Virginia Form R 5e Instructions 2000

What is the Virginia Form R 5e Instructions

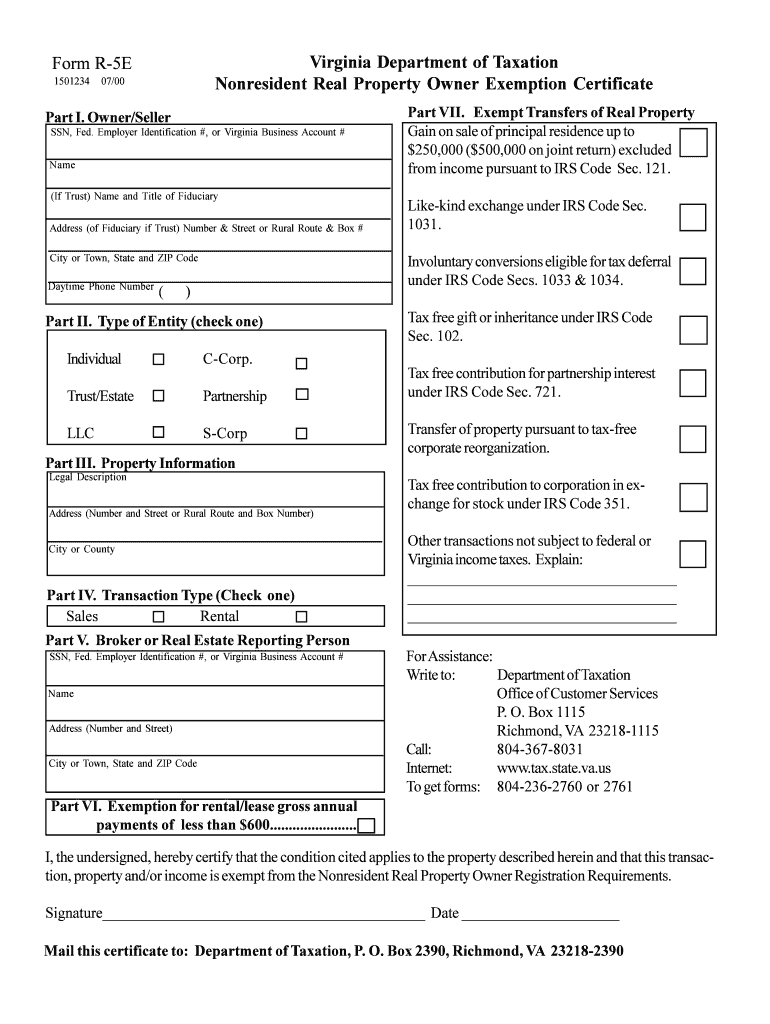

The Virginia Form R 5e Instructions are guidelines provided by the Virginia Department of Taxation to assist taxpayers in completing the Form R-5e, which is used for claiming a refund of Virginia income tax withheld. This form is particularly relevant for individuals who have had Virginia state income tax withheld from their wages or other income sources and wish to ensure they receive the appropriate refund. Understanding these instructions is crucial for accurate completion and compliance with state tax regulations.

Steps to complete the Virginia Form R 5e Instructions

Completing the Virginia Form R 5e requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including your W-2 forms and any other relevant income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the total amount of Virginia income tax withheld as shown on your W-2 forms.

- Calculate the refund amount you are claiming based on your total income and tax withheld.

- Review your completed form for accuracy and ensure all required fields are filled out.

- Sign and date the form to verify its authenticity.

How to obtain the Virginia Form R 5e Instructions

The Virginia Form R 5e Instructions can be obtained directly from the Virginia Department of Taxation's official website. They are typically available in PDF format, allowing for easy downloading and printing. Additionally, physical copies may be requested through local tax offices or by contacting the Department of Taxation directly. It is important to ensure that you are using the most current version of the instructions to comply with any recent updates or changes in tax law.

Legal use of the Virginia Form R 5e Instructions

The Virginia Form R 5e Instructions are legally binding when completed accurately and submitted in accordance with state tax laws. Taxpayers are responsible for ensuring that the information provided is truthful and complete. Misrepresentation or failure to comply with the instructions may lead to penalties, including fines or denial of refund claims. It is advisable to keep copies of all submitted forms and supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form R 5e are typically aligned with the state income tax filing deadlines. Generally, taxpayers must submit their refund claims by the due date of their income tax return, which is usually May 1st for most individuals. It is essential to stay informed about any changes to these dates, especially in light of potential extensions or adjustments made by the Virginia Department of Taxation.

Form Submission Methods (Online / Mail / In-Person)

The Virginia Form R 5e can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online: Taxpayers can file electronically through the Virginia Department of Taxation's online portal, which offers a streamlined process for submitting forms and receiving refunds.

- Mail: Completed forms can be printed and mailed to the appropriate address provided in the instructions. Ensure that sufficient postage is applied.

- In-Person: Taxpayers may also submit their forms in person at local tax offices, where assistance may be available if needed.

Quick guide on how to complete virginia form r 5e instructions 2000

Your instructional manual on how to assemble your Virginia Form R 5e Instructions

If you’re pondering how to produce and deliver your Virginia Form R 5e Instructions, here are several straightforward recommendations on how to facilitate tax submission.

To get started, all you need is to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow serves as a very accessible and robust document management tool that allows you to modify, draft, and finalize your income tax forms seamlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures and revisit to edit details as necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and easy sharing.

Adhere to the instructions below to finalize your Virginia Form R 5e Instructions in just a few moments:

- Establish your account and start editing PDFs in no time.

- Utilize our directory to locate any IRS tax document; browse through variants and schedules.

- Press Get form to access your Virginia Form R 5e Instructions in our editor.

- Complete the necessary fillable fields with your details (text, figures, checkmarks).

- Employ the Sign Tool to add your legally-recognized electronic signature (if required).

- Examine your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes digitally with airSlate SignNow. Please be aware that filing on paper can elevate return errors and postpone refunds. Naturally, before electronically filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct virginia form r 5e instructions 2000

FAQs

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

How many rupees can be needed to fill out the form?

300,000.00

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the virginia form r 5e instructions 2000

How to generate an electronic signature for your Virginia Form R 5e Instructions 2000 online

How to generate an eSignature for your Virginia Form R 5e Instructions 2000 in Google Chrome

How to make an eSignature for signing the Virginia Form R 5e Instructions 2000 in Gmail

How to generate an eSignature for the Virginia Form R 5e Instructions 2000 right from your smart phone

How to create an eSignature for the Virginia Form R 5e Instructions 2000 on iOS

How to generate an electronic signature for the Virginia Form R 5e Instructions 2000 on Android OS

People also ask

-

What are Virginia Form R 5e Instructions?

Virginia Form R 5e Instructions provide guidance on how to complete the Virginia Form R 5e, which is essential for businesses and individuals filing certain tax documents in Virginia. These instructions detail the required information, deadlines, and submission processes to ensure compliance with state regulations.

-

How does airSlate SignNow help with Virginia Form R 5e Instructions?

airSlate SignNow simplifies the process of managing Virginia Form R 5e Instructions by allowing users to create, send, and eSign documents efficiently. With our user-friendly platform, you can ensure that your forms are completed accurately and submitted on time, streamlining your workflow and enhancing productivity.

-

Is there a cost associated with using airSlate SignNow for Virginia Form R 5e Instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, providing affordable options for managing documents like Virginia Form R 5e Instructions. Each plan includes features that enhance document management, including electronic signatures and templates, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for managing Virginia Form R 5e Instructions?

airSlate SignNow provides features such as customizable templates, secure eSigning, real-time tracking, and cloud storage that are ideal for managing Virginia Form R 5e Instructions. These tools help you create a seamless process for filling out and submitting forms, ensuring compliance with all necessary guidelines.

-

Can I integrate airSlate SignNow with other applications for Virginia Form R 5e Instructions?

Absolutely! airSlate SignNow integrates easily with various applications such as Google Drive, Dropbox, and CRM systems, enhancing your ability to manage Virginia Form R 5e Instructions. This integration allows for smoother workflows, as you can access and send documents from your preferred tools.

-

What are the benefits of using airSlate SignNow for Virginia Form R 5e Instructions?

Using airSlate SignNow for Virginia Form R 5e Instructions streamlines your document handling process, reduces paperwork, and saves time. The platform's eSigning capabilities ensure that your forms are legally binding and securely stored, providing peace of mind for users managing sensitive information.

-

Is airSlate SignNow secure for handling Virginia Form R 5e Instructions?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Virginia Form R 5e Instructions and other documents are protected. Our platform uses encryption and secure data storage solutions to safeguard your information, allowing you to manage your documents with confidence.

Get more for Virginia Form R 5e Instructions

- Passport health plan form

- Custom subway card quote form

- Underground storage tank monitoring system daily inspection form

- Tournament application form updated 10413 say soccer saysoccer

- Clallam county fire district no 2 residential burn bpermitb form

- Sewage system file review north bay mattawa conservation form

- Excelsior college transcript request form

- Arizona model plan form edward j maney chapter 13 trustee

Find out other Virginia Form R 5e Instructions

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now