Massachusetts 1 Es Form

What is the Massachusetts 1 Es Form

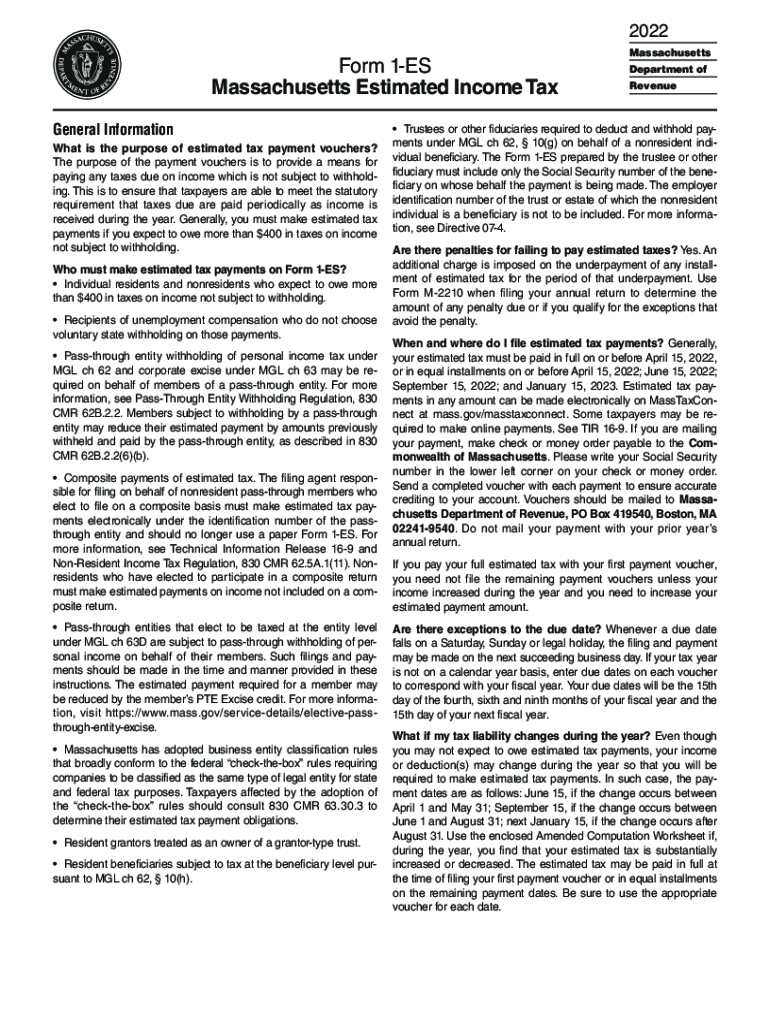

The Massachusetts 1 Es form, also known as the MA 1 Es, is a crucial document used for estimating income tax for individuals and businesses in Massachusetts. This form is essential for taxpayers who expect to owe more than $400 in state income tax for the year. By submitting the 1 Es form, taxpayers can calculate their estimated tax payments and ensure compliance with state tax regulations. This proactive approach helps to avoid penalties and interest that may arise from underpayment of taxes.

How to use the Massachusetts 1 Es Form

Using the Massachusetts 1 Es form involves several straightforward steps. First, gather all necessary financial information, including income sources, deductions, and credits. Next, complete the form by entering your estimated income, adjustments, and applicable deductions. The form will guide you through calculating your estimated tax liability. Once completed, you can submit the form electronically or by mail, depending on your preference. This process ensures that you stay on track with your tax obligations throughout the year.

Steps to complete the Massachusetts 1 Es Form

Completing the Massachusetts 1 Es form requires careful attention to detail. Begin by filling in your personal information, including your name, address, and Social Security number. Then, proceed to estimate your total income for the year, factoring in wages, self-employment income, and any other sources. After that, calculate your deductions and credits, which will reduce your taxable income. Finally, determine your estimated tax liability and the amount you plan to pay with your submission. Ensure that all figures are accurate to avoid issues with the Massachusetts Department of Revenue.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is essential for timely submission of the Massachusetts 1 Es form. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. It is important to mark these dates on your calendar to avoid penalties for late payments. If the due date falls on a weekend or holiday, the deadline is typically extended to the next business day. Adhering to these deadlines ensures that you remain compliant with Massachusetts tax laws.

Penalties for Non-Compliance

Failure to submit the Massachusetts 1 Es form or underpayment of estimated taxes can result in significant penalties. The Massachusetts Department of Revenue may impose a penalty if you owe more than $400 and do not pay at least 90% of your current year’s tax liability or 100% of the previous year’s tax. Additionally, interest may accrue on any unpaid amounts. Understanding these penalties emphasizes the importance of timely and accurate submissions, helping taxpayers avoid unnecessary financial burdens.

Required Documents

To complete the Massachusetts 1 Es form effectively, certain documents are necessary. Gather your prior year’s tax return, which provides a basis for estimating your income and deductions. Additionally, collect any relevant financial statements, such as W-2s, 1099s, and records of other income sources. Documentation of deductions, such as mortgage interest statements or business expenses, is also essential. Having these documents on hand will streamline the completion process and improve accuracy.

Who Issues the Form

The Massachusetts 1 Es form is issued by the Massachusetts Department of Revenue (DOR). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The DOR provides resources and guidance on how to complete the form and submit payments. By utilizing the information and support available from the DOR, taxpayers can navigate the estimated income tax process more effectively.

Quick guide on how to complete massachusetts 1 es form

Finish Massachusetts 1 Es Form effortlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Massachusetts 1 Es Form on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to modify and eSign Massachusetts 1 Es Form with ease

- Find Massachusetts 1 Es Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow portions of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and eSign Massachusetts 1 Es Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts 1 es form

Create this form in 5 minutes!

How to create an eSignature for the massachusetts 1 es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts estimated income tax?

The Massachusetts estimated income tax is a prepayment of your expected state income tax liability for the year. It is required for individuals who expect to owe more than a certain amount when filing their state tax returns. Understanding this tax helps in effective financial planning and avoiding penalties.

-

How can airSlate SignNow assist with Massachusetts estimated income tax documents?

airSlate SignNow allows businesses to easily send and eSign documents related to Massachusetts estimated income tax requirements. This streamlines the process, ensuring that all tax-related forms are completed accurately and efficiently. Our platform provides a secure way to manage your tax documentation.

-

Are there any costs associated with using airSlate SignNow for Massachusetts estimated income tax forms?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs, ensuring you can manage your Massachusetts estimated income tax forms cost-effectively. Each plan is designed to provide great value with features that enhance document management and electronic signing. Explore our plans to find one that integrates well with your business.

-

What features does airSlate SignNow offer for managing Massachusetts estimated income tax documents?

airSlate SignNow offers numerous features to simplify managing Massachusetts estimated income tax documents. Features include customizable templates, real-time tracking of document status, and secure cloud storage. These tools help businesses streamline their tax preparation processes and ensure compliance.

-

Can I integrate airSlate SignNow with other software for Massachusetts estimated income tax calculations?

Yes, airSlate SignNow integrates with various accounting and tax software, allowing for seamless management of your Massachusetts estimated income tax calculations. This integration helps automate data input and enhances accuracy in your tax documentation. Our platform supports a wide range of third-party applications for your convenience.

-

What are the benefits of using airSlate SignNow for Massachusetts estimated income tax issues?

Using airSlate SignNow for Massachusetts estimated income tax helps streamline document workflows, reduce paper usage, and improve efficiency. With our eSigning capabilities, you can sign and send tax documents quickly, ensuring timely submission to avoid penalties. Additionally, our user-friendly interface makes it accessible for all team members.

-

Is airSlate SignNow secure for handling sensitive Massachusetts estimated income tax information?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to ensure your Massachusetts estimated income tax information is protected. We use encryption and secure storage solutions to safeguard your documents and personal data. Trust us to keep your sensitive financial information safe.

Get more for Massachusetts 1 Es Form

- Chase loan modification number form

- Notice of completion certificate dl 101 form

- Fill out china visa online form

- Da form 3822

- Ahca 1823 form 2013

- How do i notify credit reporting agencies of a loved oneamp39s death form

- Short sale third party authorization form ning

- Sample reference check template form

Find out other Massachusetts 1 Es Form

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document