Purchase and Sale Agreement Washington State Form

What is the residential purchase and sale agreement in Washington State?

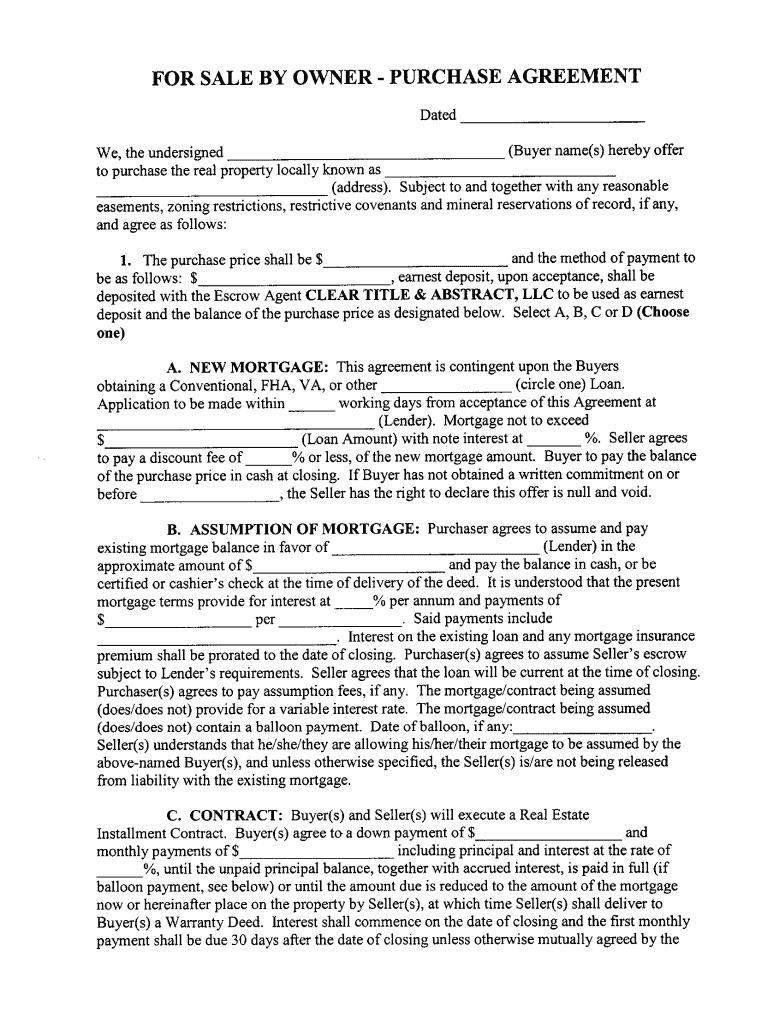

The residential purchase and sale agreement is a legally binding document used in real estate transactions in Washington State. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement typically includes essential details such as the purchase price, financing arrangements, and contingencies that must be met for the sale to proceed. Understanding this document is crucial for both buyers and sellers to ensure a smooth transaction process and to protect their legal rights.

Key elements of the residential purchase and sale agreement

A well-structured residential purchase and sale agreement includes several key elements that define the transaction. These elements typically encompass:

- Property Description: A detailed description of the property being sold, including its address and legal description.

- Purchase Price: The agreed-upon amount the buyer will pay for the property.

- Contingencies: Conditions that must be satisfied for the sale to proceed, such as financing approval or home inspections.

- Closing Date: The date on which the transaction will be finalized, and ownership will transfer to the buyer.

- Earnest Money: A deposit made by the buyer to demonstrate their serious intent to purchase the property.

Each of these elements plays a critical role in ensuring that both parties are clear on their responsibilities and expectations throughout the transaction.

Steps to complete the residential purchase and sale agreement

Completing a residential purchase and sale agreement involves several important steps. First, both parties should gather all necessary information about the property and their respective needs. Next, they should carefully fill out the agreement, ensuring that all key elements are included. It is advisable for both parties to review the document thoroughly, possibly with legal assistance, to ensure clarity and compliance with Washington State laws. Once both parties are satisfied with the terms, they can sign the agreement electronically, which is legally recognized in Washington State.

Legal use of the residential purchase and sale agreement

The legal use of the residential purchase and sale agreement in Washington State is governed by specific laws and regulations. To be enforceable, the agreement must meet certain criteria, including the inclusion of all required elements and compliance with state laws regarding real estate transactions. Electronic signatures are valid under Washington State law, provided that the signing process adheres to the standards set forth by the ESIGN Act and UETA. This ensures that the agreement is legally binding and can be upheld in a court of law if necessary.

How to obtain the residential purchase and sale agreement

Obtaining a residential purchase and sale agreement in Washington State can be accomplished through various means. Many real estate agents provide standardized forms that comply with state laws. Additionally, legal professionals can draft customized agreements tailored to specific transactions. Online resources also offer templates that can be filled out and customized as needed. It is essential to ensure that any form used is up-to-date and complies with current Washington State regulations to avoid potential legal issues.

State-specific rules for the residential purchase and sale agreement

Washington State has specific rules governing the residential purchase and sale agreement that both buyers and sellers should be aware of. For instance, the agreement must include specific disclosures regarding property conditions, such as lead paint and other environmental hazards. Additionally, Washington law mandates that certain contingencies be included, like the buyer's right to conduct inspections. Familiarizing oneself with these state-specific rules helps ensure compliance and protects the interests of all parties involved in the transaction.

Quick guide on how to complete washington residential real estate purchase and sale agreement

Complete Purchase And Sale Agreement Washington State effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed forms, as you can locate the necessary document and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without holdups. Handle Purchase And Sale Agreement Washington State on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Purchase And Sale Agreement Washington State with ease

- Obtain Purchase And Sale Agreement Washington State and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with a few clicks from any device you prefer. Modify and eSign Purchase And Sale Agreement Washington State and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Who makes the purchase and sale agreement, plus a contingency to buy a real estate property?

Who makes the purchase and sale agreement:A Purchase and Sale (P&S) understanding is an authoritative archive that has been arranged and consented to by lawyers speaking to the buyer and seller in a land exchange. In Massachusetts, it must be marked by a purchaser and dealer after both sides have gone to a concurrence on an offer on a bit of land. The P&S will incorporate the last deal cost and all terms of the buy, and it covers the weeks between when a property is removed the market and shutting; a few conditions stretch out past the end date.takes after is a rundown of normal possibilities that can be found in most home buy understandings.Contingency to buy a real estate property:Financing/Loan ContingencyAll home deal contracts will be dependent upon you, the Buyer, having the capacity to secure a credit or other wellspring of financing with which to buy the house. This possibility may put a day and age amongst marking and shutting in which the purchaser must secure this financing. For a first time purchaser, the a lot of cash included can appear to be very overwhelming, however remember this is quite normal. In the event that you can pay money in advance for the offer of the home, then you will have the capacity to discard this possibility.2. Home InspectionA typical possibility inside a home deal assention contract is one that gives the purchaser the privilege to no less than one home review before a specific date. This possibility ought to likewise give the purchaser the chance to escape the agreement, or request repairs, if the purchaser is not, in compliance with common decency, happy with the state of the house.3. ProtectionMost property holders will need to ensure that their new buy has home protection before moving in. Be that as it may, insurance agencies have turned out to be increasingly hesitant to protect properties and homes in specific parts of the nation.4. TitleThis can be a standout amongst the most imperative possibilities for you as the purchaser. This possibility will permit you to leave the agreement if the dealer of the home can't demonstrate that he or she has substantial legitimate title to the property that is available to be purchased.What to do nextSubsequent to considering what sorts of possibilities you need in your home deal understanding, set them in motion as a feature of your offer to purchase the house.

-

If your real estate attorney was negligent and had you sign an agreement without explaining it to you, can you back out of the home purchase?

No. If you had questions you should have asked them to the attorney before signing the contract. If the attorney was not answering them in a way you can understand you could have found a different attorney. Not all lawyers are equal in talent and communication skills.Finally you still might be able to back out of the contract. Most purchase agreements provide a timeframe for inspection and allow a buyer to terminate during the inspection period for any reason or no reason.If you missed the inspection period deadline that means your earnest money deposit is at risk (or non refundable) and the seller can keep it. Despending on how large the earnest money deposit (a few hundred bucks to several thousand) you should be able to make a business decision if it's worth walking away from the deal if you really don't want to buy the property. It may cost you some money in losing your deposit but it may be a better decision than closing on a property you don't want to buy. Good luck!

-

Where do residential real estate companies get their forms from (i.e., offer to purchase, addendum, counters, etc.)? How often are they updated?

Most states have standardized forms to simplify this for all parties to a residential transaction. Keep in mind that commercial transactions are a lot more cavalier. As it is assumed that someone purchasing commercial property is somewhat savvy, the government does not aim to regulate and “protect” these individuals as heavily. Florida has the Florida Real Estate Commission (FREC), which governs real estate brokerage activity and provides guidance on best practices. Most states have something comparable that puts together these forms you reference.

-

When a Purchase and Sale Agreement doesn't close and neither buyer nor seller had signed the final paperwork on closing day, how do you determine which party bsignNowed the contract? I'm in Washington State and our contract was the standard MLS form.

It depends on why the parties didn’t close the transaction. You would need to describe the sequence of events or reason why it evolved this way.Example 1: Let’s say the buyer’s lender needed additional time to get the loan documents into escrow and the loan funded (an avoidable issue but one which occurs quite often). Without the loan docs to sign, the closing gets delayed. The seller needed the funds on time to close on the purchase of their next home on time, so now we’ve got one very upset seller!This would be a bsignNow by the buyer. The seller can sign quickly just after the buyer does, so they wait for confirmation that the loan docs are received, etc. In this case, neither party has signed but it’s the buyer’s fault.Example 2: Let’s say the buyer is ready to sign the loan documents but the lender requires a particular document signed by the seller. The seller is scheduled to sign their papers on Thursday afternoon and closing (title transfer to the buyer) is set for the following day, Friday afternoon*. The buyer has movers and everything set to move-in Friday evening.Unfortunately, the seller misses the bus to the signing appointment and cannot get to the escrow office before it closes on Thursday. The seller reschedules to sign on Friday, but the buyer is not available to sign the loan docs on Friday, so the closing slips to the following week. It turns out that Monday is a holiday, so the closing gets delayed until Tuesday (at the earliest). Uh oh…The buyer loses their appointment with the moving company, they have to cancel all the friends who were going to help, and the buyer is leaving on Tuesday for a business trip, so a bad situation is getting worse. We’ve got one very upset buyer who now wants compensation.This would be a bsignNow by the seller. In this case, neither party has signed but it’s the seller’s fault.And, yes, stuff like this does happen. After you’ve been a broker for 20+ years, you have a few stories to tell.*Assume that we table fund Friday morning and record special Friday afternoon. It happens.Note: the answer by Robert Flynn misunderstands the question: the Purchase/Sale Agreement has been signed and is executory. The poster said the final closing papers (loan, deed of trust, etc.) were yet to be signed. Big difference.

-

Can I sue a homeowner or their real estate in a situation where both parties signed a purchase agreement then the buyer signed the contract, didn’t send it to me and eventually backed out?

Almost certainly no.There are certain things you must have to create a legal, enforceable contract:Legal intentCapacity of the partiesConsideration (something of value)Mutual agreementAdditionally, almost everything involving real estate falls under the Statute of Frauds. This comes from the English Common law, and says the contract must be in writing to be enforceable. It includes agreements to by or sell real estate and agreements made in consideration of marriage. (Just tossing that last in because its interesting)A real estate purchase contract starts with an offer in writing. The offeree (seller) may accept the offer as presented, reject it or make a counter-offer. Any change to the offer, no matter how minor, constitutes a counter-offer. The original offeror can do the same thing. There is no contract until and unless there is the meeting of the minds—complete agreement—and the agreement has been communicated to all parties.Once there is a meeting of minds, the document becomes an executory contract; that is, one which is in the process of being performed. Almost all real estate purchase agreements contain certain contingencies (we often call them “weasel clauses). Among these are typically loan, appraisal and inspection contingencies.The loan contingency states that the buyer must apply for and be approved for a loan within a certain period (typically 17–21 days). If the buyer does not get the loan for any reason, they get to walk, and they’ll get their earnest money deposit (the consideration) back.If the property appraises for less than the purchase, price, they can walk. If there is something on an inspection report they don’t like, they can walk.Once the buyer has removed all contingencies, they are obligated to perform—to complete the purchase. If they don’t, they are said to be in bsignNow—violating the contract—and may forfeit their deposit.Most real estate purchase contracts today are written by the various state Realtors’ Associations. They typically contain a “Liquidated Damages” clause to be initialed by the parties. This clause states in essence, “The parties agree that determining exact money damages in the event that the buyer does not perform is very difficult. Therefore, buyer and seller agree that the buyer’s earnest money deposit will be considered satisfaction for a bsignNow by the buyer.”In plain language the Liquidated Damages clause states that if a buyer decides not to proceed after having removed all contingencies, they may forfeit their earnest money deposit to the seller.Most contracts also contain an Arbitration Clause. By initialing this, both parties agree to go to binding arbitration rather than filing a lawsuit.If the buyer in your case did not deposit a check with escrow, you never had a contract. If there were contingencies which they did not remove, such as a loan contingency, they are completely free to walk. If you made a counter offer which they chose to ignore, you never had a contract. If your acceptance of their offer was not communicated to them (typically be delivering to them a fully-executed copy of the purchase agreement), you did not have a contract.Someone who “ghosts” and does not take the steps to proceed with a purchase for whatever reason almost invariably has plenty of legal “outs” if they don’t want to go forward. I believe your best bet is just to get on with your life and find another buyer.My standard disclaimer: While I am confident in the accuracy of my statements here, no one should construe a single word of it to be legal advice. I am not an attorney, although I know a whole lot of really fine legalish words. The best. They’re terrific. Anyone who needs legal advice should seek such advice from a duly licensed professional. Relying on “legal” advice on Quora could be an indication of a need for another kind of professional help.I hope this is helpful. Good luck.

-

If a California real estate purchase agreement is found to be null and void, how should a party who paid a deposit recover it? Is a lawyer needed? Is a summary judgment usually received? About how many billable lawyer hours would this involve?

Good answer from Bruce. If this was part of a court proceeding, though, you certainly can consult with the lawyer who represented you at the proceeding for clarification on recovery of your deposit.But let me make a guess: Did the contract simply fall through? Maybe one party didn’t perform as agreed to?Disclaimer: I’m only licensed in Virginia, not California. And I’m not a lawyer, so this isn’t legal advice.If the deposit is being held in escrow (often it’s in an escrow account in the name of the listing agent’s brokerage . . . though it could be elsewhere), then it generally takes agreement of both parties—buyer and seller—to release the funds. Neither the would-be buyer or would-be seller alone can get the funds released.Assuming the matter is just between the buyer and seller—that no court has issued a decision on how the funds are to be distributed—then it’s up to the buyer and seller to agree. In general, understandably, if the buyer defaulted on some term of the contract, then the seller retains all or most of the deposit. On the other hand, if the seller defaulted, the buyer should receive all or most of his/her deposit back. (The person at fault doesn’t get to keep/recover the money.) But ultimately that’s an issue between the buyer and seller.If there’s a problem—say the seller defaulted but won’t agree to return the money—then you may have to go to court. It’ll then be up to the court to decide who gets what. And unfortunately I can’t give you an estimate of how much time, or how much in fees, that would cost.

Create this form in 5 minutes!

How to create an eSignature for the washington residential real estate purchase and sale agreement

How to make an electronic signature for your Washington Residential Real Estate Purchase And Sale Agreement in the online mode

How to create an eSignature for your Washington Residential Real Estate Purchase And Sale Agreement in Chrome

How to create an electronic signature for putting it on the Washington Residential Real Estate Purchase And Sale Agreement in Gmail

How to generate an electronic signature for the Washington Residential Real Estate Purchase And Sale Agreement straight from your smartphone

How to create an electronic signature for the Washington Residential Real Estate Purchase And Sale Agreement on iOS

How to create an eSignature for the Washington Residential Real Estate Purchase And Sale Agreement on Android devices

People also ask

-

What is a purchase and sale agreement?

A purchase and sale agreement is a legally binding contract between a buyer and a seller that outlines the terms and conditions of a property transaction. This agreement crucially details the purchase price, deposit amount, closing date, and any contingencies. Utilizing airSlate SignNow can simplify the process of drafting and signing your purchase and sale agreement.

-

How does airSlate SignNow facilitate the eSigning of a purchase and sale agreement?

airSlate SignNow allows users to create, send, and eSign a purchase and sale agreement quickly and securely online. Our platform offers easy-to-use tools for adding electronic signatures, thereby eliminating the need for physical paperwork. This streamlining enhances the efficiency of your real estate transactions.

-

What features does airSlate SignNow offer for managing purchase and sale agreements?

airSlate SignNow provides features such as customizable templates for purchase and sale agreements, automated reminders, and tracking for your documents. Additionally, you can integrate various third-party applications to enhance your workflow management. These features collectively ensure a smooth experience for users throughout the agreement process.

-

Is airSlate SignNow a cost-effective solution for small businesses handling purchase and sale agreements?

Yes, airSlate SignNow is designed to be a cost-effective solution, especially for small businesses dealing with purchase and sale agreements. Our pricing plans are flexible, allowing businesses to choose options that suit their budget and needs. This allows small enterprises to leverage necessary tools without overspending.

-

Can I customize my purchase and sale agreement template in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates for purchase and sale agreements, enabling you to tailor documents to specific needs or preferences. You can adjust fields, clauses, and conditions as required. This customization ensures that your agreements meet legal requirements and reflect the unique aspects of each transaction.

-

What integrations does airSlate SignNow support for purchase and sale agreements?

airSlate SignNow offers a wide range of integrations with popular tools and applications, such as CRM systems, cloud storage, and communication platforms. This enhances the efficiency of managing your purchase and sale agreements by allowing for seamless data transfer and collaboration across various platforms. Simplifying integration means you can maintain your workflow without interruption.

-

How secure is the eSigning process for purchase and sale agreements on airSlate SignNow?

The eSigning process for purchase and sale agreements on airSlate SignNow adheres to the highest security standards, including encryption and compliance with eSignature laws. This ensures that your documents are secured and authentic, protecting sensitive information throughout the signing process. Trust in our platform means you can focus on your transaction with peace of mind.

Get more for Purchase And Sale Agreement Washington State

Find out other Purchase And Sale Agreement Washington State

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors