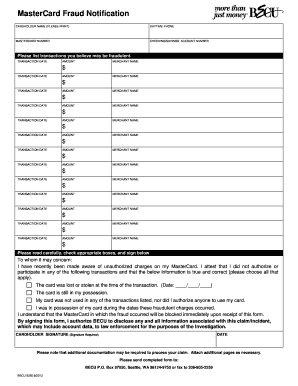

Becu Fraud Alert Form

What is the BECU Fraud Alert

The BECU Fraud Alert is a crucial tool designed to protect members from unauthorized transactions and identity theft. This alert notifies financial institutions and credit bureaus that a member suspects fraudulent activity on their accounts. By placing a fraud alert, individuals can help safeguard their personal information and ensure that any attempts to open new accounts or make significant transactions are verified through additional identification checks.

How to use the BECU Fraud Alert

Using the BECU Fraud Alert involves a straightforward process. Members can initiate the alert by contacting BECU directly or through their online banking platform. Once the alert is in place, it remains active for a specified period, typically 90 days, during which creditors must take extra steps to verify the member's identity before granting credit. Members can renew or extend the alert as needed, ensuring ongoing protection against fraud.

Steps to complete the BECU Fraud Alert

Completing the BECU Fraud Alert requires a few essential steps:

- Contact BECU via phone or online to report suspected fraud.

- Provide necessary personal information, including your name, address, and account details.

- Confirm your identity through security questions or other verification methods.

- Receive confirmation of the fraud alert being placed on your account.

Following these steps ensures that your accounts are monitored for any suspicious activity, providing peace of mind.

Legal use of the BECU Fraud Alert

The BECU Fraud Alert is legally recognized under the Fair Credit Reporting Act (FCRA). This law allows consumers to place alerts on their credit reports when they suspect fraud. Financial institutions are obligated to adhere to these alerts, ensuring that they take appropriate measures to verify identity before extending credit. This legal framework empowers consumers to protect their financial interests effectively.

Key elements of the BECU Fraud Alert

Several key elements define the BECU Fraud Alert:

- Duration: The alert typically lasts for 90 days but can be renewed.

- Notification: Creditors must be informed of the alert to take necessary precautions.

- Verification: Additional identification checks are required for new credit applications.

- Consumer Rights: Members have the right to dispute any unauthorized transactions.

Understanding these elements can help members navigate the process and utilize the alert effectively.

Examples of using the BECU Fraud Alert

Members may find the BECU Fraud Alert useful in various scenarios, such as:

- Receiving unsolicited credit card offers after a data breach.

- Noticing unusual transactions on their bank statements.

- Experiencing identity theft or unauthorized account access.

In each case, placing a fraud alert can help mitigate risks and protect personal financial information.

Quick guide on how to complete becu fraud alert

Effortlessly prepare Becu Fraud Alert on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Becu Fraud Alert on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Becu Fraud Alert with ease

- Find Becu Fraud Alert and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new document prints. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Becu Fraud Alert and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the becu fraud alert

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BECU routing number and why do I need it?

The BECU routing number is a nine-digit identifier used to facilitate electronic transactions and money transfers between banks. It is essential for setting up direct deposits, automatic payments, and transferring funds. Knowing your BECU routing number ensures smooth processing of your financial transactions.

-

How can I find my BECU routing number?

You can find your BECU routing number by checking your account statements, visiting the BECU website, or using the mobile banking app. The routing number is typically listed in the account details section. If you're still unsure, contacting BECU customer support can provide assistance.

-

How does the BECU routing number work with airSlate SignNow?

At airSlate SignNow, the BECU routing number can be utilized for seamless transactions involving document signing and payment processing. Whether you are sending invoices or contracts requiring payment, having your BECU routing number ensures that funds are directed correctly. Our platform simplifies the integration of such banking details into your workflows.

-

Are there any fees associated with using the BECU routing number for payments?

Typically, using your BECU routing number for direct deposits and standard ACH transfers is free of charge. However, it's advised to check with BECU or your specific payment service provider for any potential fees. At airSlate SignNow, we aim to provide economical solutions, ensuring your business transactions remain budget-friendly.

-

Can I use the BECU routing number for international transfers?

Using a BECU routing number is primarily for domestic transactions within the United States. For international transfers, you may need to use an IBAN or SWIFT code depending on the receiving bank. It's important to verify the details with BECU or your bank to ensure smooth international transaction processes.

-

What benefits does integrating the BECU routing number offer with airSlate SignNow?

Integrating the BECU routing number with airSlate SignNow streamlines your document signing and payment processes. It allows fast and efficient transactions directly from your signed documents, enhancing your overall workflow productivity. This integration minimizes delays and ensures accurate payment processing, ultimately benefiting your business operations.

-

Is my BECU routing number secure when using airSlate SignNow?

Yes, your BECU routing number is kept secure when using airSlate SignNow. Our platform employs end-to-end encryption and compliance protocols to protect sensitive financial information. We prioritize your security, allowing you to eSign documents comfortably while ensuring your bank details remain confidential.

Get more for Becu Fraud Alert

Find out other Becu Fraud Alert

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy