Arkansas Form Tax 2019

What is the Arkansas Form Tax

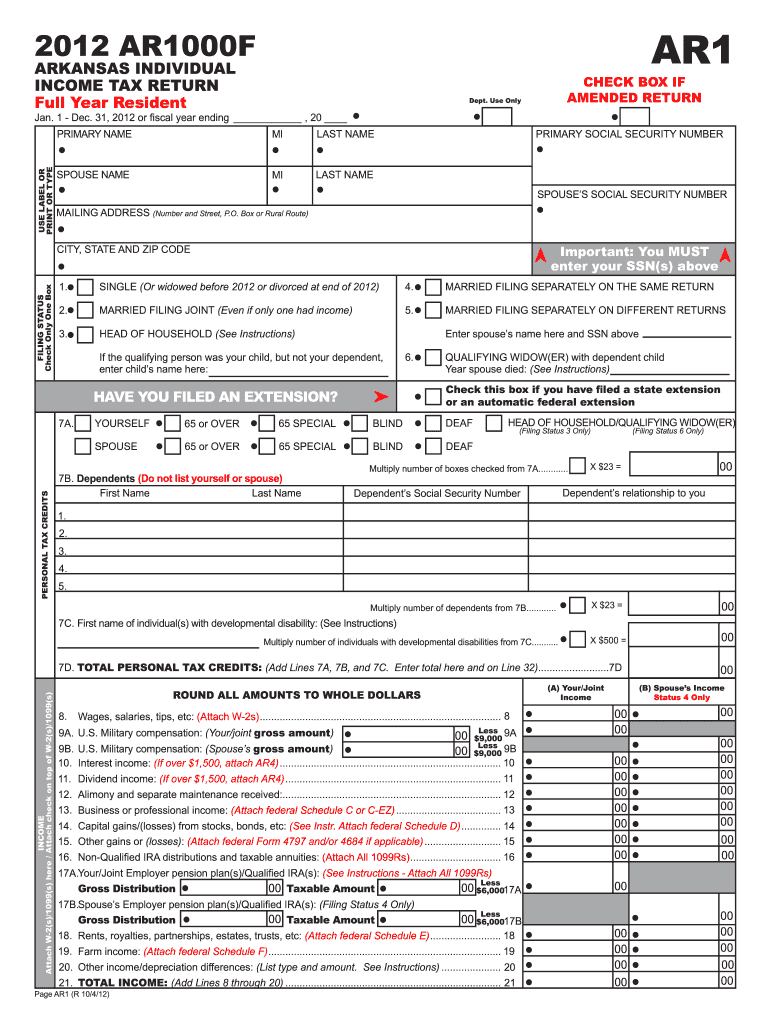

The Arkansas Form Tax refers to the various tax forms required by the state of Arkansas for individuals and businesses to report income and calculate tax liabilities. This includes forms for income tax, sales tax, and various other tax obligations. Each form serves a specific purpose and is designed to ensure compliance with state tax laws. Understanding the Arkansas Form Tax is essential for accurate reporting and to avoid penalties.

How to use the Arkansas Form Tax

Using the Arkansas Form Tax involves several steps to ensure proper completion and submission. First, determine which specific form applies to your situation, whether it is for individual income tax, corporate tax, or another category. After identifying the correct form, gather all necessary documentation, such as income statements and deductions. Fill out the form accurately, ensuring all information is complete. Finally, submit the form through the appropriate channels, either electronically or by mail, depending on the form's requirements.

Steps to complete the Arkansas Form Tax

Completing the Arkansas Form Tax involves a systematic approach:

- Identify the correct form based on your tax situation.

- Gather all required documents, including W-2s, 1099s, and receipts for deductions.

- Fill out the form carefully, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline, either online or by mail.

Legal use of the Arkansas Form Tax

The Arkansas Form Tax is legally binding when completed and submitted according to state regulations. To ensure its legality, it is important to follow all instructions provided with the form and to comply with the relevant tax laws. Electronic submissions are accepted, provided they meet the requirements set forth by the Arkansas Department of Finance and Administration. Utilizing a secure platform for e-signatures can further enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Arkansas Form Tax vary depending on the type of tax being reported. Generally, individual income tax returns are due on April 15 each year. However, businesses may have different deadlines based on their fiscal year. It is crucial to be aware of these dates to avoid late fees and penalties. Marking your calendar with these important dates can help ensure timely compliance.

Required Documents

To successfully complete the Arkansas Form Tax, certain documents are essential. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any additional income, such as rental income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Arkansas Form Tax can be done through various methods. Online submission is often the fastest and most efficient way, allowing for immediate processing. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own guidelines, so it is important to follow the instructions specific to the form being submitted.

Quick guide on how to complete 2012 arkansas form tax

Complete Arkansas Form Tax seamlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers all the features necessary to create, modify, and eSign your documents promptly without delays. Manage Arkansas Form Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Arkansas Form Tax effortlessly

- Locate Arkansas Form Tax and click Access Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Finish button to save your changes.

- Choose your preferred method to submit your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries regarding lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Arkansas Form Tax to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 arkansas form tax

Create this form in 5 minutes!

How to create an eSignature for the 2012 arkansas form tax

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Arkansas Form Tax and how can airSlate SignNow help?

The Arkansas Form Tax refers to various tax forms and documentation required by the state. airSlate SignNow simplifies the process of managing and eSigning these forms, ensuring that businesses can efficiently handle Arkansas Form Tax submissions without hassle.

-

How much does airSlate SignNow cost for handling Arkansas Form Tax?

airSlate SignNow offers various pricing plans that are designed to be budget-friendly for businesses of all sizes. You can choose a plan that fits your needs while ensuring a seamless experience in managing Arkansas Form Tax forms at an affordable rate.

-

Does airSlate SignNow integrate with other software for Arkansas Form Tax management?

Yes, airSlate SignNow integrates with numerous applications to streamline the management of Arkansas Form Tax. This integration helps ensure that all your tax-related documents are connected and accessible, enhancing productivity and efficiency.

-

What features does airSlate SignNow offer for processing Arkansas Form Tax?

airSlate SignNow offers features such as customizable templates, secure eSignature functionality, and real-time tracking for Arkansas Form Tax documents. These features ensure that your forms are filled out correctly and submitted on time.

-

Is airSlate SignNow secure for submitting Arkansas Form Tax?

Absolutely, airSlate SignNow puts a high emphasis on security, utilizing encryption and secure cloud storage to protect sensitive information, including Arkansas Form Tax documents. Customers can have peace of mind knowing their data is safeguarded.

-

Can I eSign Arkansas Form Tax documents on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage and eSign Arkansas Form Tax documents on the go. This flexibility ensures that you can handle your tax submissions wherever you are.

-

What support options are available for airSlate SignNow users dealing with Arkansas Form Tax?

airSlate SignNow provides various support options, including live chat, email assistance, and a comprehensive knowledge base. This ensures that users can get help with any questions related to Arkansas Form Tax swiftly.

Get more for Arkansas Form Tax

- Police clearance certificate template form

- Texas response to motion for summary judgment example form

- Progress test 2 units 4 6 answers form

- H1822 form

- Moon phase worksheet pdf form

- Medical history initial intake form

- Medical history initial intake form 346188132

- Piedmont hospital discharge papers 449000602 form

Find out other Arkansas Form Tax

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy