Iowa Department of Revenue Ia 8453 Ind Form 2011

What is the Iowa Department Of Revenue IA 8453 IND Form

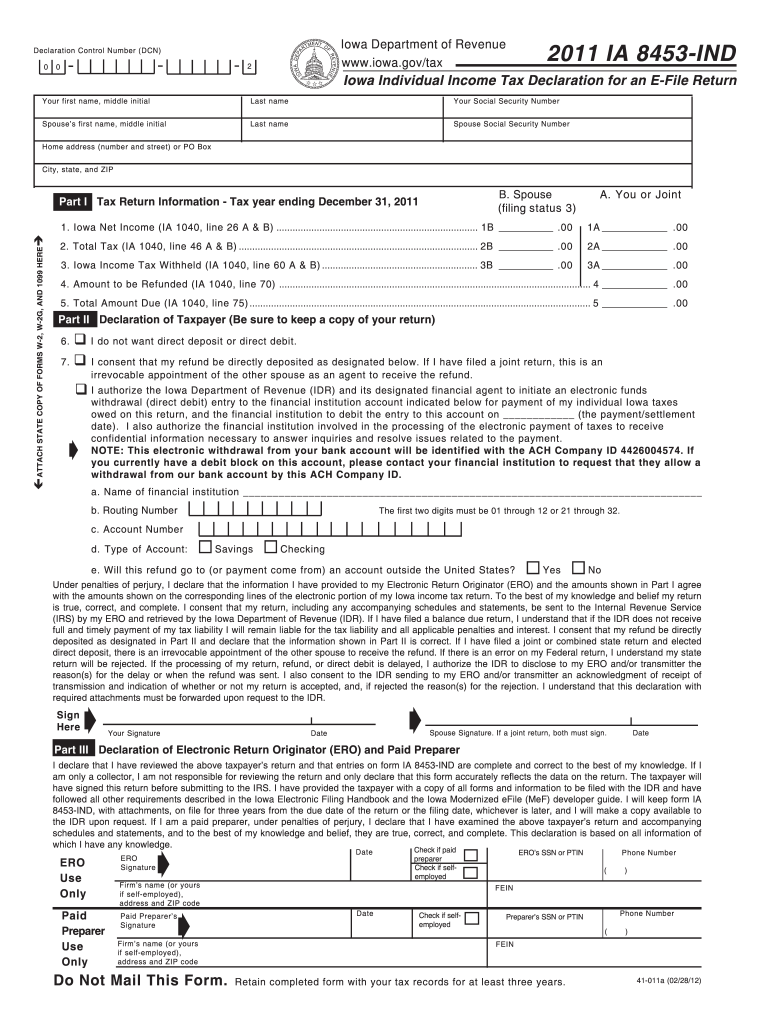

The Iowa Department Of Revenue IA 8453 IND Form is a crucial document used by individual taxpayers in Iowa to authenticate and submit their income tax returns electronically. This form serves as a declaration of the taxpayer's identity and verifies the accuracy of the information provided in the electronic submission. It is essential for ensuring compliance with state tax regulations and facilitates the e-filing process.

How to use the Iowa Department Of Revenue IA 8453 IND Form

To effectively use the Iowa Department Of Revenue IA 8453 IND Form, taxpayers must first complete their income tax return using an approved e-filing method. After preparing the return, the IA 8453 IND Form must be filled out with accurate personal information, including the taxpayer's name, Social Security number, and signature. Once completed, this form should be submitted electronically alongside the tax return to validate the submission.

Steps to complete the Iowa Department Of Revenue IA 8453 IND Form

Completing the Iowa Department Of Revenue IA 8453 IND Form involves several key steps:

- Gather personal information, including your Social Security number and income details.

- Access the IA 8453 IND Form through the Iowa Department of Revenue's official website or an approved e-filing software.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to prevent any errors that could delay processing.

- Sign the form electronically, which validates the submission of your tax return.

- Submit the completed form along with your electronic tax return.

Legal use of the Iowa Department Of Revenue IA 8453 IND Form

The Iowa Department Of Revenue IA 8453 IND Form has legal significance as it acts as a binding document that confirms the authenticity of the taxpayer's electronic submission. By signing this form, taxpayers affirm that the information provided is correct and complete, thereby adhering to Iowa tax laws. Failure to properly complete or submit this form can lead to penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

It is vital for taxpayers to be aware of the filing deadlines associated with the Iowa Department Of Revenue IA 8453 IND Form. Generally, individual income tax returns are due by April 30 of each year. However, taxpayers should check for any updates or changes to deadlines, especially during tax season, to ensure timely filing and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Department Of Revenue IA 8453 IND Form can be submitted electronically as part of the e-filing process. Taxpayers should ensure they have access to a compatible e-filing platform that supports the submission of this form. While electronic submission is the preferred method, taxpayers may also inquire about mail or in-person submission options if necessary, although these methods are less common for this form.

Quick guide on how to complete iowa department of revenue ia 8453 ind 2011 form

Your assistance manual on how to prepare your Iowa Department Of Revenue Ia 8453 Ind Form

If you’re curious about how to generate and submit your Iowa Department Of Revenue Ia 8453 Ind Form, here are a few brief tips on how to simplify tax processing.

To start, you simply need to create your airSlate SignNow profile to revamp how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, draft, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to amend information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Iowa Department Of Revenue Ia 8453 Ind Form in just a few minutes:

- Create your account and start working on PDFs shortly.

- Utilize our directory to access any IRS tax form; explore various versions and schedules.

- Click Get form to open your Iowa Department Of Revenue Ia 8453 Ind Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to include your legally-binding eSignature (if required).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper can lead to return errors and delay refunds. Of course, before e-filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa department of revenue ia 8453 ind 2011 form

Create this form in 5 minutes!

How to create an eSignature for the iowa department of revenue ia 8453 ind 2011 form

How to make an eSignature for the Iowa Department Of Revenue Ia 8453 Ind 2011 Form online

How to create an electronic signature for your Iowa Department Of Revenue Ia 8453 Ind 2011 Form in Google Chrome

How to generate an electronic signature for putting it on the Iowa Department Of Revenue Ia 8453 Ind 2011 Form in Gmail

How to make an electronic signature for the Iowa Department Of Revenue Ia 8453 Ind 2011 Form from your smart phone

How to generate an electronic signature for the Iowa Department Of Revenue Ia 8453 Ind 2011 Form on iOS

How to generate an electronic signature for the Iowa Department Of Revenue Ia 8453 Ind 2011 Form on Android OS

People also ask

-

What is the Iowa Department Of Revenue Ia 8453 Ind Form?

The Iowa Department Of Revenue Ia 8453 Ind Form is an essential document used for electronically filing Iowa individual income tax returns. It serves as a declaration of the taxpayer's identity and consent for electronic filing. Understanding this form is crucial for ensuring compliance with Iowa tax laws.

-

How can airSlate SignNow help with the Iowa Department Of Revenue Ia 8453 Ind Form?

airSlate SignNow provides an efficient platform for electronically signing and sending the Iowa Department Of Revenue Ia 8453 Ind Form. With its user-friendly interface, you can quickly complete and submit this form, ensuring a smooth filing process without any hassles.

-

Is airSlate SignNow cost-effective for handling the Iowa Department Of Revenue Ia 8453 Ind Form?

Yes, airSlate SignNow is a cost-effective solution for managing the Iowa Department Of Revenue Ia 8453 Ind Form. Our pricing plans are designed to accommodate various business needs, allowing you to send and eSign documents without overspending on unnecessary features.

-

What features does airSlate SignNow offer for the Iowa Department Of Revenue Ia 8453 Ind Form?

airSlate SignNow offers several features that enhance the handling of the Iowa Department Of Revenue Ia 8453 Ind Form, including customizable templates, in-app document tracking, and secure cloud storage. These features streamline the eSigning process and ensure your documents are always accessible.

-

Can I integrate airSlate SignNow with other applications for the Iowa Department Of Revenue Ia 8453 Ind Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can help manage the Iowa Department Of Revenue Ia 8453 Ind Form. You can connect with popular business tools like Google Drive, Salesforce, and more for a cohesive workflow.

-

What are the benefits of using airSlate SignNow for the Iowa Department Of Revenue Ia 8453 Ind Form?

Using airSlate SignNow for the Iowa Department Of Revenue Ia 8453 Ind Form simplifies the eSigning process, reduces turnaround time, and enhances document security. Additionally, our platform ensures compliance with eSignature laws, giving you peace of mind as you handle sensitive tax documents.

-

Is it easy to use airSlate SignNow for filing the Iowa Department Of Revenue Ia 8453 Ind Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to file the Iowa Department Of Revenue Ia 8453 Ind Form. Our intuitive interface guides you through the eSigning process, allowing you to complete and submit your forms quickly and efficiently.

Get more for Iowa Department Of Revenue Ia 8453 Ind Form

Find out other Iowa Department Of Revenue Ia 8453 Ind Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors