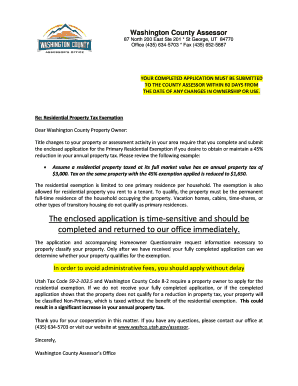

Washington County Tax Assessor Form

What is the Washington County Tax Assessor

The Washington County Tax Assessor is a government office responsible for determining the value of properties within Washington County, Utah. This office plays a crucial role in property tax assessments, ensuring that property owners are fairly taxed based on the value of their real estate holdings. The assessor's office collects data on property characteristics, market conditions, and comparable sales to establish property values. This information is essential for local governments to generate revenue for public services such as education, infrastructure, and emergency services.

How to use the Washington County Tax Assessor

Utilizing the Washington County Tax Assessor's services can be straightforward. Property owners can visit the official website to access valuable resources, including property tax information, assessment records, and forms needed for appeals or adjustments. Users can search for property details by entering their address or parcel number. Additionally, the website often provides tools for estimating property taxes and understanding local tax rates, which can help homeowners plan their finances effectively.

Steps to complete the Washington County Tax Assessor

Completing the Washington County Tax Assessor form involves several steps to ensure accurate assessment and compliance. First, gather all necessary documents related to property ownership, including deeds and previous tax statements. Next, access the online form via the Washington County official website. Fill out the required fields, providing accurate information about the property, such as its location, size, and any improvements made. Once completed, review the form for accuracy before submitting it electronically or by mail, depending on your preference.

Legal use of the Washington County Tax Assessor

The legal use of the Washington County Tax Assessor’s services is governed by state and local laws. Property owners have the right to appeal their property assessments if they believe the valuation is inaccurate. This process typically requires submitting an appeal form to the assessor’s office within a specified timeframe. It is essential for property owners to understand their rights and obligations under the law, as well as the procedures for contesting assessments to ensure compliance with all legal requirements.

Required Documents

When interacting with the Washington County Tax Assessor, certain documents are typically required to facilitate the assessment process. These may include:

- Property deed or title

- Previous property tax statements

- Documentation of property improvements or renovations

- Any relevant appraisal reports

Having these documents ready can streamline the process and help ensure accurate assessments.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms to the Washington County Tax Assessor can be done through various methods to accommodate different preferences. Property owners can complete and submit forms online via the official website, which is often the most efficient option. Alternatively, forms can be printed, filled out manually, and mailed to the assessor's office. For those who prefer direct interaction, in-person submissions are also accepted at the county office. It is important to check the specific submission guidelines and deadlines for each method to ensure timely processing.

Quick guide on how to complete washington county tax assessor

Complete Washington County Tax Assessor effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and digitally sign your documents promptly without delays. Manage Washington County Tax Assessor on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and electronically sign Washington County Tax Assessor with ease

- Locate Washington County Tax Assessor and click Get Form to commence.

- Use the tools we provide to fill out your document.

- Highlight important portions of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or an invitation link, or simply download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and electronically sign Washington County Tax Assessor to ensure effective communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the washington county tax assessor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Washington County Assessor?

The Washington County Assessor is responsible for determining the value of properties for tax purposes. This includes assessing real estate and personal property within the county, ensuring that property taxes are fairly and accurately assessed. Understanding the role of the Washington County Assessor can help you better navigate property tax obligations.

-

How can I contact the Washington County Assessor's office?

You can contact the Washington County Assessor's office via phone or through their official website. They provide various methods of communication to help you with inquiries, such as property assessments or tax questions. It’s best to check their hours of operation for prompt assistance regarding your concerns.

-

Are there any fees associated with services provided by the Washington County Assessor?

Yes, the Washington County Assessor may charge fees for certain services, such as property tax appeal filings or obtaining property information. It’s advisable to visit their official website or contact their office directly for a detailed fee schedule. Understanding these fees can help you better plan your budget regarding property assessments.

-

What information is needed for a property assessment from the Washington County Assessor?

When requesting a property assessment from the Washington County Assessor, you typically need to provide detailed information about the property, including its location, size, and any improvements made. This detailed information helps the Assessor accurately appraise the property's value for tax purposes. Accurate documentation can expedite the assessment process.

-

How does the Washington County Assessor determine property values?

The Washington County Assessor determines property values using various methods, including sales comparisons, cost assessments, and income approaches. They analyze market trends and property characteristics to ensure fair and accurate valuations. This process is crucial for maintaining equity in property tax assessments within the county.

-

What are the benefits of understanding your assessment with the Washington County Assessor?

Understanding your assessment with the Washington County Assessor can help you ensure that your property taxes are fair and accurate. It allows you to recognize if there are discrepancies that may warrant a formal appeal. Ultimately, this knowledge can save you money and provide peace of mind regarding your property tax responsibilities.

-

Can I appeal my property assessment through the Washington County Assessor's office?

Yes, property owners can appeal their assessment through the Washington County Assessor's office if they believe their property has been inaccurately valued. The appeal process typically involves submitting a formal application along with evidence supporting your claim. Early action is advisable to adhere to prescribed timelines for appeals.

Get more for Washington County Tax Assessor

Find out other Washington County Tax Assessor

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document