by entering your personal information, income details, and applicable deductions. After filling out the form, review it for accuracy, sign it, and choose your submission method—either electronically or by mail.

Steps to complete the Arkansas State Income Tax Forms

Completing the Arkansas State Income Tax Forms requires a systematic approach:

- Gather necessary documents, such as income statements and receipts for deductions.

- Select the correct form based on your filing status (e.g., individual, business).

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, and dividends.

- Apply any eligible deductions and credits to reduce your taxable income.

- Review the completed form for accuracy and ensure all required signatures are present.

- Submit the form electronically or via mail, following the guidelines provided for your chosen method.

Legal use of the Arkansas State Income Tax Forms

The legal use of the Arkansas State Income Tax Forms is governed by state tax laws, which require accurate reporting of income and compliance with filing deadlines. To be legally binding, the forms must be signed by the taxpayer, and any electronic submissions must adhere to the regulations set forth by the Arkansas Department of Finance and Administration. Understanding these legal requirements is crucial for avoiding penalties and ensuring that your tax filings are accepted by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Arkansas State Income Tax Forms are typically aligned with federal tax deadlines. For most individual taxpayers, the deadline to file is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any extensions that may apply and the deadlines for making estimated tax payments throughout the year. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

Arkansas State Income Tax Forms can be submitted through various methods to accommodate different preferences. Taxpayers can file electronically using approved e-filing software, which often provides a streamlined process and faster processing times. Alternatively, forms can be printed and mailed to the appropriate state tax office. For those who prefer in-person submissions, visiting a local tax office may be an option, though it is advisable to check for any specific requirements or appointments needed.

Quick guide on how to complete arkansas state income tax forms 2010

Effortlessly Prepare Arkansas State Income Tax Forms on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Handle Arkansas State Income Tax Forms on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Modify and Electronically Sign Arkansas State Income Tax Forms with Ease

- Obtain Arkansas State Income Tax Forms and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign function, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors requiring new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Arkansas State Income Tax Forms to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas state income tax forms 2010

Create this form in 5 minutes!

How to create an eSignature for the arkansas state income tax forms 2010

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What are Arkansas State Income Tax Forms?

Arkansas State Income Tax Forms are official documents required for filing state income taxes in Arkansas. These forms include information about your income, deductions, and other relevant financial details necessary for state tax compliance. It's crucial for taxpayers to accurately complete these forms to avoid potential penalties.

-

How can airSlate SignNow help with Arkansas State Income Tax Forms?

AirSlate SignNow streamlines the process of completing and submitting Arkansas State Income Tax Forms. Our easy-to-use platform allows users to electronically sign needed forms, ensuring a faster and more efficient filing process. This not only saves time but also minimizes errors that could occur with manual submissions.

-

Are there features specifically designed for Arkansas State Income Tax Forms?

Yes, airSlate SignNow offers features tailored for Arkansas State Income Tax Forms, such as customizable templates, eSignature capabilities, and automatic form filling. These features simplify the tax preparation process, making it easier for users to ensure their forms are correctly filled out and promptly submitted to the state.

-

What is the pricing for using airSlate SignNow for Arkansas State Income Tax Forms?

AirSlate SignNow offers competitive pricing plans suitable for businesses and individuals needing to complete Arkansas State Income Tax Forms. Options include monthly and annual subscriptions with varying features. You can choose a plan that best fits your needs, making tax compliance more affordable and accessible.

-

Can I integrate airSlate SignNow with other software to manage Arkansas State Income Tax Forms?

Absolutely! AirSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage Arkansas State Income Tax Forms. Whether it's accounting software or CRM platforms, these integrations streamline workflows and help you maintain organized records for tax purposes.

-

What are the benefits of using airSlate SignNow for Arkansas State Income Tax Forms?

Using airSlate SignNow for Arkansas State Income Tax Forms offers numerous benefits, such as increased efficiency, security, and reduced paperwork. The platform ensures that your documents are electronically signed and securely stored, making them easily accessible. Ultimately, this creates a hassle-free experience for managing your tax documents.

-

Is airSlate SignNow user-friendly for filing Arkansas State Income Tax Forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to file Arkansas State Income Tax Forms. The intuitive interface guides users step-by-step in filling out and signing forms. This accessibility means even those unfamiliar with digital documentation can confidently manage their tax submissions.

Get more for Arkansas State Income Tax Forms

Find out other Arkansas State Income Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors