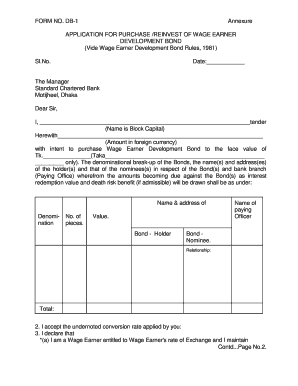

Wage Earners Development Bond Form

What is the Wage Earners Development Bond

The Wage Earners Development Bond is a financial instrument designed primarily for individuals working abroad, allowing them to invest in the development of their home country. This bond typically offers a fixed interest rate, providing a secure way for wage earners to contribute to national projects while earning returns on their investment. The funds raised through these bonds are often utilized for infrastructure development, educational initiatives, and other significant projects that benefit the economy.

How to use the Wage Earners Development Bond

Using the Wage Earners Development Bond involves a straightforward process. First, individuals interested in investing must ensure they meet the eligibility criteria, which typically includes being a wage earner working overseas. Once eligibility is confirmed, the next step is to complete the necessary application forms, which can often be done online for convenience. After submitting the application, investors will receive confirmation and details regarding their bond purchase, including interest rates and maturity periods.

Steps to complete the Wage Earners Development Bond

Completing the Wage Earners Development Bond involves several key steps:

- Verify eligibility: Confirm that you qualify as a wage earner and understand the investment requirements.

- Gather required documents: Collect any necessary identification and proof of employment.

- Fill out the application form: Complete the Wage Earners Development Bond form accurately, ensuring all information is correct.

- Submit the application: Send the completed form along with any required documents, either online or through the designated submission method.

- Receive confirmation: Await acknowledgment of your application and details regarding your bond investment.

Key elements of the Wage Earners Development Bond

Several key elements define the Wage Earners Development Bond:

- Interest Rate: The bond typically offers a competitive interest rate, ensuring a return on investment.

- Maturity Period: Bonds usually have a specified maturity period, at the end of which the principal and interest are paid back.

- Investment Purpose: Funds from the bond are directed towards national development projects, contributing to the economy.

- Eligibility Requirements: Specific criteria must be met to qualify for investment in the bond.

Legal use of the Wage Earners Development Bond

The Wage Earners Development Bond is legally recognized as a valid investment vehicle under U.S. law. To ensure compliance, investors must adhere to all regulations governing bond purchases, including proper documentation and reporting of income generated from the bond. Legal frameworks protect the rights of bondholders and outline the responsibilities of issuing institutions, ensuring a secure investment environment.

Who Issues the Form

The Wage Earners Development Bond form is typically issued by financial institutions or government agencies responsible for managing these bonds. In the United States, this may include specific banks or government bodies that oversee the issuance and regulation of such financial instruments. It is essential for investors to obtain the form from a legitimate source to ensure its validity and compliance with applicable laws.

Quick guide on how to complete wage earners development bond

Easily prepare Wage Earners Development Bond on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly solution to conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Wage Earners Development Bond on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and electronically sign Wage Earners Development Bond effortlessly

- Locate Wage Earners Development Bond and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your files or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Wage Earners Development Bond and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage earners development bond

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a wage earner bond?

A wage earner bond is a type of surety bond that guarantees an individual's wage payments in case of default by their employer. This bond is particularly useful for employees who want to ensure their financial security. By investing in a wage earner bond, businesses can build trust with employees and fulfill their ethical obligations.

-

How does a wage earner bond benefit employees?

A wage earner bond provides peace of mind to employees, ensuring that they will receive their wages even if the company encounters financial difficulties. This bond can also enhance employee loyalty and satisfaction, contributing to a more stable work environment. Employees can feel secure knowing their earnings are protected.

-

What features does airSlate SignNow offer for wage earner bonds?

airSlate SignNow offers a seamless document signing experience, allowing businesses to easily create, send, and eSign wage earner bond documents. The platform simplifies the management of such bonds with customizable templates and secure storage. Businesses can also track the status of documents, ensuring that all legal obligations are fulfilled.

-

Is there a cost associated with obtaining a wage earner bond through airSlate SignNow?

Yes, obtaining a wage earner bond through airSlate SignNow involves fees that vary based on the specific type and amount of the bond needed. However, the overall cost is designed to be competitive and cost-effective for businesses. Investing in a wage earner bond is beneficial for maintaining employee trust and ensuring compliance.

-

How can I integrate wage earner bonds into my existing processes with airSlate SignNow?

Integrating wage earner bonds into your existing processes can be easily accomplished with airSlate SignNow’s user-friendly interface. You can streamline workflows by automating document preparation and signatures related to these bonds. This integration not only saves time but also reduces the chance of errors during the signing process.

-

What industries commonly utilize wage earner bonds?

Wage earner bonds are commonly used in industries such as manufacturing, construction, and hospitality, where worker safety and financial security are top priorities. Businesses operating in these sectors often use wage earner bonds to assure employees their wages will be paid in the event of financial instability. This practice fosters a secure working environment across various industries.

-

Can wage earner bonds be customized for specific business needs?

Absolutely! airSlate SignNow allows businesses to customize wage earner bonds according to their specific requirements. Companies can modify terms and conditions, as well as include additional clauses to suit their operational needs. This flexibility ensures that the wage earner bond aligns perfectly with your business model and employee agreements.

Get more for Wage Earners Development Bond

Find out other Wage Earners Development Bond

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online