1099 C 2018

What is the 1099 C

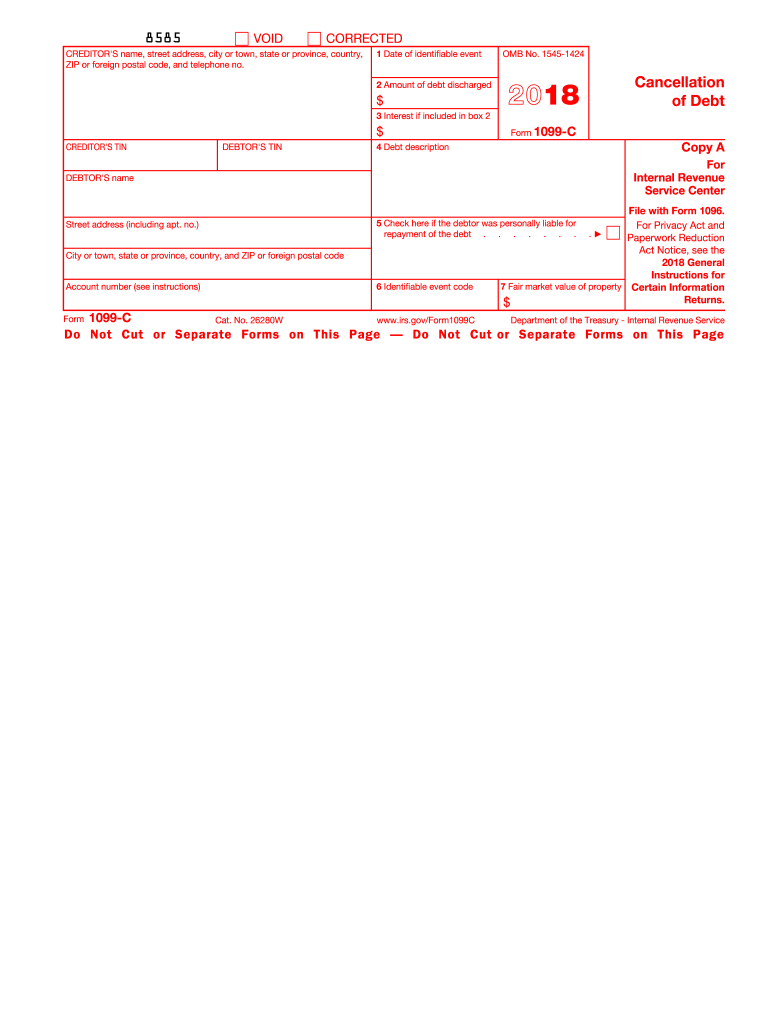

The 1099 C form, officially known as the federal tax form 1099-C, is used by creditors to report the cancellation of debt. This form is crucial for taxpayers who have had a debt forgiven or canceled, as it may have tax implications. When a creditor forgives a debt of six hundred dollars or more, they are required to file this form with the IRS and provide a copy to the debtor. The amount reported on the 1099 C is generally considered taxable income, which means it must be reported on your tax return.

How to use the 1099 C

Using the 1099 C involves understanding its implications for your tax situation. Once you receive the form, review it for accuracy, ensuring that the amount of canceled debt is correct. You will need to report this amount on your tax return, typically on Form 1040. If you believe you qualify for an exclusion, such as insolvency or bankruptcy, you may need to complete additional forms to claim these exceptions. It is advisable to consult a tax professional if you are unsure how to proceed.

Steps to complete the 1099 C

Completing the 1099 C requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Enter the creditor's information, including their name, address, and taxpayer identification number.

- Fill in the amount of debt canceled, ensuring it matches the creditor's records.

- Provide the date of cancellation and any applicable identification numbers.

- Review the form for accuracy before submitting it to the IRS and providing a copy to the debtor.

Key elements of the 1099 C

The 1099 C includes several key elements that are essential for both the creditor and the debtor. These elements are:

- Creditor's Information: Name, address, and taxpayer identification number of the entity that canceled the debt.

- Debtor's Information: Name, address, and taxpayer identification number of the individual whose debt was canceled.

- Amount of Debt Canceled: The total amount of debt forgiven, which is reported as income.

- Date of Cancellation: The date when the debt was canceled, which is important for tax reporting purposes.

- Account Number: A unique identifier for the account associated with the canceled debt.

IRS Guidelines

The IRS provides specific guidelines for the use and reporting of the 1099 C. According to IRS regulations, creditors must file this form when they cancel a debt of six hundred dollars or more. The form must be submitted to the IRS by the end of February if filed on paper or by the end of March if filed electronically. Additionally, creditors must provide a copy of the form to the debtor by the same deadlines. It is important to follow these guidelines to avoid penalties and ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 C are critical for both creditors and debtors. The form must be filed with the IRS by February twenty-eighth for paper submissions and by March thirty-first for electronic submissions. Debtors should receive their copies by these same dates. Keeping track of these deadlines helps ensure that all parties comply with IRS regulations and avoid potential penalties.

Quick guide on how to complete 2015 1099 c

Finish 1099 C effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle 1099 C on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign 1099 C without hassle

- Locate 1099 C and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, through email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 C and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 c

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 c

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a 1099 C form and when is it used?

A 1099 C form, also known as the Cancellation of Debt form, is used to report the cancellation of debt by a lender to the IRS. Businesses typically use this form when they forgive a debt that is $600 or more. It's important to accurately report any 1099 C forms to avoid tax implications for both the creditor and debtor.

-

How can airSlate SignNow help with 1099 C document management?

airSlate SignNow offers a seamless way to send and eSign 1099 C forms electronically, ensuring quick turnaround times and secure transactions. Our platform simplifies document management, allowing users to track and store signed forms efficiently. This helps streamline your tax preparation process and ensures compliance with IRS regulations.

-

Is airSlate SignNow suitable for small businesses handling 1099 C forms?

Absolutely! airSlate SignNow provides small businesses with an affordable and user-friendly solution for managing 1099 C forms. Our platform is designed to cater to businesses of all sizes, enabling you to easily prepare, send, and eSign documents without the need for extensive resources.

-

What features does airSlate SignNow offer for handling 1099 C forms?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning, making it easy to handle 1099 C forms. You can create and edit templates specifically for 1099 C forms, ensuring that all necessary information is included. Plus, our cloud storage keeps your documents safe and accessible.

-

Are there any integrations available for managing 1099 C forms with airSlate SignNow?

Yes, airSlate SignNow integrates with various accounting and financial software, allowing for streamlined management of 1099 C forms. This integration enables automatic population of data into your 1099 C forms, reducing manual entry errors and saving you time. Popular integrations include QuickBooks, Xero, and more.

-

What are the pricing options for airSlate SignNow for handling 1099 C forms?

airSlate SignNow offers competitive pricing plans tailored for different business needs, including options for those frequently dealing with 1099 C forms. Our subscription plans are designed to be cost-effective, ensuring you only pay for the features you need. Explore our pricing page to find the plan that best fits your budget.

-

How secure is the eSigning process for 1099 C forms with airSlate SignNow?

The security of your 1099 C forms is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure servers to protect your documents during the eSigning process. Additionally, we provide compliance with industry standards, ensuring that your sensitive financial information remains safe.

Get more for 1099 C

Find out other 1099 C

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple