Polk County Local Business Tax Account Application 2017-2026

Understanding the Polk County Local Business Tax Account Application

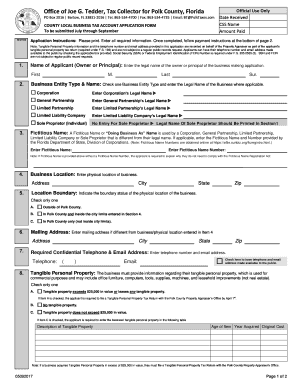

The Polk County Local Business Tax Account Application is a crucial document for individuals and businesses wishing to operate legally within Polk County. This application serves as a means for the county to collect business taxes and ensure compliance with local regulations. It is essential for obtaining a Polk County business license, which is required for various business activities. By completing this application, applicants declare their intent to conduct business and provide necessary information about their operations, including business structure and location.

Steps to Complete the Polk County Local Business Tax Account Application

Completing the Polk County Local Business Tax Account Application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business name, address, and ownership details. Next, accurately fill out the application form, ensuring that all sections are completed. It is important to review the form for any errors before submission. Once the application is complete, you can submit it either online or via mail, depending on the options provided by the county. Keep a copy of the submitted application for your records.

Required Documents for the Application

When applying for the Polk County Local Business Tax Account, certain documents are typically required to support your application. These may include proof of identity, such as a driver's license or state ID, and any necessary business formation documents, like articles of incorporation for corporations or operating agreements for LLCs. Additionally, you may need to provide a federal Employer Identification Number (EIN) if applicable. Ensuring that you have all required documents ready can streamline the application process and reduce delays.

Legal Use of the Polk County Local Business Tax Account Application

The Polk County Local Business Tax Account Application is legally binding once submitted. It is important to provide truthful and accurate information, as any discrepancies can lead to penalties or denial of your application. The application must comply with local laws and regulations governing business operations in Polk County. By using a reliable electronic signature solution, such as signNow, you can ensure that your application is submitted securely and in compliance with eSignature laws, enhancing its legal validity.

Form Submission Methods

Applicants have several methods to submit the Polk County Local Business Tax Account Application. The most convenient option is typically online submission, which allows for immediate processing and confirmation. Alternatively, applicants may choose to mail their completed application to the designated county office. In-person submission is also an option, allowing applicants to receive assistance if needed. Each method has its own processing times and requirements, so it is advisable to check the specific guidelines provided by Polk County.

Application Process & Approval Time

The application process for the Polk County Local Business Tax Account typically involves several stages. After submission, the application will be reviewed by county officials to ensure all information is complete and accurate. The approval time can vary based on the volume of applications received and the complexity of the business being registered. Generally, applicants can expect to receive a response within a few weeks. It is advisable to follow up if you have not received any communication regarding your application status.

Quick guide on how to complete polk county local business tax account application

Prepare Polk County Local Business Tax Account Application effortlessly on any device

Online document management has become widely accepted among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Polk County Local Business Tax Account Application on any device with airSlate SignNow's Android or iOS applications, streamlining any document-related tasks today.

How to modify and eSign Polk County Local Business Tax Account Application with ease

- Obtain Polk County Local Business Tax Account Application and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Polk County Local Business Tax Account Application to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the polk county local business tax account application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Polk County business license and why do I need one?

A Polk County business license is a legal authorization required to operate a business within Polk County. It ensures that you comply with local regulations, zoning laws, and tax requirements. Obtaining this license not only legitimizes your business but also builds trust with your customers.

-

How can the airSlate SignNow solution assist me with my Polk County business license application?

airSlate SignNow streamlines the document signing process, enabling you to easily fill out and eSign your Polk County business license application online. This reduces the time spent on paperwork and ensures that your application is submitted efficiently. With its user-friendly interface, you'll find it easy to gather signatures and manage necessary documents.

-

What are the costs associated with obtaining a Polk County business license?

The cost of a Polk County business license varies based on the type of business and specific regulations. Generally, fees can range from $50 to several hundred dollars. It's important to check with the Polk County business office for the most accurate pricing and any additional requirements.

-

Are there any specific documents required for a Polk County business license?

Yes, to obtain a Polk County business license, you'll typically need to provide identification, a completed application form, and any relevant business documentation. Additional requirements may include zoning permits or health department approvals, depending on your business type. Using airSlate SignNow can help you gather and submit these documents digitally.

-

What features does airSlate SignNow offer for managing my Polk County business documents?

airSlate SignNow provides various robust features including easy eSigning, document templates, and secure storage to manage your Polk County business documents effectively. You can also track the status of your documents in real time, making it easier to ensure everything is processed promptly and efficiently.

-

How does airSlate SignNow ensure the security of my Polk County business license documents?

airSlate SignNow prioritizes security through advanced encryption and compliance with international data protection regulations. This ensures that your Polk County business license documents are securely eSigned and stored. You can confidently manage sensitive business paperwork knowing that your information is well-protected.

-

Can I integrate airSlate SignNow with other applications for my business needs?

Absolutely! airSlate SignNow offers seamless integrations with several popular applications, including Google Drive, Salesforce, and more. This flexibility allows you to enhance your business workflows, making it easier to manage your Polk County business license and other critical documents.

Get more for Polk County Local Business Tax Account Application

- To bamsi staff from professional development and training bb bamsi form

- Licensed vendor directory umass amherst form

- My 4 h pet and small animal project record book ag ndsu form

- Orono me 04469 5781 form

- Revoking ferpa consent to release student information formdocx

- Employee tuition assistance application no employee form

- Vcu response form

- Mhq ucla form

Find out other Polk County Local Business Tax Account Application

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT