Irs Form 8824

What is the IRS Form 8824

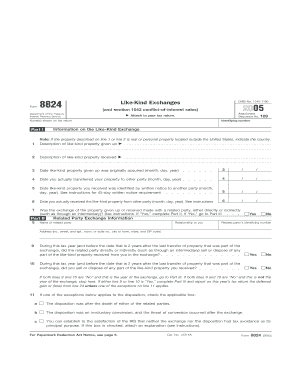

The IRS Form 8824, also known as the Like-Kind Exchange form, is used by taxpayers to report the exchange of real property held for productive use in a trade or business or for investment. This form is essential for individuals or businesses that wish to defer capital gains taxes on the exchange of similar properties. The form outlines the details of the exchange, including the properties involved, the dates of the exchange, and any gain or loss realized during the transaction.

Steps to Complete the IRS Form 8824

Completing the IRS Form 8824 involves several key steps to ensure accurate reporting of the like-kind exchange. Here’s a brief overview:

- Identify the properties: Clearly define the relinquished and replacement properties involved in the exchange.

- Determine the value: Assess the fair market value of both properties at the time of the exchange.

- Fill out the form: Provide detailed information regarding the properties, including their addresses, dates of acquisition, and dates of exchange.

- Calculate any gain or loss: Use the appropriate calculations to determine if there is any realized gain or loss from the exchange.

- Review and submit: Ensure all information is accurate before submitting the form to the IRS.

Legal Use of the IRS Form 8824

The legal use of IRS Form 8824 is crucial for taxpayers engaging in like-kind exchanges. To ensure that the exchange qualifies for tax deferral, certain conditions must be met, such as the properties being of similar nature and the exchange being completed within specific time frames. Filing this form correctly helps in maintaining compliance with IRS regulations, which is essential to avoid penalties or tax liabilities.

How to Obtain the IRS Form 8824

The IRS Form 8824 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is advisable to download the most current version of the form to ensure compliance with the latest tax regulations. Additionally, physical copies may be available at local IRS offices or through tax professionals.

Examples of Using the IRS Form 8824

Examples of using IRS Form 8824 include scenarios where a property owner exchanges a rental property for another rental property or a business owner trades commercial real estate for a different commercial property. In each case, the form must accurately reflect the details of the exchange to qualify for tax deferment.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 8824 typically align with the taxpayer's annual tax return deadlines. For most individuals, this is April 15 of the following year. If the taxpayer is unable to file by this date, they may request an extension, but it is important to ensure that the form is submitted by the extended deadline to avoid penalties.

Quick guide on how to complete irs form 8824

Effortlessly Complete Irs Form 8824 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and eSign your documents swiftly without holdups. Manage Irs Form 8824 on any system with airSlate SignNow Android or iOS applications and enhance your document-centric workflow today.

Easily Modify and eSign Irs Form 8824 with Ease

- Find Irs Form 8824 and click Get Form to begin.

- Utilize our tools to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searching, or errors necessitating new document prints. airSlate SignNow meets your document management requirements in just a few clicks from a device of your choice. Edit and eSign Irs Form 8824 to ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8824

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8824 and why is it important?

Form 8824 is an essential document used for reporting Like-Kind Exchanges under the IRS guidelines. Understanding how to properly fill out form 8824 ensures tax compliance and helps businesses defer capital gains taxes on exchanged properties.

-

How can airSlate SignNow simplify the process of completing form 8824?

airSlate SignNow streamlines the completion and eSigning of form 8824 with its user-friendly interface. Users can easily input information, automate workflows, and ensure that all required signatures are obtained swiftly.

-

Is there a cost associated with using airSlate SignNow for form 8824?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, making it affordable to send and eSign form 8824. Each plan includes features that enhance document management and simplify the signing process.

-

What features does airSlate SignNow offer for managing form 8824?

airSlate SignNow provides features such as templates, reminders, and comprehensive tracking specifically for form 8824. This ensures that users can monitor the status of their documents in real-time and get notified of pending actions.

-

Can form 8824 be integrated with other software?

Absolutely! airSlate SignNow allows integrations with various applications, enabling seamless data transfer when managing form 8824. This flexibility helps users keep their workflow synchronized across platforms.

-

What benefits does airSlate SignNow provide for businesses completing form 8824?

The primary benefits include enhanced efficiency, improved accuracy, and fortified compliance when completing form 8824. By utilizing airSlate SignNow, businesses save time and reduce errors associated with manual processes.

-

How secure is the information submitted with form 8824 using airSlate SignNow?

airSlate SignNow employs industry-leading security protocols to protect sensitive information submitted with form 8824. Data encryption and secure storage ensure that your documents remain confidential and secure.

Get more for Irs Form 8824

- 2019 schedule k 1 form 1065 internal revenue service

- F8863 form 8863 department of the treasury internal revenue

- Form 1120 h internal revenue service

- About form 656internal revenue service

- Current tax return pdf form 1040 us individual income

- Form 433 a oic rev 3 2019 collection information statement for wage earners and

- Error to display the webpage again internet explorer needs form

- Instructions for form 941 rev january 2019 instructions for form 941 employers quarterly federal tax return

Find out other Irs Form 8824

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter