Eta Form 9154 2012-2026

What is the Eta Form 9154

The Eta Form 9154 is a specific tax form used in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for businesses and individuals who need to comply with federal tax regulations. It serves as a means to report income, deductions, and other relevant tax information. Understanding the purpose of the Eta Form 9154 is crucial for ensuring accurate reporting and compliance with IRS guidelines.

Steps to complete the Eta Form 9154

Completing the Eta Form 9154 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay special attention to the sections that require specific details about your income and deductions. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Legal use of the Eta Form 9154

The legal use of the Eta Form 9154 is governed by IRS regulations, which outline the requirements for reporting financial information. It is important to ensure that the form is completed in accordance with these regulations to avoid penalties. Using the form legally means providing truthful and accurate information, as well as adhering to submission deadlines. Failure to comply with these requirements can result in fines or other legal consequences, making it essential for taxpayers to understand their obligations when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Eta Form 9154 are critical for compliance with IRS regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, businesses may have different deadlines depending on their tax structure. It is important to stay informed about any changes to these deadlines, as missing them can result in penalties. Marking important dates on a calendar can help ensure timely filing and compliance.

Required Documents

To complete the Eta Form 9154 accurately, several documents are required. These typically include income statements, such as W-2s or 1099s, receipts for deductible expenses, and any prior year tax returns. Having these documents on hand will facilitate the completion of the form and help ensure that all necessary information is reported. Organizing these documents before starting the form can streamline the process and reduce the likelihood of errors.

Who Issues the Form

The Eta Form 9154 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources for taxpayers to understand how to use the form correctly. It is important for users to refer to the IRS website or official publications for the most current version of the form and any updates regarding its use.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Eta Form 9154 can result in various penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. The IRS takes non-compliance seriously, and it is essential for taxpayers to understand the consequences of failing to file the form accurately and on time. Staying informed about these penalties can motivate timely and accurate submissions.

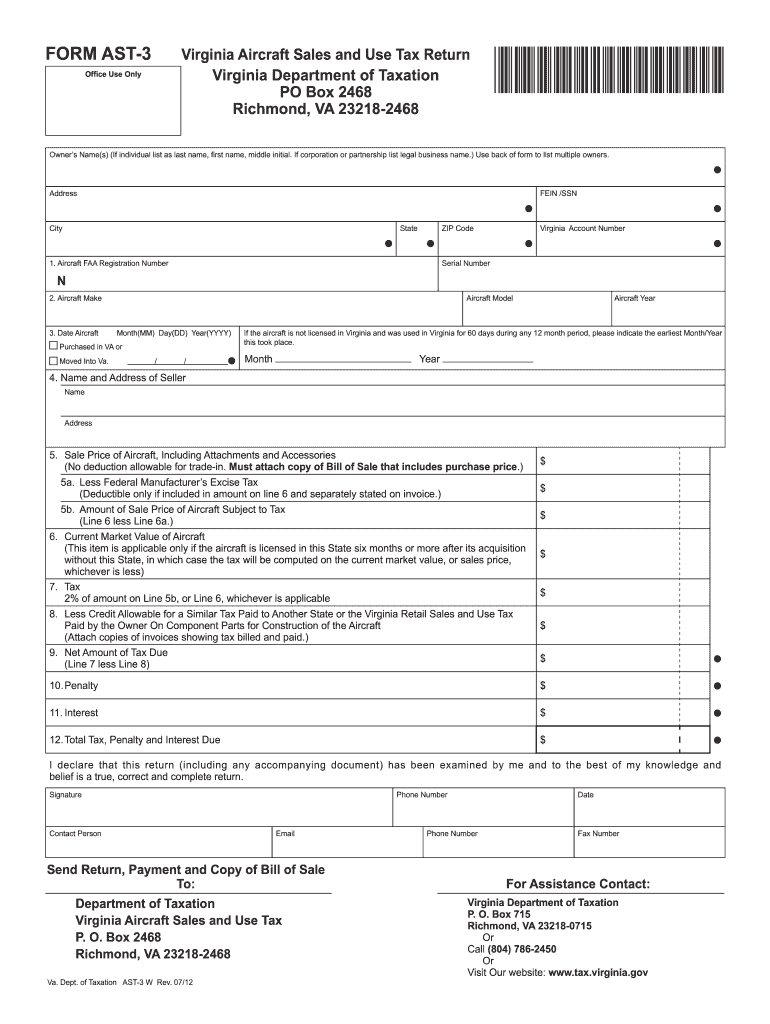

Quick guide on how to complete form ast 3 virginia department of taxation virginiagov tax virginia

Your assistance manual on how to prepare your Eta Form 9154

If you're curious about how to finalize and submit your Eta Form 9154, here are a few concise guidelines to simplify your tax filing process.

To begin, you simply need to create your airSlate SignNow account to transform your document management experience online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revert to adjust responses as needed. Optimize your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps outlined below to complete your Eta Form 9154 in a matter of minutes:

- Establish your account and start processing PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Eta Form 9154 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and amend any errors.

- Save changes, print your document, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Please be aware that filing by hand can lead to return discrepancies and delay refunds. Moreover, prior to e-filing your taxes, verify the IRS website for submission regulations in your jurisdiction.

Create this form in 5 minutes or less

FAQs

-

How does a Virginia LLC transfer a machine which is out of the normal line of business to another Virginia LLC without incurring sales tax?

Bill of Sale and record it appropriately on the Books.

-

How will it play out if Virginia’s Gov. Northam suddenly switch party and becomes a Republican? Will he get the support of Trump and McConnell to stay on?

Of course he won’t get their support if he suddenly changes parties.Why on Earth would they take this piece of baggage on just because he conveniently decided to change parties?Plus his views on infanticide are so antithetical to most Republicans that even if he were a Republican all along he wouldn't be getting support from the Republican party. When discussing abortion in the third trimester he had the following to say.“If a mother is in labor, I can tell you exactly what would happen. The infant would be delivered. The infant would be kept comfortable. The infant would be resuscitated if that’s what the mother and the family desired, and then a discussion would ensue between the physicians and the mother,” Northam said in the interview.There is no way a politician who talks so casually about murdering babies could make it in the Republican partyAlthough he later complained about how his remarks were taken he did not deny supporting infanticide. Rather he stressed how much he cares about children.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

Some in California want to secede from the state and form the new state of California. According to Article 4 Section 3 of the US Constitution, permission to secede must be sought from the state legislature. How did W Virginia secede from Virginia?

West Virginia became a separate state the same way California would have to split into separate states. The people of West Virginia wanted to separate from Virginia, and Congress wanted them to. In the case of West Virginia it didn’t hurt that the State of Virginia was in rebellion and as far as Congress was concerned didn’t have a legitimate legislature to block separation.Splitting a state into smaller states or joining small states into one larger state are possible as long as Congress and the state legislatures involved agree. Don’t hold your breath.

Create this form in 5 minutes!

How to create an eSignature for the form ast 3 virginia department of taxation virginiagov tax virginia

How to create an electronic signature for your Form Ast 3 Virginia Department Of Taxation Virginiagov Tax Virginia online

How to make an electronic signature for the Form Ast 3 Virginia Department Of Taxation Virginiagov Tax Virginia in Chrome

How to generate an eSignature for putting it on the Form Ast 3 Virginia Department Of Taxation Virginiagov Tax Virginia in Gmail

How to generate an eSignature for the Form Ast 3 Virginia Department Of Taxation Virginiagov Tax Virginia from your mobile device

How to make an electronic signature for the Form Ast 3 Virginia Department Of Taxation Virginiagov Tax Virginia on iOS devices

How to generate an electronic signature for the Form Ast 3 Virginia Department Of Taxation Virginiagov Tax Virginia on Android devices

People also ask

-

What is the Eta Form 9154 and how does it work?

The Eta Form 9154 is a document used for electronic signatures in various business transactions. With airSlate SignNow, you can easily manage and eSign the Eta Form 9154, streamlining your workflow and ensuring compliance. This user-friendly platform allows you to send, sign, and store your forms securely.

-

How much does it cost to use airSlate SignNow for the Eta Form 9154?

airSlate SignNow offers flexible pricing plans that cater to different business needs for managing the Eta Form 9154. You can choose from various subscription options, including monthly and annual plans, to find the best fit for your budget. Each plan provides access to features necessary for efficient document management and eSignature.

-

What are the key features of airSlate SignNow for the Eta Form 9154?

When using airSlate SignNow for the Eta Form 9154, you benefit from features like customizable templates, real-time tracking, and secure storage. The platform also supports multiple signing options, making it easier for you to obtain signatures quickly and efficiently. Additionally, the user-friendly interface simplifies the process of sending and managing your documents.

-

Can I integrate airSlate SignNow with other applications for the Eta Form 9154?

Yes, airSlate SignNow supports integrations with numerous applications, enhancing your workflow when dealing with the Eta Form 9154. You can seamlessly connect with tools like Google Drive, Salesforce, and Dropbox to access your documents easily. These integrations help you streamline your processes and improve productivity.

-

Is airSlate SignNow secure for handling the Eta Form 9154?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Eta Form 9154 and other documents are protected with advanced encryption technology. The platform complies with industry standards and regulations, providing a secure environment for electronic signatures and document management.

-

How can airSlate SignNow benefit my business when using the Eta Form 9154?

Using airSlate SignNow for the Eta Form 9154 can signNowly enhance your business's efficiency. The platform allows for faster turnaround times on documents, reduces paperwork, and minimizes the risk of errors. By streamlining the signing process, you can focus more on your core business activities.

-

Is there a mobile app for airSlate SignNow to manage the Eta Form 9154?

Yes, airSlate SignNow offers a mobile app that allows you to manage the Eta Form 9154 on-the-go. This mobile solution ensures that you can send, sign, and track your documents directly from your smartphone or tablet. It provides flexibility and convenience, making it easier to handle important documents anytime, anywhere.

Get more for Eta Form 9154

- Bidder form

- Do it yourself divorce rosen law firm form

- Bossier application form

- What is form approved omb no0960 0292

- Provider adjustment request form buckeye community health plan

- Pet addendum form

- Application for salesuse tax exemption app 0201 nevada form

- Cytp waiting list application mccs camp pendleton form

Find out other Eta Form 9154

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document