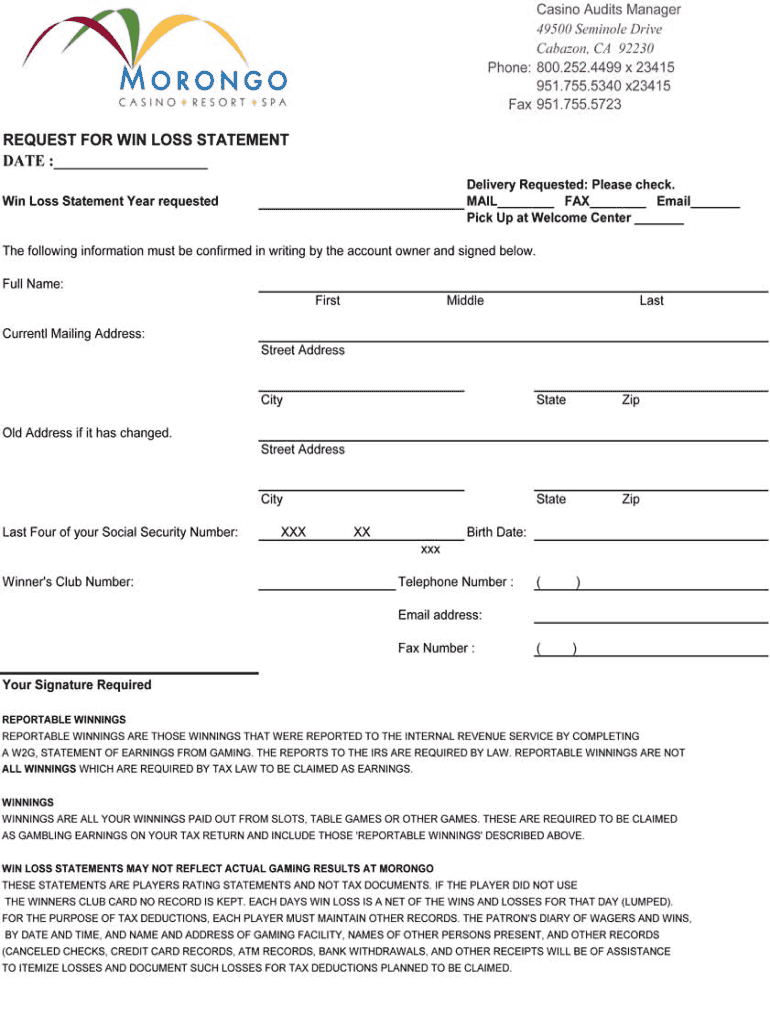

Moronogo Win Loss Statement Form

What makes the casino win loss statement form 100310302 legally valid?

Completing the casino win loss statement form 100310302 online is a fairly simple undertaking. However, it’s not always immediately obvious how you can make it professional-looking and legally binding at the same time.

The validity of any executed document, such as the casino win loss statement form 100310302 is based on particular requirements and regulations that you need to comply with. They consist of different eSignature laws, like ESIGN, UETA and eIDAS, and industry-leading information protection frameworks.

airSlate SignNow is definitely an innovative cloud-based eSignature tool that provides a simple way to complete any papers digitally while staying compliant with all the respective privacy and security requirements and legal frameworks.

How to shield your casino win loss statement form 100310302 when executing electronically?

As the saying goes, forewarned is forearmed. It is advisable to know about the possible security threats you might encounter when completing the casino win loss statement form 100310302 online and the best way to avoid them in a timely manner.

airSlate SignNow offers you extra possibilities for guaranteeing the protection and validity, and consistency of completed digital documents:

- Adherence to the key security standards: GDPR and CCPA, SOC II Type 2, 256-bit encryption.

- Simple secure credential administration: create an additional layer of protection coming from one of three options: password, phone call, or SMS.

- One source of truth at your fingertips: be aware of what happened, who did it, and when they did it with the Audit Trail option.

- Disaster recovery strategy: ensure that your record-based sessions run as frictionlessly as possible without disruptions.

Execute and certify your casino win loss statement form 100310302 with complete confidence that your form will be safeguarded and that your eSignature will be legally binding and admissible in the courtroom.

Quick guide on how to complete casino win loss statement form 100310302

Unearth the method to effortlessly navigate the Moronogo Win Loss Statement completion with this uncomplicated guide

Online document filing and certification is becoming more prevalent and is the preferred choice for numerous users. It offers numerous benefits over conventional printed documents, including convenience, efficiency, enhanced precision, and security.

Utilizing tools like airSlate SignNow, you can locate, alter, sign, enhance, and dispatch your Moronogo Win Loss Statement without being mired in endless printing and scanning processes. Follow this brief tutorial to commence and finalize your form.

Follow these steps to obtain and complete Moronogo Win Loss Statement

- Begin by clicking the Get Form button to access your form in our editor.

- Pay attention to the green indicator on the left that highlights required fields so you don’t miss them.

- Utilize our advanced features to annotate, modify, sign, protect, and enhance your form.

- Protect your document or transform it into a fillable form using the appropriate tab features.

- Review the form and check it for errors or inconsistencies.

- Click DONE to complete the editing process.

- Change the name of your form or leave it as is.

- Select the storage option you wish to use for your form, send it via USPS, or click the Download Now button to save your form.

If Moronogo Win Loss Statement isn’t what you were seeking, you can examine our extensive collection of pre-imported templates that you can fill out with ease. Explore our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I treat unrealized losses in equity for ITR? Which form should I fill out?

There is no procedure for set of unrealized losses in equity from other profit. The actual losses can be set of against the profit of other equities. For the purpose of profit or losses in the transaction of equity, the form no.3 should be filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

How do I go about getting cash back that was seized in a raid? I have proof the cash was won the night before at the casino. Cops gave me the wrong form to fill out.

How do I go about getting cash back that was seized in a raid? I have proof the cash was won the night before at the casino. Cops gave me the wrong form to fill out.Go to the police station front desk and request the correct form, bring what you were given and explain the problem. Either they will have what you need or can direct you to where you might need to go, which might be the court house or some other tier of administration. It just depends on how the county administration and filing is set up.If they can not sort it out then you need an attorney, sooner rather than later.The longer you wait, the harder this will be to recover.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

If I was at a Casino and lost over $20,000 in a slot machine before hitting a $10,000 jackpot, will I still have to fill out a tax form and declare that as income even thought I really lost $10,000?

There are two ways to handle slot winnings/losses. The “regular” way is that all winnings (whether you receive a W-2G or not) are reported on your 1040 as “other income”, and your losses that you can substantiate are deducted on your Schedule A (assuming that you itemize, etc.). Under that method, yes, you would report the $10K jackpot (plus any other winnings that came out of the machine(s)), and you would deduct your losses up to the amount of your reported winnings as an itemized deduction.The other way to do it is the technically correct way — and that is to net your slot results on a “session” basis. That is, from the time that you pull your first lever (or push your first “spin” button”) of the day until you stop playing the slots, other than short breaks — but not beyond midnight — you total your net winnings/losses, and that’s your winnings or losses for the “session” that are reportable on your tax return. That method, for example, enables you to take advantage of losses even if you don’t itemize deductions. Now, that’s not going to match up with any W-2G’s that you get, because the casinos don’t report on that basis (they don’t even report on the basis of a midnight-to-midnight day). But the IRS has ways in which you can indicate that on your return.So the answer to your question is, maybe. It depends on (i) when did you lose the $20K and win the $10K?, (ii) what kind of records do you have (a “players’ card” statement would be great), and (iii) what else did you win gambling?

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How likely are you to win a car from filling out a form at a mall? Who drives the new car home? What are your chances to win another car again?

I am going to get pretty literal here. Please forgive meHow likely are you to win a car from filling out a form at a mall? In the US, at least, this is usually spelled out somewhere on the form or on a website listed on the form. If it is not, you could ask (and may or may not get a truthful answer). If none of this works, you could probably be able to guess using a few factors: * How many people take the time to stop and enter (what percentage of passers-by, multiplied by amount of typical or expected foot-traffic)?* Are multiple entries allowed? * How long will entries be accepted before the drawing? As a rule of thumb, if the odds aren’t stated (and usually, even if they are) the odds are probably staggering. If you multiply the amount of time it takes to fill out the form by the amount of forms you would have to fill-out before you had an even 1% chance of winning the car, you would likely do better using that time to get a second job. Oh, and lastly, realize that the reason they are enticing you with the chance to win a car is that they are collecting your personal information on the form. It usually is quite a cheap way to generate a LOT of personal data, add you to mailing/dialing lists, etc. They folks running the drawing often gather another great bit of psychology about you: person who fills out form likes to enter “something for nothing” type contests (the drawing itself). This can be valuable to advertisers.Who drives the new car home? By definition of “home” the owner (presumably the winner) would drive the car “home”. If the car is driven to your house by an employee of the company running the lottery, they would just be driving the car to the winners residence…not their “home”.Frankly, I am not sure of what is meant by this question. I would assume that any winner of the drawing would either pick up the vehicle and drive it themselves away from the drawing or other site where the prize was moved to, possibly prepped for delivery tot he winner, or someone would deliver it to the winner’s home by driving it or trucking it there.What are your chances to win another car again? Your chances of winning the next drawing you entered would be EXACTLY the same as they would be had you lost the previous one, as specified in item number one. The odds of winning/losing do not change based on previous outcome. Think about it this way: If I just flipped a coin and it landed on “heads” 50 times in a row, what are the chances that it will be “heads” on the 51st attempt? EXACTLY (assuming there is nothing about the coin or flip that favors one side over the other) 1 in 2 or 50%, just as it was the first flip, just as it will be on the 51st millionth.Now the probability of winning 2 drawings, each with 1 million entries is staggeringly small. But they are two separate events, each governed independently by their own set of probabilities. Landing on heads 51 times in a row or winning 2 cars in consecutive drawings would be matters of remarkable coincidence: respectively 50 1 in 2 or 2 one in a million events happening to share the same outcome.Good luck

Create this form in 5 minutes!

How to create an eSignature for the casino win loss statement form 100310302

How to generate an eSignature for your Casino Win Loss Statement Form 100310302 online

How to create an eSignature for the Casino Win Loss Statement Form 100310302 in Google Chrome

How to create an electronic signature for putting it on the Casino Win Loss Statement Form 100310302 in Gmail

How to generate an electronic signature for the Casino Win Loss Statement Form 100310302 right from your mobile device

How to generate an eSignature for the Casino Win Loss Statement Form 100310302 on iOS

How to generate an electronic signature for the Casino Win Loss Statement Form 100310302 on Android OS

People also ask

-

What is the Moronogo Win Loss Statement?

The Moronogo Win Loss Statement is a comprehensive report that analyzes the outcomes of sales opportunities within your business. This statement provides insights into why deals were won or lost, helping you identify patterns and improve your sales strategies. Utilizing the Moronogo Win Loss Statement can empower your team to make data-driven decisions.

-

How can I generate a Moronogo Win Loss Statement using airSlate SignNow?

Generating a Moronogo Win Loss Statement with airSlate SignNow is straightforward. You can easily create and customize your documents, including the Moronogo Win Loss Statement, using our user-friendly platform. Once your document is ready, you can send it for eSignature instantly, streamlining the entire process.

-

What features of airSlate SignNow support the Moronogo Win Loss Statement?

AirSlate SignNow offers a range of features that support the creation and management of the Moronogo Win Loss Statement. These include customizable templates, real-time collaboration, and secure eSignature capabilities. With these tools, you can ensure that your Moronogo Win Loss Statement is both accurate and professional.

-

Is airSlate SignNow cost-effective for creating a Moronogo Win Loss Statement?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to various needs, allowing you to create essential documents like the Moronogo Win Loss Statement without breaking the bank. With airSlate SignNow, you can achieve signNow savings while still enjoying robust features.

-

Can I integrate airSlate SignNow with other tools for the Moronogo Win Loss Statement?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, enhancing the functionality of your Moronogo Win Loss Statement. Whether you use CRM systems, project management tools, or accounting software, our platform can easily connect to ensure a smooth workflow.

-

What are the benefits of using the Moronogo Win Loss Statement for my business?

Using the Moronogo Win Loss Statement can signNowly benefit your business by providing insights into your sales performance. This analysis helps you understand customer preferences and optimize your sales approach, leading to increased conversion rates. By leveraging the data in the Moronogo Win Loss Statement, you can refine your strategies for greater success.

-

Is there customer support available for questions about the Moronogo Win Loss Statement?

Yes, airSlate SignNow provides excellent customer support for any inquiries related to the Moronogo Win Loss Statement. Our dedicated support team is available to assist you with any questions or challenges you may encounter while using our platform. We’re committed to ensuring you have all the resources you need to succeed.

Get more for Moronogo Win Loss Statement

- Bill of sale for a tractor form

- Change in terms addendum to agreement of sale pa form

- Apria wound vac form

- Composite claim form aadhar in word format

- What is form i 730

- Form ar 11 aliens change of address card form ar 11 aliens change of address card

- Form i 601 instructions for application for waiver of grounds of inadmissibility form i 601 instructions for application for

- Application for waiver of passport andor visa dhs form

Find out other Moronogo Win Loss Statement

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF