Loanliner Application Form

What is the Loanliner Application

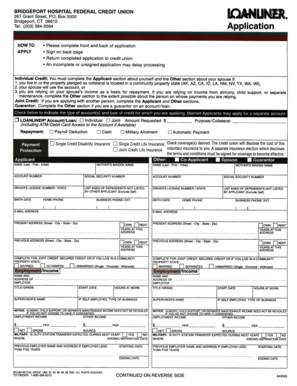

The Loanliner application is a standardized form used primarily in the financial sector to streamline the process of applying for loans. It serves as a comprehensive document that collects essential information from applicants, including personal details, financial history, and the specifics of the loan being requested. This application is crucial for lenders to assess the creditworthiness of potential borrowers and make informed lending decisions.

How to Use the Loanliner Application

Using the Loanliner application involves several straightforward steps. First, gather all necessary documentation, such as identification and financial statements. Next, fill out the application form accurately, ensuring all information is complete to avoid delays. After completing the form, review it for any errors or omissions. Finally, submit the application electronically or via mail, depending on the lender’s requirements. Utilizing digital tools can enhance the efficiency of this process.

Steps to Complete the Loanliner Application

Completing the Loanliner application requires careful attention to detail. Follow these steps for a smooth experience:

- Collect all required documents, including proof of income and identification.

- Access the Loanliner application form through your lender’s website or a trusted platform.

- Fill in personal information, such as your name, address, and Social Security number.

- Provide financial details, including current debts and income sources.

- Specify the loan amount and purpose.

- Review the application for accuracy and completeness.

- Submit the application as instructed by your lender.

Legal Use of the Loanliner Application

The Loanliner application is legally binding when completed in accordance with established regulations. It must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) to ensure that electronic signatures are recognized. Using a secure platform for submission can further enhance the legal validity of the application.

Key Elements of the Loanliner Application

Several key elements are essential for a successful Loanliner application. These include:

- Personal Information: Basic details about the applicant, including name and contact information.

- Financial Information: Disclosure of income, assets, and liabilities.

- Loan Details: Specifics regarding the loan amount requested and its intended use.

- Signature: A digital or handwritten signature that verifies the authenticity of the application.

Examples of Using the Loanliner Application

The Loanliner application is commonly used in various scenarios, such as:

- Individuals applying for personal loans to cover unexpected expenses.

- Homebuyers seeking mortgages to finance property purchases.

- Small business owners applying for loans to expand their operations.

Quick guide on how to complete loanliner application 100297721

Complete Loanliner Application smoothly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Loanliner Application on any device through the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Loanliner Application effortlessly

- Find Loanliner Application and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this task.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Loanliner Application and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loanliner application 100297721

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is loanliner and how does it work?

Loanliner is a streamlined solution designed for businesses that need to manage loan documents efficiently. It allows users to create, send, and eSign documents quickly, ensuring a smooth transaction process. By enabling electronic signatures, Loanliner removes the hassle of printing and scanning, speeding up your workflow.

-

What are the key features of loanliner?

Loanliner offers a variety of key features, including customizable document templates, real-time tracking of document status, and secure electronic signatures. Additionally, it provides options for team collaboration, ensuring that all stakeholders can contribute effectively. These features make managing loan documents simpler and more efficient.

-

Is loanliner a cost-effective solution?

Yes, loanliner is designed to be a cost-effective solution for businesses of all sizes. The pricing structure is competitive, allowing organizations to save on printing and mailing costs while increasing productivity. With loanliner, you gain access to powerful document management tools without breaking the bank.

-

How does loanliner improve the loan documentation process?

Loanliner signNowly improves the loan documentation process by automating various tasks, such as sending reminders and tracking document status. This reduces delays and enhances communication among team members and clients. By using loanliner, businesses can complete their loan transactions faster and with greater confidence.

-

Can loanliner integrate with other software tools?

Absolutely! Loanliner is designed to easily integrate with various software applications including CRM systems and accounting software. This interoperability allows for a seamless workflow, enabling users to manage loan documents alongside their existing tools. Integration options enhance the overall efficiency of your operations.

-

What types of businesses can benefit from loanliner?

Loanliner is beneficial for any business that deals with loan documentation, including banks, credit unions, and mortgage companies. It's especially useful for organizations that prioritize efficiency and customer service. By using loanliner, these businesses can improve their document handling processes and serve their clients better.

-

Is loanliner secure for handling sensitive information?

Yes, loanliner ensures high levels of security for handling sensitive information such as loan documents. It uses encryption and secure access protocols to protect data during transmission and storage. This means that businesses can trust loanliner to maintain the confidentiality and integrity of their important documents.

Get more for Loanliner Application

- Form 19 notice of proposed entry to premises residential tenancy

- Virginia beach police department vbgovcom form

- Trs forms

- 2020 missouri employer reporting of 1099 instructions and specifications handbook form

- Toll free number 1 form

- Notification of demolition and renovation operations form

- A guide for organizing domestic limited liability companies in illinois form

- Medicare two way claim form ms001 services australia

Find out other Loanliner Application

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement