Employee HSA Contribution Form 20110526 HealthEquity 2011

What is the Employee HSA Contribution Form 20110526 HealthEquity

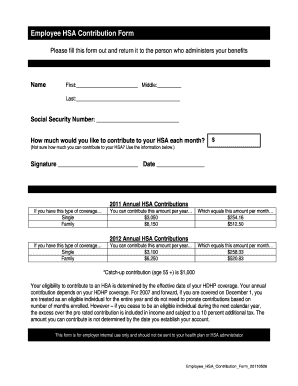

The Employee HSA Contribution Form 20110526 HealthEquity is a crucial document used by employees to designate contributions to their Health Savings Accounts (HSAs). This form allows employees to specify the amount they wish to contribute, ensuring compliance with IRS regulations. It serves as a record for both the employee and employer, facilitating accurate tracking of contributions throughout the tax year. Understanding this form is essential for maximizing tax benefits associated with HSAs.

Steps to complete the Employee HSA Contribution Form 20110526 HealthEquity

Completing the Employee HSA Contribution Form 20110526 HealthEquity involves several straightforward steps:

- Gather necessary information: Collect personal details such as your name, address, and Social Security number.

- Specify contribution amounts: Indicate how much you plan to contribute to your HSA for the year, ensuring it aligns with IRS limits.

- Review employer policies: Check with your employer regarding any specific requirements or limits related to contributions.

- Sign and date the form: Ensure you provide your signature and the date to validate the form.

- Submit the form: Deliver the completed form to your HR department or the designated benefits administrator.

Legal use of the Employee HSA Contribution Form 20110526 HealthEquity

The Employee HSA Contribution Form 20110526 HealthEquity is legally binding when properly executed. To ensure its legality, the form must meet specific criteria outlined by the IRS and comply with federal laws governing HSAs. This includes accurate completion, proper signatures, and adherence to contribution limits. Electronic signatures are permissible under the ESIGN Act, provided they meet the necessary security and identification standards.

Key elements of the Employee HSA Contribution Form 20110526 HealthEquity

Several key elements are essential for the Employee HSA Contribution Form 20110526 HealthEquity:

- Employee identification: Personal information to identify the employee making the contributions.

- Contribution amounts: Clear indication of the dollar amount the employee intends to contribute.

- Employer information: Details about the employer to ensure proper processing of the contributions.

- Signature and date: Required for validation, confirming the employee's intent to contribute.

How to obtain the Employee HSA Contribution Form 20110526 HealthEquity

Obtaining the Employee HSA Contribution Form 20110526 HealthEquity is a simple process. Employees can typically request the form through their HR department or benefits administrator. Many employers also provide the form online via their internal employee portals. It is advisable to ensure you have the most current version of the form to avoid any compliance issues.

Form Submission Methods (Online / Mail / In-Person)

The Employee HSA Contribution Form 20110526 HealthEquity can be submitted through various methods depending on employer preferences:

- Online submission: Many employers allow electronic submission via secure portals, making the process efficient.

- Mail: Employees may choose to print the form and send it via postal service to their HR department.

- In-person: Submitting the form directly to HR or benefits personnel ensures immediate processing and confirmation.

Quick guide on how to complete employee hsa contribution form 20110526 healthequity

Complete Employee HSA Contribution Form 20110526 HealthEquity effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Employee HSA Contribution Form 20110526 HealthEquity on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign Employee HSA Contribution Form 20110526 HealthEquity with ease

- Find Employee HSA Contribution Form 20110526 HealthEquity and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Employee HSA Contribution Form 20110526 HealthEquity and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employee hsa contribution form 20110526 healthequity

Create this form in 5 minutes!

How to create an eSignature for the employee hsa contribution form 20110526 healthequity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSA contribution form template?

An HSA contribution form template is a standardized document designed to simplify the process of contributing to a Health Savings Account (HSA). This template outlines the necessary information required for contributions, making it easy for both individuals and businesses to manage HSA accounts efficiently.

-

How can airSlate SignNow assist with HSA contribution form templates?

airSlate SignNow offers customizable HSA contribution form templates that can be easily filled out and eSigned. With its intuitive interface, users can efficiently manage their HSA contributions, ensuring compliance and accuracy in the process.

-

Are there any costs associated with using airSlate SignNow's HSA contribution form template?

While airSlate SignNow offers various pricing plans, using their HSA contribution form template can enhance your productivity at a competitive rate. Consider exploring their options to find a plan that fits your needs without compromising on features.

-

What features does the airSlate SignNow HSA contribution form template include?

The airSlate SignNow HSA contribution form template includes features such as customizable fields, electronic signature capabilities, and secure storage. These functionalities ensure that submitting contributions is quick, easy, and compliant with regulations.

-

Can I integrate the HSA contribution form template with other software?

Yes, airSlate SignNow allows seamless integrations with various software applications, enhancing the usability of the HSA contribution form template. This ensures that data flows smoothly between platforms, streamlining your contributions and documentation.

-

Is the HSA contribution form template mobile-friendly?

Absolutely! The airSlate SignNow HSA contribution form template is designed to be mobile-friendly, allowing users to complete and sign forms on the go. This flexibility ensures convenient access and ease of use for busy individuals and businesses.

-

What are the benefits of using an HSA contribution form template from airSlate SignNow?

Using an HSA contribution form template from airSlate SignNow provides several benefits, including time savings, increased accuracy, and enhanced security. The template simplifies the contribution process, making it efficient while ensuring data integrity.

Get more for Employee HSA Contribution Form 20110526 HealthEquity

Find out other Employee HSA Contribution Form 20110526 HealthEquity

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure