FISCAL YEAR FORM of LIST Return of Personal Property Subject 2010-2026

Understanding the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

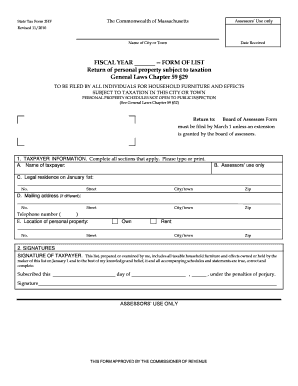

The FISCAL YEAR FORM OF LIST Return Of Personal Property Subject is a crucial document used primarily for reporting personal property owned by individuals or businesses during a specific fiscal year. This form helps local governments assess property taxes accurately. It typically includes details about various types of personal property, such as machinery, equipment, and other tangible assets. Understanding this form is essential for compliance with local tax regulations and ensuring that property is reported correctly to avoid potential penalties.

Steps to Complete the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

Completing the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject involves several key steps:

- Gather all relevant information about your personal property, including descriptions, purchase dates, and values.

- Obtain the form from your local tax authority or download it from their website.

- Fill out the form accurately, ensuring that all sections are completed, including any required signatures.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online, by mail, or in person, depending on your local regulations.

Legal Use of the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

The legal use of the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject is to comply with state and local tax laws. This form serves as an official declaration of personal property ownership, which is necessary for tax assessment purposes. Failing to file this form can result in penalties, including fines or increased tax assessments. It is essential to understand the legal implications of this form to ensure compliance and avoid any legal issues related to property taxation.

Filing Deadlines and Important Dates

Filing deadlines for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject vary by state and local jurisdiction. Typically, these deadlines fall at the end of the fiscal year or at the beginning of the subsequent year. It is crucial to be aware of these dates to ensure timely submission. Late submissions may incur penalties or interest on unpaid taxes, making it vital to stay informed about your specific deadlines.

Required Documents for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

When preparing to file the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject, certain documents are typically required. These may include:

- Proof of ownership for each item of personal property, such as purchase receipts or invoices.

- Previous year’s tax returns, if applicable, to provide a basis for current reporting.

- Any relevant documentation that supports the valuation of the property, such as appraisals or market analyses.

Having these documents ready can streamline the filing process and ensure that all information reported is accurate.

Examples of Using the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

Examples of using the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject can help clarify its application. For instance, a small business owner may need to report equipment and machinery used in operations. An individual may need to list personal items such as vehicles or valuable collectibles. Each example illustrates the importance of accurately reporting personal property to comply with tax obligations and avoid potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct fiscal year form of list return of personal property subject

Create this form in 5 minutes!

How to create an eSignature for the fiscal year form of list return of personal property subject

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

The FISCAL YEAR FORM OF LIST Return Of Personal Property Subject is a document that businesses must file to report personal property for tax purposes. This form helps ensure compliance with local tax regulations and provides a clear overview of owned assets. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

-

How can airSlate SignNow assist with the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

airSlate SignNow streamlines the process of completing and submitting the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject. Our platform allows users to easily fill out, sign, and send documents electronically, saving time and reducing errors. This efficiency is essential for meeting filing deadlines and maintaining compliance.

-

What are the pricing options for using airSlate SignNow for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject without breaking the bank. You can choose from monthly or annual subscriptions, depending on your needs.

-

What features does airSlate SignNow provide for managing the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to simplify the management of the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject. These tools enhance collaboration and ensure that all parties can easily access and sign necessary documents. Additionally, our user-friendly interface makes the process straightforward.

-

Are there any integrations available with airSlate SignNow for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for easy document management and sharing. These integrations help streamline your processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

Using airSlate SignNow for the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, while also providing a faster turnaround for signatures. This leads to improved compliance and peace of mind.

-

Is airSlate SignNow secure for handling the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the FISCAL YEAR FORM OF LIST Return Of Personal Property Subject. Our platform is designed to keep your sensitive information safe while ensuring that you can easily access and manage your documents.

Get more for FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

- Power attorney form 481371802

- Oregon painting contractor package form

- Pennsylvania process form

- Premarital agreements prenuptial 481371805 form

- Pennsylvania living wills and health care package form

- Rhode island no fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or form

- Sc termination form

- Texas texas southern district bankruptcy guide and forms package for chapters 7 or 13

Find out other FISCAL YEAR FORM OF LIST Return Of Personal Property Subject

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement