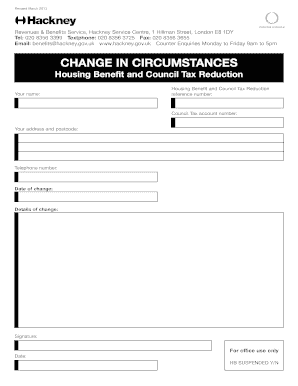

Hackney Council Tax Form

What is the Hackney Council Tax?

The Hackney Council Tax is a local taxation system implemented by the Hackney Borough Council in the United Kingdom. It is primarily used to fund local services such as education, transportation, and public safety. Residents of Hackney are required to pay this tax based on the value of their property and the number of occupants. The council tax is crucial for maintaining community services and infrastructure, ensuring that residents have access to essential amenities.

How to use the Hackney Council Tax

Using the Hackney Council Tax involves understanding your obligations and how to manage payments. Residents can calculate their council tax based on their property band and the number of adults living in the household. Payments can be made online, by direct debit, or through traditional methods such as bank transfers. It is essential to stay informed about any changes in rates or regulations, which can affect your payment responsibilities.

Steps to complete the Hackney Council Tax

Completing your Hackney Council Tax responsibilities involves several steps:

- Determine your property band, which affects the amount you owe.

- Check for any discounts or exemptions you may qualify for, such as single occupancy discounts.

- Register for council tax online through the Hackney Council website.

- Set up your payment method, choosing from options like direct debit or online payments.

- Keep track of your payments and any correspondence from the council regarding your tax status.

Required Documents

When dealing with the Hackney Council Tax, certain documents may be required to verify your identity and circumstances. These can include:

- Proof of identity, such as a driver's license or passport.

- Proof of residency, such as utility bills or lease agreements.

- Documentation for any discounts or exemptions claimed, such as evidence of student status or disability.

Eligibility Criteria

Eligibility for the Hackney Council Tax is generally based on residency and property ownership. All adults living in a property are liable for council tax, but certain exemptions exist. Key criteria include:

- Residents under the age of 18 are not liable.

- Full-time students may be exempt from paying council tax.

- Individuals with severe mental impairments may also qualify for exemptions.

Penalties for Non-Compliance

Failure to comply with Hackney Council Tax regulations can result in penalties. These may include:

- Additional charges added to your account for late payments.

- Legal action taken by the council to recover unpaid taxes.

- Potential court costs if the matter escalates to legal proceedings.

Quick guide on how to complete hackney council tax

Effortlessly Complete Hackney Council Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Hackney Council Tax on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Hackney Council Tax with Ease

- Locate Hackney Council Tax and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you'd like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Edit and eSign Hackney Council Tax to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hackney council tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a hackney change of circumstances?

A hackney change of circumstances refers to any modifications in your status or situation that need to be reported to the local authority handling your taxi licensing. This could include changes in your address, personal details, or financial situation. It's crucial to inform them promptly to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with a hackney change of circumstances?

airSlate SignNow makes it easy to manage your hackney change of circumstances by allowing you to digitally sign and send necessary documents. With our user-friendly platform, you can quickly complete any required paperwork from anywhere, ensuring your licensing remains up-to-date without any hassle.

-

Is there a cost associated with using airSlate SignNow for managing hackney change of circumstances?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget and usage requirements while ensuring that you have access to tools that streamline your hackney change of circumstances documentation.

-

What features does airSlate SignNow offer for managing documents related to hackney change of circumstances?

Our platform offers features such as document templates, secure eSignatures, and real-time tracking for your hackney change of circumstances documents. These tools ensure that your applications are completed accurately and submitted efficiently, saving you time and effort.

-

Can airSlate SignNow integrate with other applications for managing hackney change of circumstances?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow when handling hackney change of circumstances. Whether you're using CRM systems, document management tools, or other software, our platform helps streamline your processes efficiently.

-

What are the benefits of using airSlate SignNow for my hackney change of circumstances?

Using airSlate SignNow for your hackney change of circumstances means you benefit from a quick, secure, and cost-effective document management solution. You can submit changes electronically at your convenience, reducing paperwork and the potential for errors, ultimately saving you time and money.

-

Is airSlate SignNow user-friendly for submitting hackney change of circumstances?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface allows you to navigate easily through the steps needed to submit your hackney change of circumstances, making the process straightforward for users of all technical abilities.

Get more for Hackney Council Tax

- Pharmacy technician all allied health schoolsfind health form

- Tuition waiver stipend docappd21618doc form

- Registration and academic recordsminnesota state form

- Igetc certification form certificate of achievement petition

- Igetc certification form

- Injury and illness prevention program iipp environment health www ehs ucsd form

- Declaration and acknowledgement form

- Forms state bar of arizona

Find out other Hackney Council Tax

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple