T79 Form

What is the T79 Form

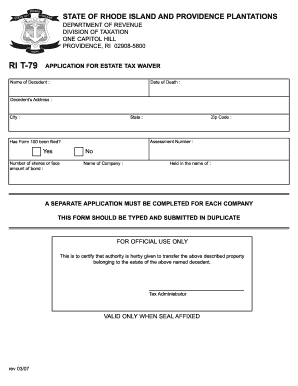

The Rhode Island tax form T-79 is a specific document used for tax purposes in the state of Rhode Island. This form is primarily utilized by taxpayers to report and claim various tax credits, deductions, or adjustments. Understanding the purpose of the T-79 form is crucial for ensuring compliance with state tax regulations and maximizing potential tax benefits.

How to use the T79 Form

Using the T-79 form involves several steps that ensure accurate reporting of tax information. Taxpayers should first gather all necessary documentation, including income statements and any relevant receipts. After filling out the form, it is important to review all entries for accuracy. Once completed, the form can be submitted either electronically or via traditional mail, depending on the taxpayer's preference and the specific submission guidelines provided by the Rhode Island Division of Taxation.

Steps to complete the T79 Form

Completing the T-79 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions or credits.

- Double-check all entries for accuracy to avoid errors that could lead to delays or penalties.

- Submit the form according to the guidelines provided by the Rhode Island Division of Taxation.

Legal use of the T79 Form

The T-79 form is legally binding when completed and submitted in accordance with Rhode Island tax laws. It is essential for taxpayers to understand that any false information or failure to report income can lead to penalties or legal repercussions. Compliance with all relevant tax regulations ensures that the form is recognized as valid by the Rhode Island Division of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the T-79 form are crucial to avoid penalties. Typically, the form must be submitted by the same deadline as the federal tax return, which is usually April 15. However, taxpayers should verify specific dates each tax year, as they may vary or be adjusted for holidays or weekends. Staying informed about these deadlines is essential for timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The T-79 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Rhode Island Division of Taxation's e-filing system.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices, which may provide assistance if needed.

Quick guide on how to complete t79 form

Prepare T79 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage T79 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign T79 Form without hassle

- Obtain T79 Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign T79 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t79 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rhode Island tax form T 79?

The Rhode Island tax form T 79 is used by businesses to report their state tax obligations. It serves as an essential document for ensuring compliance with Rhode Island tax laws. Understanding how to complete this form correctly is critical for avoiding penalties.

-

How can airSlate SignNow help with the Rhode Island tax form T 79?

AirSlate SignNow provides a streamlined process for sending and signing the Rhode Island tax form T 79 electronically. With its user-friendly interface, you can easily manage document workflows, ensuring that your forms are sent and signed promptly. This can save time and reduce the risk of errors.

-

Is airSlate SignNow suitable for small businesses needing to file the Rhode Island tax form T 79?

Absolutely! AirSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Its affordability and features make it an excellent choice for small businesses looking to handle the Rhode Island tax form T 79 efficiently.

-

What features does airSlate SignNow offer specifically for tax forms like the Rhode Island tax form T 79?

AirSlate SignNow offers features such as templates, unlimited e-signatures, and secure document storage. These tools make it easier to prepare, send, and store the Rhode Island tax form T 79. Additionally, the platform ensures that your documents are compliant and legally binding.

-

Can I integrate airSlate SignNow with other software to manage my Rhode Island tax form T 79?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software. This allows you to create a seamless workflow for managing the Rhode Island tax form T 79 and other documents. Integrations streamline your processes and help sync data across platforms.

-

What are the benefits of using airSlate SignNow for the Rhode Island tax form T 79 compared to traditional methods?

Using airSlate SignNow for the Rhode Island tax form T 79 offers signNow benefits over traditional paper methods. You'll experience faster turnaround times, reduced printing and mailing costs, and improved accuracy. Additionally, the ability to track document status in real-time enhances transparency.

-

Is there customer support available for questions about the Rhode Island tax form T 79?

Yes, airSlate SignNow offers dedicated customer support to assist users with any inquiries regarding the Rhode Island tax form T 79. Whether you need help understanding the form or navigating the platform, support teams are readily available to assist you. This ensures that you can efficiently manage your tax form submissions.

Get more for T79 Form

Find out other T79 Form

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien