Charitable Gift Transfer Charles Schwab Client Center Form

What is the Charitable Gift Transfer Charles Schwab Client Center

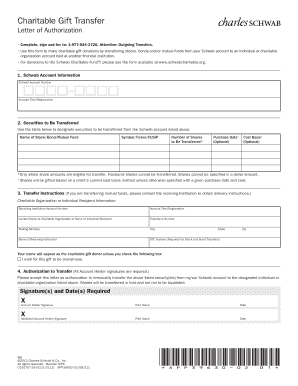

The Charitable Gift Transfer Charles Schwab Client Center form is a document that facilitates the transfer of assets to charitable organizations through Charles Schwab. This form is essential for clients who wish to make charitable donations while potentially benefiting from tax deductions. By utilizing this form, individuals can ensure their contributions are processed correctly and efficiently, aligning with their philanthropic goals.

How to use the Charitable Gift Transfer Charles Schwab Client Center

Using the Charitable Gift Transfer Charles Schwab Client Center form involves several straightforward steps. First, clients need to access the form, which can typically be found on the Charles Schwab website or through their client portal. After downloading or opening the form, clients should fill in their personal information, including account details and the specifics of the donation. It's crucial to specify the recipient charity and the type of asset being transferred, whether it be cash, stocks, or other securities. Once completed, the form must be submitted according to the instructions provided, either digitally or via traditional mail.

Steps to complete the Charitable Gift Transfer Charles Schwab Client Center

Completing the Charitable Gift Transfer Charles Schwab Client Center form involves a series of clear steps:

- Access the form through the Charles Schwab website or client portal.

- Fill in your personal information, including your name, address, and Schwab account number.

- Indicate the charitable organization receiving the gift, ensuring it is a qualified charity.

- Specify the type of asset you are transferring, such as cash or securities.

- Review the form for accuracy and completeness.

- Submit the form electronically or print it for mailing, following the provided submission guidelines.

Legal use of the Charitable Gift Transfer Charles Schwab Client Center

The legal use of the Charitable Gift Transfer Charles Schwab Client Center form is governed by various regulations that ensure the validity of charitable donations. To be legally binding, the form must be filled out accurately and submitted in accordance with both federal and state laws. This includes compliance with IRS regulations regarding charitable contributions, which may affect the deductibility of the donation on the donor's tax return. It is advisable for clients to keep a copy of the completed form for their records and consult with a tax professional to understand the implications of their charitable giving.

Required Documents

When completing the Charitable Gift Transfer Charles Schwab Client Center form, certain documents may be required to ensure a smooth process. These documents typically include:

- A valid identification document, such as a driver’s license or passport.

- Proof of ownership for the assets being transferred, such as account statements for securities.

- Documentation from the charitable organization confirming its status as a qualified charity.

Having these documents ready can expedite the processing of the charitable gift transfer.

Form Submission Methods

The Charitable Gift Transfer Charles Schwab Client Center form can be submitted through various methods, depending on client preference and the capabilities of the Schwab platform. Clients can typically choose to:

- Submit the form electronically via the Schwab client portal.

- Print the completed form and mail it to the designated Schwab address.

- Deliver the form in person at a local Schwab branch office.

Each method has its advantages, and clients should select the one that best suits their needs.

Quick guide on how to complete charitable gift transfer charles schwab client center

Complete Charitable Gift Transfer Charles Schwab Client Center smoothly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Charitable Gift Transfer Charles Schwab Client Center on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Charitable Gift Transfer Charles Schwab Client Center effortlessly

- Obtain Charitable Gift Transfer Charles Schwab Client Center and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of your documents or black out sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from your chosen device. Modify and eSign Charitable Gift Transfer Charles Schwab Client Center and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charitable gift transfer charles schwab client center

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Charles Schwab charitable gift transfer form?

The Charles Schwab charitable gift transfer form is a document that facilitates the donation of assets such as stocks or mutual funds to charitable organizations. This form streamlines the gift transfer process, ensuring that donations are processed efficiently while maximizing tax benefits for the donor.

-

How do I fill out the Charles Schwab charitable gift transfer form?

Filling out the Charles Schwab charitable gift transfer form involves providing your personal information, the charity's details, and the assets you wish to donate. It's essential to ensure that all information is accurate to avoid delays in processing your charitable contribution.

-

Are there fees associated with using the Charles Schwab charitable gift transfer form?

Typically, there aren’t any fees associated with completing the Charles Schwab charitable gift transfer form, but it's advisable to check with Schwab or the receiving charity for any potential costs involved during the transfer process. Overall, using this form can simplify your charitable giving without incurring signNow expenses.

-

What benefits do I get from using the Charles Schwab charitable gift transfer form?

Utilizing the Charles Schwab charitable gift transfer form can provide tax advantages, simplify asset donations, and facilitate a smooth transfer to your chosen charity. By using this form, donors can ensure their gifts are handled professionally, maximizing the benefit to the nonprofit.

-

Can I integrate the Charles Schwab charitable gift transfer form with other tools?

While the Charles Schwab charitable gift transfer form itself is a standalone document, airSlate SignNow allows for seamless integration with various tools, which can enhance your document management and eSigning experience. This ability to integrate can simplify the workflow when handling charitable contributions.

-

How long does it take to process the Charles Schwab charitable gift transfer form?

The processing time for the Charles Schwab charitable gift transfer form can vary based on the type of asset being donated and the specifics of the charity. Generally, once the form is submitted, you can expect a response within a few business days, though asset transfers may take longer.

-

What types of donations can I make using the Charles Schwab charitable gift transfer form?

The Charles Schwab charitable gift transfer form is designed to accommodate various types of donations, including stocks, bonds, mutual funds, and cash. This flexibility allows donors to choose the assets that align best with their charitable goals and tax planning strategies.

Get more for Charitable Gift Transfer Charles Schwab Client Center

- Guide for arkansas social work degrees and schools form

- Student request to receive allergy immunotherapy student request to receive allergy immunotherapy form

- Thielen student health centeriowa state university thielen student form

- Form w 2 form 1042 s reprint request form northwestern

- Apply to an accelerated4 1 degree program the graduate form

- Ohsp form 1occupational risk assessment kansas state

- Utsa residency application form

- Nys office of alcoholism and substance abuse services oasas ny form

Find out other Charitable Gift Transfer Charles Schwab Client Center

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure