Icd 9 Procedure Form

What is the ICD 9 Procedure?

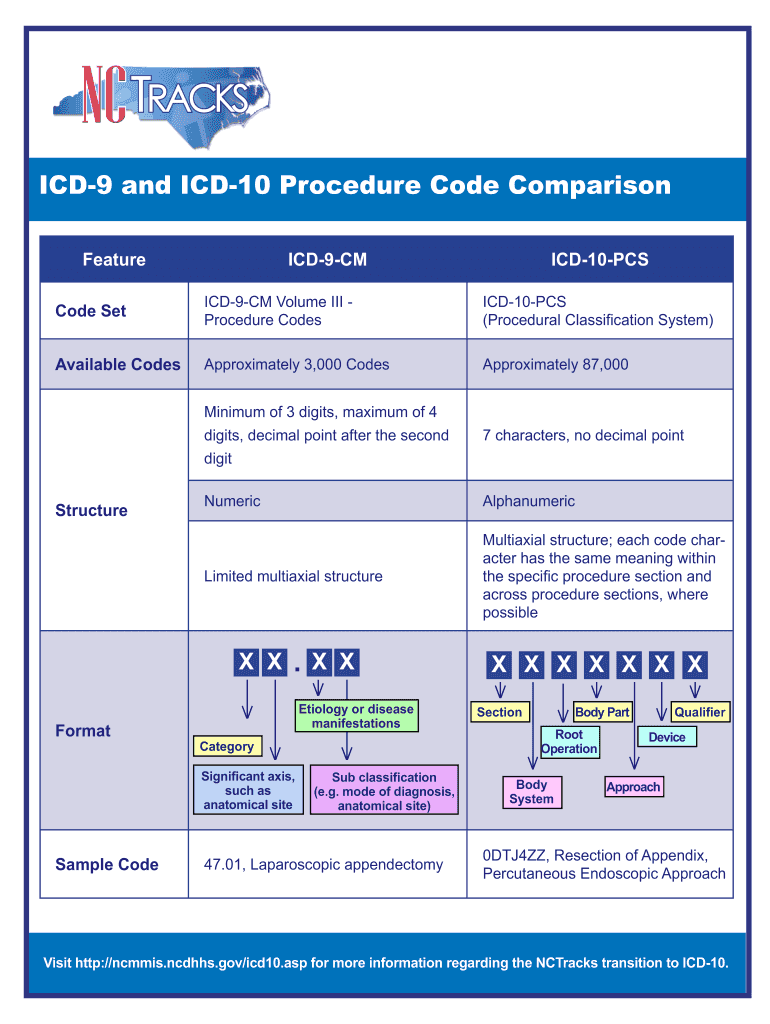

The ICD 9 procedure code refers to a classification system used to code and categorize medical procedures. This system, developed by the World Health Organization, is crucial for healthcare providers, insurers, and researchers in the United States. It allows for standardization in documenting and billing for medical services, ensuring that healthcare data is consistent and comparable across different settings.

ICD 9 codes are alphanumeric and typically consist of three to four characters, with the possibility of extending to five characters for more specific procedures. Understanding these codes is essential for accurate medical billing and coding, as they directly impact reimbursement rates and healthcare statistics.

How to Use the ICD 9 Procedure

Using the ICD 9 procedure code involves several steps to ensure accuracy and compliance. First, healthcare providers must identify the specific procedure performed on a patient. This can be done by reviewing medical records, physician notes, and other relevant documentation.

Next, coders must reference the official ICD 9 coding manual or an electronic coding tool to find the appropriate code that corresponds to the procedure. It is important to select the most specific code available to reflect the exact nature of the service provided. Once the correct code is identified, it should be entered into the patient's billing record for processing by insurance companies or other payers.

Steps to Complete the ICD 9 Procedure

Completing the ICD 9 procedure code accurately requires a systematic approach. Here are the key steps:

- Gather Documentation: Collect all relevant medical records and notes that detail the procedure.

- Identify the Procedure: Determine the specific procedure performed based on the documentation.

- Consult the Coding Manual: Use the ICD 9 coding manual or an electronic tool to find the appropriate code.

- Verify Code Accuracy: Ensure that the selected code is the most specific and accurate representation of the procedure.

- Enter the Code: Input the ICD 9 procedure code into the billing system or patient record.

- Review for Compliance: Double-check the entry for compliance with coding guidelines and regulations.

Legal Use of the ICD 9 Procedure

The legal use of the ICD 9 procedure code is governed by various regulations and standards within the healthcare industry. Accurate coding is not only essential for proper reimbursement but also for compliance with federal and state laws. Errors in coding can lead to legal repercussions, including audits and penalties.

Healthcare providers must adhere to the coding guidelines established by the Centers for Medicare & Medicaid Services (CMS) and the American Health Information Management Association (AHIMA). These guidelines help ensure that the coding process is transparent, ethical, and compliant with healthcare laws.

Examples of Using the ICD 9 Procedure

Examples of ICD 9 procedure codes illustrate the diversity of medical services and their classifications. For instance:

- Code 36.01: Coronary artery bypass grafting (CABG) procedure.

- Code 81.00: Total abdominal hysterectomy.

- Code 87.41: Arthroscopy of the knee.

These examples highlight how specific procedures are categorized, allowing for efficient billing and data analysis in healthcare settings.

Digital vs. Paper Version

When it comes to the ICD 9 procedure code, both digital and paper versions exist, each with its own advantages. Digital coding tools offer enhanced accuracy, automated updates, and easy access to coding resources. They often include features that assist coders in finding the correct codes quickly.

On the other hand, paper versions of the ICD 9 coding manual may be preferred by some professionals for their tangible format. However, they require regular updates to remain current with coding changes. Ultimately, the choice between digital and paper formats depends on the preferences and needs of the healthcare provider or coding professional.

Quick guide on how to complete icd 9 procedure form

Uncover how to effortlessly navigate the Icd 9 Procedure implementation with this simple guide

Online document submission and completion are rapidly gaining traction and have become the preferred choice for a broad spectrum of users. It presents numerous benefits over outdated paper documents, such as convenience, time-saving, enhanced accuracy, and safety.

Using tools like airSlate SignNow, you can locate, modify, endorse, and enhance your Icd 9 Procedure without getting bogged down in endless printing and scanning. Follow this brief guide to begin and complete your document.

Follow these instructions to obtain and complete Icd 9 Procedure

- Begin by clicking the Get Form button to access your document in our editor.

- Pay attention to the green label on the left indicating required fields to ensure you don’t miss any.

- Utilize our professional features to annotate, modify, sign, secure, and enhance your document.

- Safeguard your file or convert it into a fillable form using the appropriate tab functions.

- Review the document and scan it for mistakes or inconsistencies.

- Click DONE to complete your edits.

- Change the name of your document or keep it as is.

- Select the storage service where you wish to keep your document, send it via USPS, or click the Download Now button to save your file.

If Icd 9 Procedure isn’t what you were looking for, you can explore our extensive library of pre-loaded forms that can be filled out with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

How do doctors make money, i.e., what is there business model like?

My first games of Monopoly as a child were extremely simple. We collected $200 when we passed Go. We bought houses and built up property. We got paid rent when someone else landed on our squares.Later games became more and more complicated. We started to pay each other for Get Out of Jail cards. We started to write IOUs and charging interest. We created convoluted contracts--I would trade someone a property they needed to create a monopoly so long as I collected a percentage of the rent. We even traded winning conditions. At its core, the game was still based on the basic idea that you got paid if someone else landed on your square, but all the side deals we would make made games get quite complex and at times, it was difficult to keep track of where everything went.Payment in medicine is very similar, in that payment has a basic core with countless arrangements made on top of it. The core of how doctors make money is that they get paid for a service, which is usually either a consultation (e.g. doctor, what do I have?) or a procedure (e.g. doctor, stitch me up please). This method of payment is known as a fee-for-service scheme, and it is the most common method of payment. How the pricing for services gets decided is a complex topic that merits its own discussion, but suffice to say, it is negotiated (as all prices are) between the payer (often an insurance company) and the payee (often a group representing doctors).For the bulk of their work, doctors use billing codes (Medical Billing Codes - ICD-9-CM, ICD-10-CM, CPT®, HCPCS - Medical Coding) to report what they have done and insurance companies pay them based on those codes.Where things get complicated is that there are lots of side deals--in fact, anything that is legal is fair game. There are uncovered services (filling out forms, cosmetic procedures, etc.) that may not be listed under specific billing codes, and doctors can charge what they want for those. There is co-payment, where more than one person (often partially the patient and mostly the insurance company) pays for the services.Doctors can also agree to alternative payment schemes. These models include capitation, wage as well as salary based models. In a capitation model, a doctor gets paid for having a patient on his/her roster, and then agrees to see that patient whenever. In a wage model, a doctor is paid based on the time they spend working. In a salary model, the doctor works for someone else and is paid a fixed amount for the duration of the contract (e.g. one year).These models have their pros and cons, and lots of other arrangements have been superimposed to try and make them work. For example, the purpose of the capitation model was to encourage doctors to not rush their services--by paying a doctor to take care of x number of patients and not by how many patients he/she sees, maybe the doctor would not have the incentive to rush appointments. However, this had the unintended consequence where physicians would purposely roster healthy patients because they are easier to take care of, meaning you can roster tons of them and get paid more. So then some insurance companies tried to pay doctors extra for seeing more complex patients--but then that encourages doctors to make patients seem sicker than they are.The wage and salary models, on the other hand, were designed to pay doctors for "being there"--it is most often used by hospitals paying for emergency room physicians, pathologists and radiologists for their work. The problem, though, is that the hospitals need to be paid in order to pay the doctors, and in order for that to happen, they need the doctors to tell them what they did so they can charge the insurance company appropriately. To solve this issue, they introduced shadow billing, where the doctors still report the work they do using the billing codes, but those numbers get reported to the hospital and the doctors are only paid a fraction of the billed fee (as compensation for completing the paperwork).And touching on these models just skims the surface. There are also experimental payment models, such as pay-for-performance, where doctors are compensated for better health outcomes and group payment models, where doctors band together to provide a set number of services and choose how they split up their earnings on their own. Not to mention all the other ways doctors can get paid, such as by working on the side as consultants or getting paid for participating for providing data for clinical research trials.So it's a complex field, and actually a pretty exciting one these days from political, technological and medical viewpoints because so many people are asking whether all this healthcare is actually resulting in better health (What Is the Business of Health Care?).tl;dr: they get paid for seeing patients and doing specific procedures, unless they've agreed to some other way of getting paid.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

What is the procedure to fill out a 15G form?

Form 15G is the form which you give to Bank requesting them not to deduct tax as the liability is on you to state the interest as your income in returns, now a days banks are deducting TDS directly and hence Form 15G may be void now a days.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

Create this form in 5 minutes!

How to create an eSignature for the icd 9 procedure form

How to make an eSignature for the Icd 9 Procedure Form in the online mode

How to create an eSignature for the Icd 9 Procedure Form in Google Chrome

How to create an eSignature for signing the Icd 9 Procedure Form in Gmail

How to make an electronic signature for the Icd 9 Procedure Form right from your smartphone

How to generate an electronic signature for the Icd 9 Procedure Form on iOS devices

How to create an eSignature for the Icd 9 Procedure Form on Android devices

People also ask

-

What is an ICD 9 procedure code?

An ICD 9 procedure code is a numerical classification used to represent specific medical procedures and diagnoses. These codes help healthcare professionals in documenting patient care and are essential for billing and insurance purposes. Understanding these codes is crucial for accurate medical record keeping.

-

How does airSlate SignNow integrate with ICD 9 procedure code documentation?

airSlate SignNow streamlines the process of managing documents that include ICD 9 procedure codes by allowing users to easily sign, send, and store these documents securely. Our platform's integration capabilities ensure that you can efficiently manage medical documents while adhering to industry standards. This enhances workflow efficiency and accuracy in documentation.

-

What are the benefits of using airSlate SignNow for managing ICD 9 procedure codes?

Using airSlate SignNow for managing ICD 9 procedure codes offers several benefits, including faster turnaround times on documents and enhanced collaboration among healthcare teams. Our solution helps ensure that all procedures are properly documented, reducing the risk of errors. Additionally, eSigning documents can signNowly improve the efficiency of your administrative processes.

-

Is airSlate SignNow cost-effective for small healthcare practices handling ICD 9 procedure codes?

Yes, airSlate SignNow provides a cost-effective solution for small healthcare practices managing ICD 9 procedure codes. Our flexible pricing plans cater to the needs of healthcare providers of all sizes without compromising on features. The investment in our platform can lead to signNow time and cost savings in document management.

-

Can airSlate SignNow assist in training staff on ICD 9 procedure codes?

While airSlate SignNow itself does not offer direct training on ICD 9 procedure codes, our platform provides a user-friendly interface that makes it easier for staff to review and sign documents related to these codes. Additionally, by streamlining documentation processes, airSlate SignNow frees up time for training staff on essential coding and billing practices.

-

What features does airSlate SignNow offer for managing documents with ICD 9 procedure codes?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for documents involving ICD 9 procedure codes. These tools help streamline document management, ensuring that your healthcare practice remains organized and compliant. You can also track document statuses and obtain signatures seamlessly.

-

How does eSigning with airSlate SignNow improve ICD 9 procedure code management?

eSigning with airSlate SignNow enhances ICD 9 procedure code management by reducing the time and resources spent on paper-based processes. By enabling quick and secure eSignatures, we remove bottlenecks in documentation workflow. This expedites the coding process, allowing healthcare providers to focus more on patient care rather than paperwork.

Get more for Icd 9 Procedure

- Florida blue appeals phone number form

- Notice of termination of notice of commencement form

- Fdny letter of recommendation form

- Nyc department of parks and recreationlabor law compliance form

- Driving licence eyesight report form 26900815

- How to make a sponsorship form

- It 255 form

- Waiver and release of liability crossfit china lake form

Find out other Icd 9 Procedure

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement