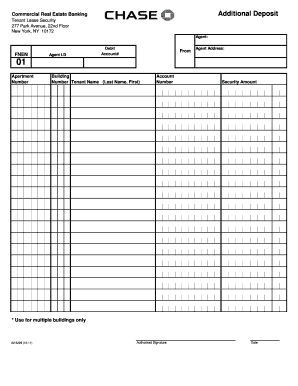

Chase Tenant Security Deposit Account Form

What is the Chase Tenant Security Deposit Account

The Chase Tenant Security Deposit Account is a specialized banking product designed to hold security deposits for rental properties. This account type ensures that the funds are managed separately from the landlord's personal finances, providing transparency and security for both tenants and landlords. It is essential for landlords to maintain compliance with state regulations regarding the handling of tenant security deposits, as improper management can lead to legal issues and disputes.

How to use the Chase Tenant Security Deposit Account

Using the Chase Tenant Security Deposit Account involves several straightforward steps. First, landlords need to open the account specifically for holding tenant security deposits. Once established, landlords can deposit the security funds received from tenants. It is crucial to keep accurate records of all transactions related to the account, including deposits and withdrawals. This practice helps ensure compliance with local laws and provides a clear financial history for both parties.

Steps to complete the Chase Tenant Security Deposit Account

Completing the setup of a Chase Tenant Security Deposit Account requires several key steps:

- Gather necessary documentation, including identification and proof of address.

- Visit a local Chase branch or access their online banking platform to initiate the account opening process.

- Fill out the required forms, specifying that the account is for tenant security deposits.

- Make an initial deposit as required by the bank's policies.

- Obtain confirmation of the account setup and keep records of all related documentation.

Legal use of the Chase Tenant Security Deposit Account

The legal use of the Chase Tenant Security Deposit Account is governed by state laws regarding security deposits. Landlords must understand their obligations, including how long they can hold the deposit, the conditions under which they can withhold funds, and the requirements for returning the deposit at the end of the tenancy. Proper use of this account helps landlords stay compliant with these laws and protects tenant rights.

Key elements of the Chase Tenant Security Deposit Account

Key elements of the Chase Tenant Security Deposit Account include:

- Segregation of funds: The account must be separate from the landlord's personal or business accounts.

- Interest accrual: In some states, security deposits must earn interest, which should be returned to the tenant.

- Record-keeping: Landlords must maintain detailed records of all transactions involving the security deposit.

- Compliance with state laws: Adhering to specific regulations regarding deposit amounts, return timelines, and permissible deductions.

State-specific rules for the Chase Tenant Security Deposit Account

State-specific rules regarding the Chase Tenant Security Deposit Account can vary significantly. Each state has its own laws dictating how security deposits should be handled, including maximum amounts, interest requirements, and timelines for returning deposits. It is important for landlords to familiarize themselves with the laws in their state to ensure compliance and avoid potential disputes with tenants.

Quick guide on how to complete chase tenant security deposit account 54125

Complete Chase Tenant Security Deposit Account effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any delays. Handle Chase Tenant Security Deposit Account on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Chase Tenant Security Deposit Account without hassle

- Find Chase Tenant Security Deposit Account and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Chase Tenant Security Deposit Account and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chase tenant security deposit account 54125

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a chase tenant security deposit account?

A chase tenant security deposit account is a dedicated account used by landlords to hold tenant security deposits securely. This account ensures transparency and proper management of funds, enabling landlords to comply with legal requirements regarding tenant deposits.

-

How can airSlate SignNow help with managing a chase tenant security deposit account?

airSlate SignNow streamlines the process of managing a chase tenant security deposit account by providing features like electronic signatures, document tracking, and secure storage. This ensures that all deposit agreements are efficiently handled, eliminating paperwork hassles and enhancing security.

-

What are the benefits of using airSlate SignNow for chase tenant security deposit accounts?

Using airSlate SignNow for chase tenant security deposit accounts allows landlords to automate workflows, reduce paperwork, and save time. This user-friendly platform enhances communication with tenants and provides an easy way to maintain compliance with security deposit regulations.

-

Is there a cost associated with using airSlate SignNow for chase tenant security deposit accounts?

Yes, airSlate SignNow offers various pricing plans that suit different business needs. The costs are competitive and are designed to be cost-effective, ensuring that managing a chase tenant security deposit account doesn't break the bank.

-

Can airSlate SignNow integrate with other property management tools for chase tenant security deposit accounts?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various property management tools. This allows for enhanced functionality, making it easier to manage chase tenant security deposit accounts alongside other essential tasks.

-

How does airSlate SignNow ensure the security of my chase tenant security deposit account information?

airSlate SignNow prioritizes data security with advanced encryption and compliance measures. Your chase tenant security deposit account information is safeguarded, ensuring that only authorized individuals have access to sensitive documents and transactions.

-

What documents do I need for a chase tenant security deposit account?

To manage a chase tenant security deposit account effectively, you typically need a lease agreement and a security deposit receipt. airSlate SignNow helps you compile and sign these documents electronically, simplifying the process for both landlords and tenants.

Get more for Chase Tenant Security Deposit Account

- To order official irs information returns such as forms w 2 and w 3 which include a

- 2020 form 8582 passive activity loss limitations

- Form 8833 treaty based return position disclosure under

- Pdf instructions for form 706 internal revenue service

- Delaware form 200 01

- W1q 9701 form

- Instructions for schedule r form 941 rev june 2020 instructions for schedule r form 941 allocation schedule for aggregate form

- Georgia form 500 nol instructions 2019

Find out other Chase Tenant Security Deposit Account

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online