Ohio Tax Exempt Form

What is the Ohio Tax Exempt Form

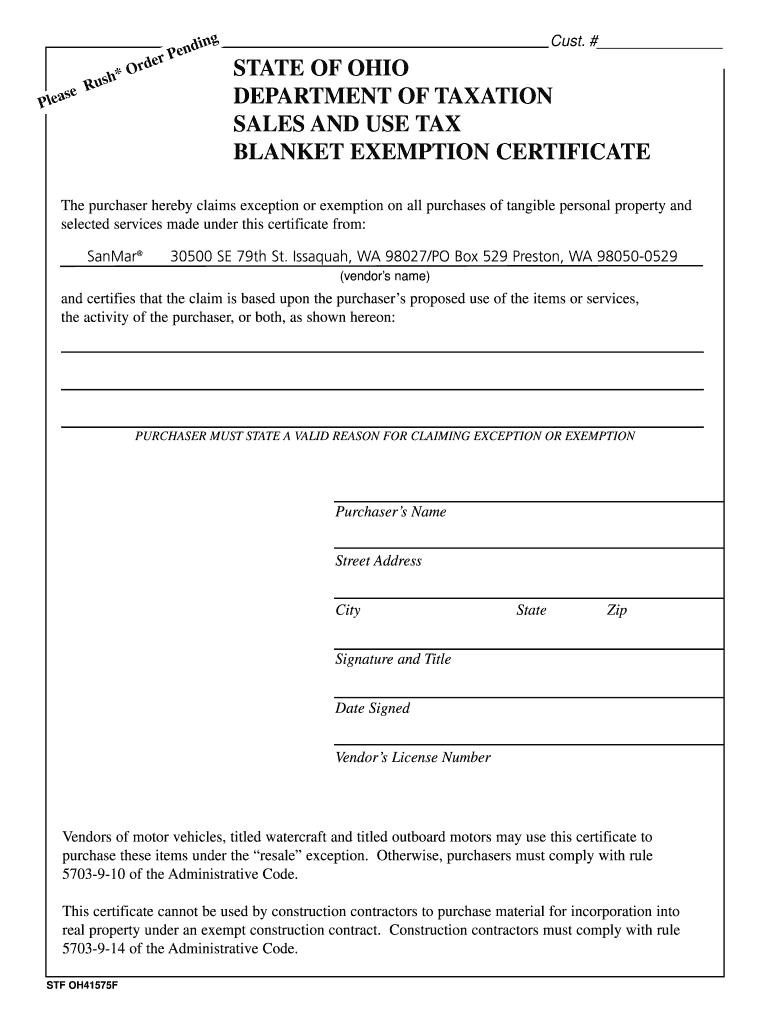

The Ohio tax exempt form, often referred to as the blanket tax exempt form, is a document used by businesses and organizations to claim exemption from sales and use tax in the state of Ohio. This form allows eligible entities, such as non-profits and certain governmental organizations, to purchase goods and services without paying sales tax. The exemption is typically granted for purchases that are directly related to the entity's exempt purpose.

How to use the Ohio Tax Exempt Form

To use the Ohio tax exempt form effectively, the entity must complete the form accurately and present it to the vendor at the time of purchase. The vendor must retain a copy of the completed form for their records. It is essential that the form is filled out with correct information, including the name of the exempt organization, the reason for the exemption, and the signature of an authorized representative. This ensures that the exemption is recognized by the vendor and complies with Ohio tax regulations.

Steps to complete the Ohio Tax Exempt Form

Completing the Ohio tax exempt form involves several key steps:

- Obtain the form from the Ohio Department of Taxation or a reliable source.

- Fill in the name and address of the exempt organization, ensuring accuracy.

- Provide the reason for the exemption, citing the specific tax code if applicable.

- Include the signature of an authorized representative, along with the date.

- Make copies of the completed form for both the organization and the vendor.

Legal use of the Ohio Tax Exempt Form

The legal use of the Ohio tax exempt form requires compliance with state laws governing tax exemptions. The form must be used solely for eligible purchases related to the exempt purpose of the organization. Misuse of the form, such as using it for personal purchases or for items not related to the exempt purpose, can lead to penalties and the loss of exemption status. It is crucial for organizations to understand their eligibility and the legal implications of using the form.

Eligibility Criteria

Eligibility for using the Ohio tax exempt form typically includes non-profit organizations, governmental entities, and certain educational institutions. To qualify, the entity must demonstrate that its purchases are directly related to its exempt activities. Additionally, organizations must be registered with the Ohio Department of Taxation and possess the necessary documentation to support their exempt status. It is advisable to review the specific criteria outlined by the state to ensure compliance.

Examples of using the Ohio Tax Exempt Form

Common examples of using the Ohio tax exempt form include:

- A non-profit organization purchasing office supplies for its operations.

- A government agency acquiring equipment for public services.

- An educational institution buying materials for classroom use.

In each case, the organization must provide the completed form to the vendor at the time of purchase to avoid sales tax charges.

Form Submission Methods

The Ohio tax exempt form can be submitted in various ways, depending on the vendor's requirements. Typically, the form is presented in person at the point of sale, but some vendors may accept it via fax or email. It is essential to confirm the preferred method of submission with the vendor to ensure proper processing and acceptance of the exemption.

Quick guide on how to complete ohio tax exempt form 15066252

Effortlessly Prepare Ohio Tax Exempt Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly and without delays. Manage Ohio Tax Exempt Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Method to Modify and eSign Ohio Tax Exempt Form Seamlessly

- Locate Ohio Tax Exempt Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ohio Tax Exempt Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio tax exempt form 15066252

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio blanket tax exempt form?

The Ohio blanket tax exempt form is a document that allows eligible organizations to purchase items without paying sales tax. Nonprofit organizations, government entities, and educational institutions commonly use this form. By utilizing the Ohio blanket tax exempt form, organizations can save money on their purchases.

-

How can airSlate SignNow help with the Ohio blanket tax exempt form?

AirSlate SignNow streamlines the process of sending and eSigning the Ohio blanket tax exempt form. Our platform allows users to quickly create, send, and receive signed documents, ensuring compliance and efficiency. With airSlate SignNow, managing your tax exempt forms becomes simple and seamless.

-

Is there a cost associated with using airSlate SignNow for the Ohio blanket tax exempt form?

While airSlate SignNow offers a range of pricing plans, the cost-effectiveness of our solution makes it an attractive option for businesses needing to manage the Ohio blanket tax exempt form. Our plans are designed to accommodate various budgets, ensuring that you can find a suitable option for your needs.

-

What features does airSlate SignNow provide for managing the Ohio blanket tax exempt form?

AirSlate SignNow offers features like customizable templates, document tracking, and secure eSigning to assist users in managing the Ohio blanket tax exempt form. These features enhance productivity and reduce turnaround times for important documents. Additionally, users can easily integrate with other systems to streamline their workflows.

-

Can I integrate airSlate SignNow with other software for handling the Ohio blanket tax exempt form?

Yes, airSlate SignNow offers integration capabilities with popular software applications to help you manage the Ohio blanket tax exempt form efficiently. This allows for the seamless flow of information between platforms, simplifying document management. By integrating our solution with your existing tools, you can enhance productivity and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for my nonprofit organization regarding the Ohio blanket tax exempt form?

By using airSlate SignNow, nonprofit organizations can efficiently manage the Ohio blanket tax exempt form, ensuring compliance and saving time. Our intuitive platform allows for easy document creation and eSigning, facilitating faster transactions. This means nonprofits can focus more on their mission and less on paperwork.

-

How secure is airSlate SignNow for handling sensitive documents like the Ohio blanket tax exempt form?

Security is a top priority at airSlate SignNow. Our platform utilizes industry-leading encryption protocols to protect sensitive information, including the Ohio blanket tax exempt form. We are committed to safeguarding your data while providing a convenient and user-friendly experience.

Get more for Ohio Tax Exempt Form

Find out other Ohio Tax Exempt Form

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe