Massachusetts State Tax Form 2hf 1998

What is the Massachusetts State Tax Form 2hf

The Massachusetts State Tax Form 2hf is a specific tax form used by individuals and businesses in Massachusetts to report certain types of income and claim applicable tax credits. This form is particularly relevant for taxpayers who need to provide detailed information regarding their financial activities within the state. Understanding the purpose of this form is essential for ensuring accurate reporting and compliance with state tax regulations.

How to use the Massachusetts State Tax Form 2hf

Using the Massachusetts State Tax Form 2hf involves several steps to ensure that all required information is accurately reported. Taxpayers should begin by gathering necessary documentation, such as income statements and previous tax returns. Next, fill out the form with precise details, ensuring that all sections are completed. After filling out the form, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Massachusetts State Tax Form 2hf

Completing the Massachusetts State Tax Form 2hf can be broken down into a series of straightforward steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Download the form from the official Massachusetts Department of Revenue website or access it through a digital platform.

- Carefully fill out each section of the form, ensuring that all information is accurate and complete.

- Double-check calculations and verify that all required signatures are included.

- Submit the completed form either electronically or by mail, depending on your preference and the submission guidelines.

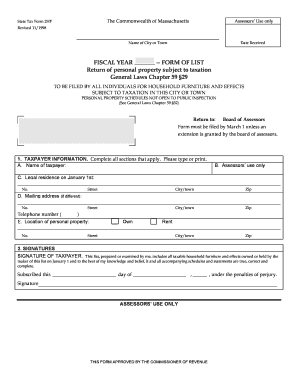

Key elements of the Massachusetts State Tax Form 2hf

The Massachusetts State Tax Form 2hf contains several key elements that are crucial for proper completion. These include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Reporting: Sections dedicated to reporting various types of income, including wages, interest, and dividends.

- Tax Credits: Opportunities to claim applicable state tax credits that may reduce overall tax liability.

- Signature Section: A place for the taxpayer to sign and date the form, affirming the accuracy of the information provided.

Legal use of the Massachusetts State Tax Form 2hf

The legal use of the Massachusetts State Tax Form 2hf is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated deadlines. Furthermore, electronic submissions are valid as long as they comply with eSignature laws, ensuring that the form is recognized by the state as an official document.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Massachusetts State Tax Form 2hf. The available methods include:

- Online Submission: Many taxpayers opt to file electronically through the Massachusetts Department of Revenue's website, which often provides a quicker processing time.

- Mail Submission: The completed form can be printed and mailed to the appropriate address as specified in the form instructions.

- In-Person Submission: Some taxpayers may choose to submit their forms in person at local tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete massachusetts state tax form 2hf

Effortlessly Prepare Massachusetts State Tax Form 2hf on Any Device

The management of documents online has gained considerable traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Massachusetts State Tax Form 2hf on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Alter and eSign Massachusetts State Tax Form 2hf with Ease

- Obtain Massachusetts State Tax Form 2hf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Massachusetts State Tax Form 2hf to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts state tax form 2hf

Create this form in 5 minutes!

How to create an eSignature for the massachusetts state tax form 2hf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts State Tax Form 2HF?

The Massachusetts State Tax Form 2HF is specifically designed for tax filings related to certain financial transactions and tax credits. It helps taxpayers report their income and calculate any liabilities or refunds due. Using the Massachusetts State Tax Form 2HF can simplify your filing process.

-

How can airSlate SignNow help me with the Massachusetts State Tax Form 2HF?

airSlate SignNow allows you to easily prepare, send, and eSign the Massachusetts State Tax Form 2HF electronically. This electronic solution streamlines the document process, saves time, and ensures accuracy. Plus, it provides secure storage and access for your important tax documents.

-

Is there a cost to use airSlate SignNow for the Massachusetts State Tax Form 2HF?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Whether you're an individual or a corporation, you can choose a plan that includes access to the Massachusetts State Tax Form 2HF and other essential eSigning features. There are flexible payment options that make it a cost-effective choice.

-

What features should I expect from airSlate SignNow regarding tax forms?

With airSlate SignNow, you can expect features like customizable templates, real-time collaboration, and secure document storage. These features enhance the experience of completing the Massachusetts State Tax Form 2HF and ensure a seamless workflow. Moreover, you can integrate it with your existing systems for added convenience.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow easily integrates with popular accounting and tax preparation software. This integration allows for a more streamlined process when handling the Massachusetts State Tax Form 2HF and other tax-related documents. You can enhance your productivity by synchronizing data between applications.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for forms like the Massachusetts State Tax Form 2HF offers numerous benefits, such as faster processing times, reduced paperwork, and enhanced security. You can also obtain legally binding eSignatures, which speed up the overall tax submission process. This solution is designed to make your tax experience smoother and more efficient.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow implements robust security measures to protect sensitive documents, including the Massachusetts State Tax Form 2HF. The platform uses advanced encryption, secure authentication, and compliance with legal standards to safeguard your information. You can trust airSlate SignNow to keep your tax documents safe.

Get more for Massachusetts State Tax Form 2hf

- Form ct 3 s i2019instructions for forms c 3 s new york s corporation franchise tax returnsct3si

- Form ct 34 i2019instructions for form ct 34 prior net operating loss deduction noldct34i

- Form it 2663 i2020instructions for form it 2663nonresident real

- Complete and file an ohio income tax amendment online form

- 2019 inactive pa corporate net income tax report rct 101 i formspublications

- Data exchangerequesting ssas death social security form

- 2it5402011webf copy louisiana file online fast easy form

- Form it 540 download fillable pdf or fill online louisiana

Find out other Massachusetts State Tax Form 2hf

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile