Nj W4 Form

What is the NJ W-4?

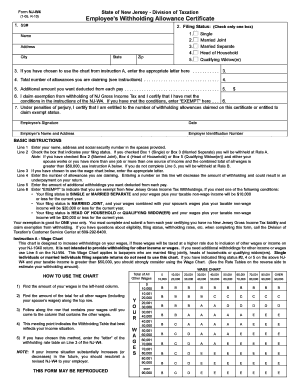

The NJ W-4 form, officially known as the Employee's Withholding Allowance Certificate, is a crucial document for employees in New Jersey. This form is used to determine the amount of state income tax that should be withheld from an employee's paycheck. It helps ensure that the correct amount of tax is deducted based on the employee's personal circumstances, such as marital status and number of dependents. Completing the NJ W-4 accurately is essential for compliance with state tax laws and for avoiding underpayment or overpayment of taxes.

Steps to Complete the NJ W-4

Filling out the NJ W-4 form involves several key steps to ensure accuracy and compliance. Here’s a streamlined process:

- Personal Information: Begin by entering your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal situation. This includes dependents and other factors that may affect your tax liability.

- Additional Withholding: If you wish to have additional amounts withheld from your paycheck, specify that in the appropriate section.

- Signature: Finally, sign and date the form to validate it.

How to Obtain the NJ W-4

The NJ W-4 form can be easily obtained through several channels. Employees can download a copy directly from the New Jersey Division of Taxation's website. Alternatively, employers often provide the form to new hires during the onboarding process. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal Use of the NJ W-4

The NJ W-4 form is legally binding when filled out correctly and submitted to your employer. It is essential for ensuring that the appropriate amount of state income tax is withheld from your earnings. Employers are required to keep the completed forms on file for their records. Misrepresentation or failure to submit a valid NJ W-4 can lead to penalties or issues with tax compliance.

Key Elements of the NJ W-4

Understanding the key elements of the NJ W-4 form is vital for effective completion. Important components include:

- Personal Information: Required details such as name, address, and Social Security number.

- Filing Status: Options to select your marital status, which affects tax calculations.

- Allowances: The number of allowances claimed, which determines withholding amounts.

- Additional Withholding: An option to specify any extra amounts you wish to withhold.

Form Submission Methods

Once the NJ W-4 form is completed, it must be submitted to your employer. This can typically be done in person, or you may have the option to submit it via email or fax, depending on your employer's policies. It is important to check with your HR department for specific submission guidelines to ensure compliance and timely processing.

Quick guide on how to complete nj w4

Manage Nj W4 seamlessly across any device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Nj W4 on any platform using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to modify and electronically sign Nj W4 effortlessly

- Find Nj W4 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for those purposes.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Nj W4 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4 form and why is it important?

A W4 form is an IRS document used by employees to indicate their tax situation to their employer. It is crucial for determining the amount of federal income tax that should be withheld from your paycheck. Understanding how to fill out a W4 form correctly can help you avoid overpaying or underpaying taxes.

-

How can airSlate SignNow help with completing a W4 form?

airSlate SignNow offers a user-friendly platform that allows you to fill out and eSign your W4 form digitally. This ensures you can complete your tax forms accurately and efficiently without the hassle of printing and faxing. Plus, you can easily send your W4 form to your employer.

-

Is there a cost associated with using airSlate SignNow for a W4 form?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs, starting with a free trial for new users. Each plan allows you to manage and eSign documents, including W4 forms, ensuring cost-effective solutions for all your document workflow needs. Detailed pricing information can be found on our website.

-

Can I integrate airSlate SignNow with other tools for handling W4 forms?

Absolutely! airSlate SignNow integrates seamlessly with various business tools such as Google Drive, Salesforce, and Zapier. This means you can easily manage your W4 forms alongside your other business documents and streamline your workflow without switching platforms.

-

What are the benefits of using airSlate SignNow for W4 forms?

Using airSlate SignNow for W4 forms offers numerous benefits, including increased efficiency, enhanced security, and ease of use. You can complete, eSign, and track your W4 form from any device, ensuring that your tax documents are handled securely and quickly. This convenience allows businesses and employees to focus on what matters most.

-

Is it easy to revise a W4 form using airSlate SignNow?

Yes, revising a W4 form using airSlate SignNow is straightforward. If your tax situation changes, you can quickly edit and re-sign your W4 form electronically. The platform's intuitive interface makes making adjustments simple while maintaining a clear audit trail of changes.

-

Can I send the W4 form to multiple recipients using airSlate SignNow?

Yes, airSlate SignNow allows you to send your W4 form to multiple recipients in just a few clicks. This feature facilitates easy collaboration among employers and employees, ensuring that everyone has the necessary documentation for accurate tax withholding. It's perfect for companies handling multiple employees' tax forms.

Get more for Nj W4

Find out other Nj W4

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself