Pit Rc Form

What is the Pit Rc

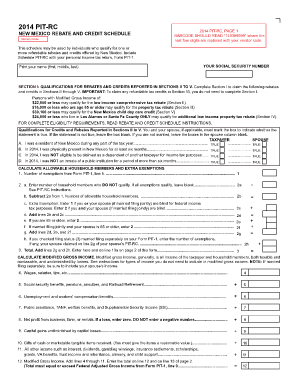

The Pit Rc, or the New Mexico Rebate and Credit Schedule, is a crucial tax form used by residents of New Mexico to claim various tax credits and rebates. This form helps individuals and businesses report their eligibility for state-specific tax benefits, including those related to property taxes and other financial incentives. Understanding the Pit Rc is essential for ensuring compliance with state tax laws and maximizing potential refunds.

How to use the Pit Rc

Using the Pit Rc involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form by providing required personal information and detailing any applicable credits or rebates. It is important to follow the instructions carefully to avoid errors that could delay processing. Once completed, the form can be submitted electronically or by mail, depending on your preference.

Steps to complete the Pit Rc

Completing the Pit Rc requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Pit Rc form from the New Mexico Taxation and Revenue Department.

- Fill in your personal information, including your name, address, and Social Security number.

- List all applicable credits and rebates you are claiming, ensuring you have the necessary documentation to support your claims.

- Double-check all entries for accuracy and completeness.

- Submit the form either electronically through a secure portal or by mailing it to the appropriate tax office.

Legal use of the Pit Rc

The legal use of the Pit Rc is governed by New Mexico tax laws. It is important to ensure that all claims made on the form are accurate and supported by appropriate documentation. Misrepresentation or fraudulent claims can lead to penalties, including fines and potential legal action. Therefore, understanding the legal implications of using this form is essential for all taxpayers.

Eligibility Criteria

To be eligible for the credits and rebates claimed on the Pit Rc, taxpayers must meet specific criteria set forth by New Mexico tax regulations. This may include residency requirements, income thresholds, and other factors that determine eligibility for various tax benefits. It is advisable to review these criteria carefully before completing the form to ensure compliance and maximize potential benefits.

Form Submission Methods

The Pit Rc can be submitted through multiple methods to accommodate different preferences. Taxpayers can choose to file electronically via the New Mexico Taxation and Revenue Department's online portal, which offers a convenient and secure way to submit forms. Alternatively, the form can be printed and mailed directly to the appropriate tax office. In-person submissions may also be available at designated locations, providing additional options for taxpayers.

Quick guide on how to complete pit rc

Prepare Pit Rc effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Pit Rc on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Pit Rc without stress

- Locate Pit Rc and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your choice. Modify and eSign Pit Rc and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit rc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pit rc and how can it benefit my business?

Pit rc is a powerful solution designed to streamline your document signing process. By incorporating pit rc into your business operations, you can enhance efficiency, reduce turnaround times, and improve customer satisfaction. This allows you to focus more on your core operations while ensuring that contracts are executed swiftly.

-

How does airSlate SignNow's pit rc compare to other e-signature solutions?

Pit rc, offered by airSlate SignNow, stands out due to its user-friendly interface and cost-effective pricing. Unlike some competitors, pit rc provides robust features without overwhelming users with complexity. This ensures businesses can easily adopt the technology and enjoy all its benefits.

-

Is there a free trial available for pit rc?

Yes, airSlate SignNow offers a free trial for pit rc, allowing businesses to explore its features without any initial investment. This trial period helps you understand how pit rc can fit into your workflows before committing to a subscription. Sign up today to experience the advantages firsthand.

-

What key features are included with pit rc?

Pit rc includes a suite of essential features such as document templates, real-time tracking, and secure storage. These functionalities are designed to enhance user experience and facilitate smoother transactions. With these tools, businesses can manage their documents effectively and securely.

-

Can I integrate pit rc with other software applications?

Absolutely! Pit rc supports various integrations with popular software applications, making it easier to incorporate into your existing workflows. Whether you're using CRM systems, cloud storage, or project management tools, pit rc can enhance interoperability and efficiency across your business.

-

What types of documents can I sign using pit rc?

With pit rc, you can sign a wide range of documents, including contracts, agreements, and consent forms. This versatility makes pit rc ideal for various industries, enabling businesses to manage all their signing needs in one platform. It simplifies the document lifecycle from creation to approval.

-

How secure is the pit rc platform for signing documents?

Pit rc prioritizes security with features such as encryption, secure access, and compliance with industry standards. This ensures that your documents remain safe from unauthorized access and that all transactions are protected. You can trust pit rc for a secure e-signature experience.

Get more for Pit Rc

- Prefinished aluminum standard stock colors 1 888 925 8638 form

- Prosci exam form

- Bail enforcement contract form

- 4 h camp f600 a formpdf university of tennessee extension

- Dss 1678 replacement affidavit info dhhs state nc form

- Desert escrow association scholarship application name of palmspringshighschool form

- Cessna 172s skyhawk standardization manual private pilot tasks legacyflightacademy form

- Pursuant to the provisions of act 162 public acts of 1982 the undersigned corporation executes the following articles michigan form

Find out other Pit Rc

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online