Employee HSA Contribution Form2013 Utah Foster Care 2013-2026

What is the HSA Contribution Form?

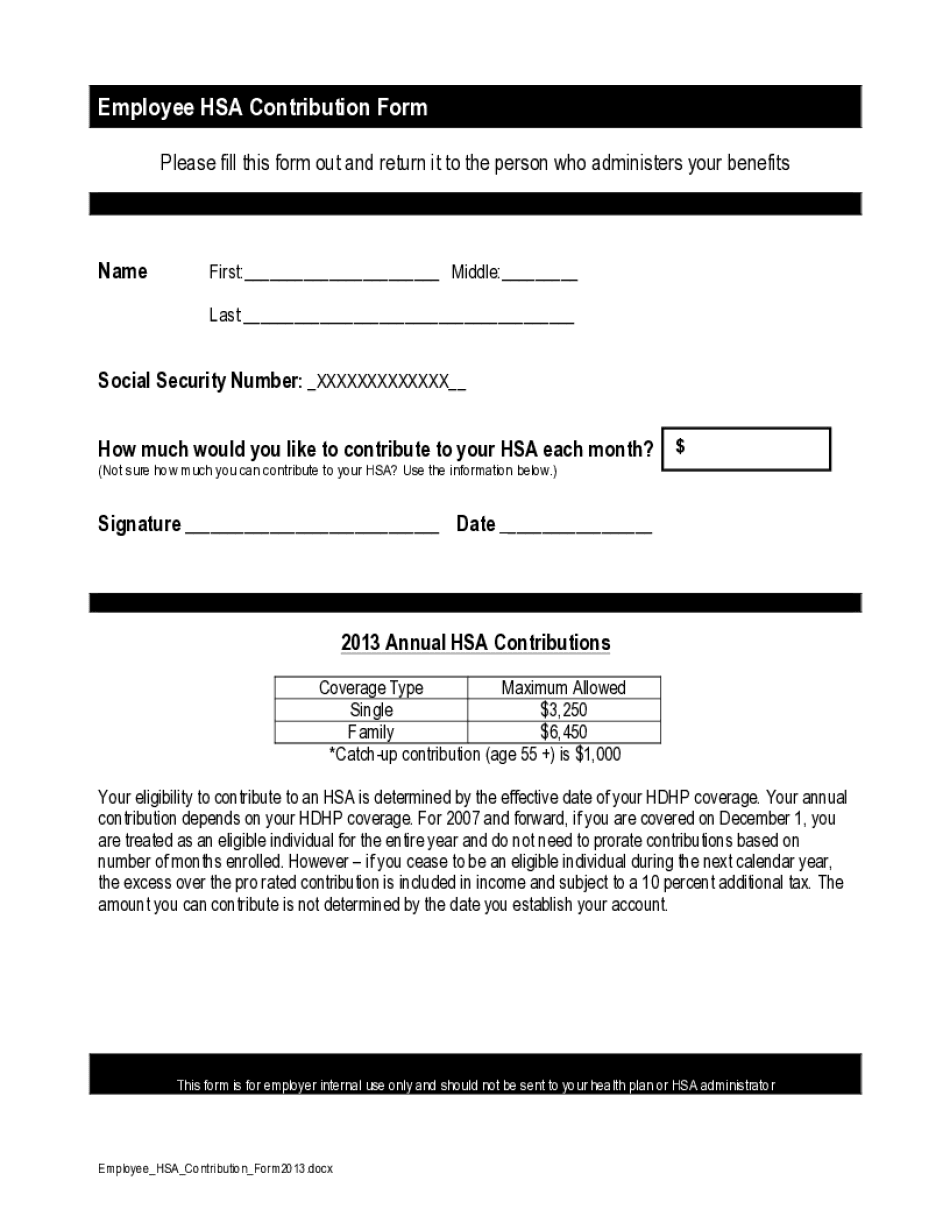

The HSA contribution form is a critical document used by employees to report contributions made to their Health Savings Account (HSA). This form is essential for tax purposes, as it helps determine the amount that can be deducted from taxable income. The contributions reported on this form are often reflected in Box 12 of the W-2 form, which indicates the total contributions made during the tax year. Understanding this form is vital for accurate tax reporting and maximizing HSA benefits.

Steps to Complete the HSA Contribution Form

Completing the HSA contribution form involves several straightforward steps. First, gather all necessary information, including your personal details and the amount contributed to your HSA. Next, accurately fill out the form, ensuring that all fields are completed correctly. It is important to double-check the amounts entered, as inaccuracies can lead to complications during tax filing. Once completed, the form should be submitted according to your employer's guidelines, typically either online or in paper format.

IRS Guidelines for HSA Contributions

The IRS sets specific guidelines regarding HSA contributions, including annual contribution limits and eligibility criteria. For the tax year, individuals should be aware of the maximum contribution limits, which can vary based on age and coverage type. It is essential to stay informed about these limits to avoid over-contributing, which could result in tax penalties. Additionally, understanding the tax advantages associated with HSA contributions can help individuals make informed decisions about their healthcare savings.

Form Submission Methods

There are several methods for submitting the HSA contribution form, depending on your employer's policies. Common submission methods include online submission through a designated portal, mailing a paper form to the HR department, or delivering it in person. Each method has its own timeline for processing, so it is advisable to check with your employer for specific instructions to ensure timely submission and compliance with tax regulations.

Key Elements of the HSA Contribution Form

The HSA contribution form includes several key elements that are essential for accurate reporting. These elements typically include the employee's name, Social Security number, the total amount contributed, and the tax year for which the contributions are being reported. Additionally, the form may require signatures or initials to validate the information provided. Understanding these components is crucial for ensuring the form is completed correctly and submitted without errors.

Penalties for Non-Compliance

Failing to comply with HSA contribution reporting requirements can result in penalties imposed by the IRS. These penalties may include additional taxes on excess contributions or failure to report contributions accurately. It is important for employees to understand the implications of non-compliance, as it can affect their tax liability and overall financial health. Staying informed about the rules and deadlines associated with HSA contributions can help mitigate these risks.

Quick guide on how to complete employee hsa contribution form2013 utah foster care

Effortlessly Prepare Employee HSA Contribution Form2013 Utah Foster Care on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Employee HSA Contribution Form2013 Utah Foster Care on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Employee HSA Contribution Form2013 Utah Foster Care with Ease

- Locate Employee HSA Contribution Form2013 Utah Foster Care and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to share your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Edit and eSign Employee HSA Contribution Form2013 Utah Foster Care and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employee hsa contribution form2013 utah foster care

Create this form in 5 minutes!

How to create an eSignature for the employee hsa contribution form2013 utah foster care

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSA contribution form template?

An HSA contribution form template is a pre-designed document that allows individuals or employers to easily record and manage health savings account contributions. This template simplifies the process, ensuring compliance with IRS regulations, and eases the reporting responsibilities for both contributors and recipients.

-

How does the airSlate SignNow HSA contribution form template work?

The airSlate SignNow HSA contribution form template enables users to fill in their contributions digitally. Users can customize the template to include specific fields and easily send it for e-signature, streamlining the entire process of providing contributions while maintaining accuracy and security.

-

Is the HSA contribution form template customizable?

Yes, the HSA contribution form template offered by airSlate SignNow is fully customizable. You can modify fields, add branding elements, and adjust formatting, allowing you to tailor the document to meet the specific needs of your organization or personal requirements.

-

What are the benefits of using the airSlate SignNow HSA contribution form template?

Using the airSlate SignNow HSA contribution form template offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance with federal regulations. Additionally, the e-signature capability ensures that all contributions are securely documented and legally binding.

-

Are there any costs associated with using the HSA contribution form template?

airSlate SignNow offers various pricing plans that cater to different business needs. While the base product may include access to the HSA contribution form template, advanced features and higher usage tiers may come with additional costs, so it's best to check the pricing page for specific details.

-

Can I integrate the HSA contribution form template with other software?

Yes, the airSlate SignNow HSA contribution form template can be integrated with numerous third-party applications. This seamless integration allows for efficient data transfer and management, enhancing overall workflow and ensuring all aspects of contributions are handled smoothly.

-

How secure is my information when using the HSA contribution form template?

When using the airSlate SignNow HSA contribution form template, your data is protected by industry-standard security measures, including encryption and secure data storage. This ensures that all sensitive information regarding your contributions remains confidential and secure from unauthorized access.

Get more for Employee HSA Contribution Form2013 Utah Foster Care

- Form llc 12a ampquotattachment to statement of information

- Only llcs form

- Llc request form for certificates of good standing andor certified copies of documents

- Supplemental labor housing inspection checklist oregon form

- Georgia dds request form

- I 9 form printable

- Oregon birth pdf form

- Make sure you are aware of possible nancial consequences form

Find out other Employee HSA Contribution Form2013 Utah Foster Care

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer