Direct Credit Authorisation Form 2013

What is the Direct Credit Authorisation Form

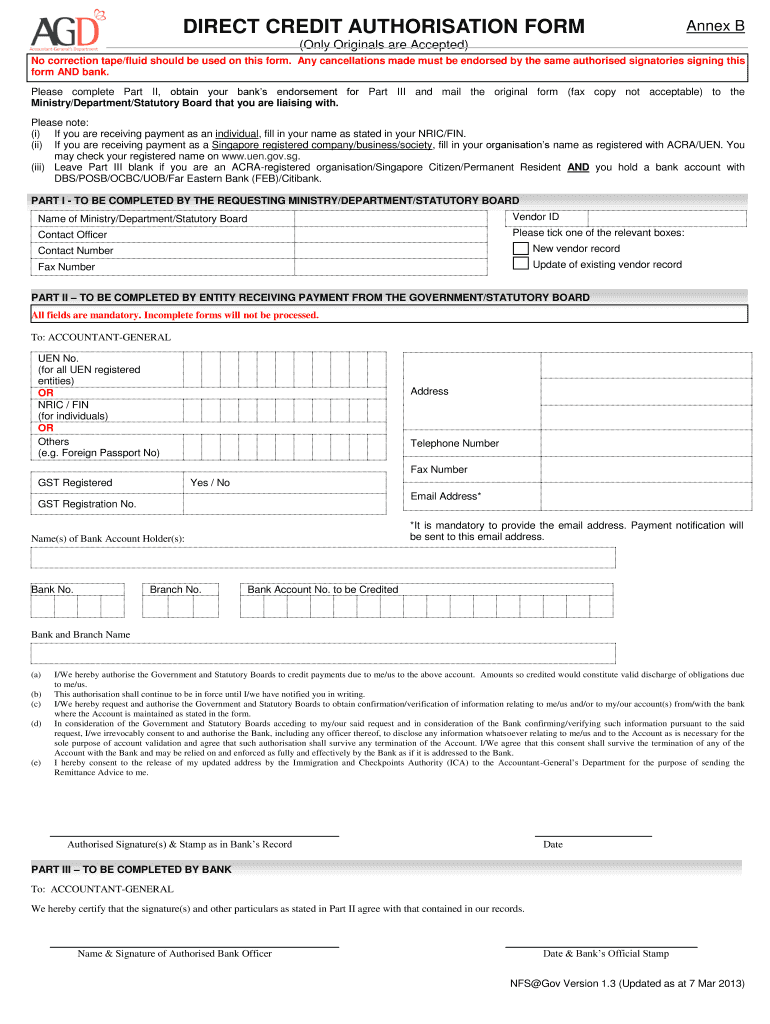

The direct credit authorisation form is a document that allows individuals or businesses to authorize a financial institution to deposit funds directly into their bank accounts. This form is commonly used for payroll deposits, government benefits, and other recurring payments. By completing this form, the account holder grants permission for automatic transactions, ensuring timely and secure payments without the need for physical checks.

How to use the Direct Credit Authorisation Form

Using the direct credit authorisation form involves several straightforward steps. First, obtain the form from your employer or the relevant financial institution. Next, fill in your personal details, including your name, address, and bank account information. It is essential to provide accurate banking details to avoid any delays in processing. After completing the form, sign and date it to confirm your authorization. Finally, submit the form to the designated party, such as your employer or benefits provider, either electronically or via mail.

Steps to complete the Direct Credit Authorisation Form

Completing the direct credit authorisation form requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate source.

- Fill in your full name and contact information.

- Provide your bank account number and routing number accurately.

- Indicate the type of account (checking or savings).

- Sign and date the form to validate your authorization.

- Submit the completed form to the requesting organization.

Legal use of the Direct Credit Authorisation Form

The direct credit authorisation form is legally binding when completed correctly. It must comply with relevant laws governing electronic signatures and financial transactions. To ensure legal validity, the form should include clear consent from the account holder, along with the necessary banking details. Organizations must also adhere to privacy regulations to protect the sensitive information contained within the form.

Key elements of the Direct Credit Authorisation Form

Several key elements are essential for the direct credit authorisation form to be effective:

- Account Holder Information: This includes the name and contact details of the individual or business authorizing the transaction.

- Banking Details: Accurate bank account number and routing number are crucial for the successful transfer of funds.

- Authorization Signature: The form must be signed by the account holder to confirm consent.

- Date: Including the date ensures clarity regarding when the authorization was granted.

Form Submission Methods

The direct credit authorisation form can be submitted through various methods, depending on the requirements of the requesting organization. Common submission methods include:

- Online Submission: Many organizations allow electronic submission through secure portals.

- Mail: The form can be printed and sent via traditional mail to the designated address.

- In-Person: Some organizations may require you to deliver the form in person, especially for sensitive transactions.

Quick guide on how to complete direct credit authorisation form 56381066

Handle Direct Credit Authorisation Form smoothly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Direct Credit Authorisation Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Direct Credit Authorisation Form effortlessly

- Obtain Direct Credit Authorisation Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Direct Credit Authorisation Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct direct credit authorisation form 56381066

Create this form in 5 minutes!

How to create an eSignature for the direct credit authorisation form 56381066

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is a direct credit authorisation form?

A direct credit authorisation form is a document that grants a company permission to deposit funds directly into a bank account. This form streamlines payment processes, ensuring that transactions are processed securely and efficiently. Using airSlate SignNow, you can easily create and manage your direct credit authorisation forms digitally.

-

How does airSlate SignNow simplify the direct credit authorisation form process?

airSlate SignNow simplifies the direct credit authorisation form process by providing an easy-to-use platform for creating, sending, and signing documents electronically. Users can customize templates and track the status of their forms, making the entire process more efficient. This helps businesses save time and reduce errors in managing payments.

-

Are there any costs associated with using airSlate SignNow for direct credit authorisation forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including the ability to manage direct credit authorisation forms. The cost often depends on the features you choose and the number of users. With a cost-effective solution, businesses can streamline their processes without breaking the bank.

-

What features does airSlate SignNow include for managing direct credit authorisation forms?

airSlate SignNow includes various features such as customizable templates, electronic signatures, and automated workflow processes for direct credit authorisation forms. Users can easily collaborate with team members, set reminders, and access signed documents from anywhere. This ensures that all transactions remain secure and organized.

-

Can I integrate airSlate SignNow with other software for managing direct credit authorisation forms?

Yes, airSlate SignNow can be integrated with various third-party applications and software to enhance the management of direct credit authorisation forms. This allows businesses to streamline their payment processes and keep all document workflows connected, providing a cohesive experience for users.

-

What are the benefits of using airSlate SignNow for direct credit authorisation forms?

Using airSlate SignNow for direct credit authorisation forms offers numerous benefits, including efficiency, security, and convenience. Businesses can expedite payment processing and reduce paperwork with electronic signatures. Additionally, the platform's tracking features ensure that all forms are managed effectively.

-

Is airSlate SignNow suitable for small businesses needing direct credit authorisation forms?

Absolutely! airSlate SignNow is ideal for small businesses that require direct credit authorisation forms, as it provides an affordable and scalable solution. With user-friendly features and customizable templates, small businesses can manage their documents without needing extensive resources or technical expertise.

Get more for Direct Credit Authorisation Form

- Infection control worksheet form

- Keslr104 form

- Temporary parenting plan form

- Liquid fuel carrier petroleum products report mf 206 kansas ksrevenue form

- Abc 1003 kansas suppliersamp39 monthly report of shipments ksrevenue form

- 2013 oil rendition form kansas department of revenue ksrevenue

- Kentucky authorized representative medicaid service form

- Attestation de rsidence 660369079 form

Find out other Direct Credit Authorisation Form

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation