Sc Form 1 309

What is the SC Form I 309

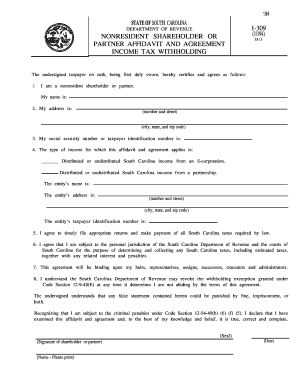

The SC Form I 309 is a crucial document used in specific legal and administrative processes within the United States. This form is typically associated with applications for certain benefits or permissions. Understanding its purpose is essential for individuals and businesses that need to navigate the relevant legal frameworks effectively. The form serves as a formal request and collects necessary information to facilitate the processing of applications or claims.

How to Obtain the SC Form I 309

Obtaining the SC Form I 309 can be done through several straightforward methods. Individuals can access the form online through official government websites or designated agencies. Additionally, physical copies may be available at local offices or community centers that provide assistance with legal documentation. It is important to ensure that the version of the form being used is the most current to avoid any issues during submission.

Steps to Complete the SC Form I 309

Completing the SC Form I 309 involves several key steps to ensure accuracy and compliance. First, gather all necessary information and documentation required for the form. This may include personal identification, financial details, or other relevant data. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is advisable to review the form for any errors before submission. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Legal Use of the SC Form I 309

The SC Form I 309 holds legal significance and must be used in accordance with established laws and regulations. Proper completion and submission of this form can affect the outcome of applications or claims. It is essential to understand the legal implications of the information provided on the form. Users should ensure compliance with relevant legal standards to avoid potential issues, including delays or rejections of their applications.

Key Elements of the SC Form I 309

Several key elements are essential when dealing with the SC Form I 309. These include personal identification information, the purpose of the form, and any supporting documentation required. Each section of the form is designed to capture specific details that are critical for processing. Understanding these elements helps individuals provide accurate information, which can lead to a smoother application process.

Form Submission Methods

The SC Form I 309 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via official platforms

- Mailing the completed form to the designated address

- In-person submission at local offices

Each method may have specific guidelines, including deadlines and required documentation, so it is important to follow the instructions closely to ensure proper handling of the form.

Quick guide on how to complete sc form 1 309

Complete Sc Form 1 309 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to draft, amend, and electronically sign your documents quickly and efficiently. Manage Sc Form 1 309 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Sc Form 1 309 with ease

- Obtain Sc Form 1 309 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Sc Form 1 309 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc form 1 309

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SC Form I 309 and how can airSlate SignNow help with it?

SC Form I 309 is typically required for specific immigration processes. airSlate SignNow simplifies the signing and submission of SC Form I 309 by providing an intuitive platform that allows users to eSign and share documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for SC Form I 309?

airSlate SignNow offers a range of pricing plans designed to fit different business needs. You can choose a plan that provides the best value for managing documents like SC Form I 309, with flexible options to suit various budgets.

-

What are the key features of airSlate SignNow for handling SC Form I 309?

airSlate SignNow offers a multitude of features for SC Form I 309, including easy eSigning, document templates, and customizable workflows. These features make the process of managing and submitting SC Form I 309 seamless and efficient.

-

Can airSlate SignNow integrate with other applications for SC Form I 309?

Yes, airSlate SignNow offers integrations with various applications to streamline the process of managing SC Form I 309. This includes seamless connections with CRMs, cloud storage services, and other productivity tools to enhance your document workflow.

-

Is airSlate SignNow secure for signing SC Form I 309?

Absolutely, airSlate SignNow employs advanced security measures to ensure that documents such as SC Form I 309 are protected. With secure encryption and compliance with industry standards, you can trust that your information is safe while using our platform.

-

What benefits does airSlate SignNow offer for businesses handling SC Form I 309?

Using airSlate SignNow for SC Form I 309 can greatly enhance efficiency and reduce turnaround times. Businesses can benefit from rapid document signing, easy tracking, and a user-friendly interface that simplifies the entire process.

-

How easy is it to eSign SC Form I 309 with airSlate SignNow?

eSigning SC Form I 309 with airSlate SignNow is designed to be straightforward. Users can sign documents online with just a few clicks, streamlining the entire process and saving valuable time.

Get more for Sc Form 1 309

Find out other Sc Form 1 309

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast