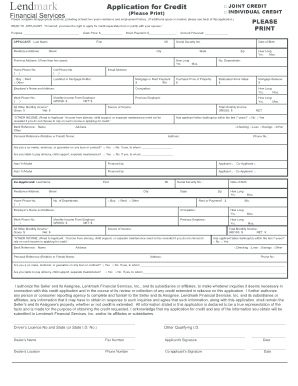

Window Works Lendmark BApplicationb for BCreditb Form

Understanding the Lendmark Financial Application for Credit

The Lendmark Financial application for credit is designed to assist individuals seeking financial support through personal loans. This application allows potential borrowers to provide essential information that lenders use to assess creditworthiness. It typically requires details such as income, employment status, and existing debts. Understanding the application process is crucial for anyone looking to secure a loan, especially for those with varying credit scores.

Steps to Complete the Lendmark Financial Application for Credit

Completing the Lendmark Financial application involves several straightforward steps:

- Gather necessary documents, including proof of income and identification.

- Visit the official Lendmark Financial website to access the application form.

- Fill out the application with accurate personal and financial information.

- Review the application for completeness and accuracy before submission.

- Submit the application electronically for processing.

Following these steps ensures that your application is processed smoothly, increasing your chances of approval.

Eligibility Criteria for Lendmark Financial Loans

To qualify for loans through Lendmark Financial, applicants must meet specific eligibility criteria. Generally, these include:

- Being at least eighteen years old.

- Having a steady source of income.

- Possessing a valid Social Security number.

- Meeting the minimum credit score requirements, which may vary based on the loan type.

Understanding these criteria helps applicants prepare adequately before starting the application process.

Legal Use of the Lendmark Financial Application for Credit

The Lendmark Financial application for credit is legally binding once submitted. It is essential for applicants to provide truthful and accurate information. Misrepresentation can lead to legal consequences, including denial of the loan or potential legal action. Compliance with federal and state regulations is critical to ensure the application process is valid and secure.

Required Documents for the Lendmark Financial Application

When applying for a loan with Lendmark Financial, several documents are typically required to support your application. These may include:

- Proof of income, such as recent pay stubs or tax returns.

- Identification documents, like a driver's license or passport.

- Bank statements to verify financial stability.

- Any additional documentation that may be requested based on individual circumstances.

Having these documents ready can expedite the application process and improve the chances of approval.

Application Process and Approval Time for Lendmark Financial Loans

The application process for Lendmark Financial loans is designed to be efficient and user-friendly. Once the application is submitted, the review process typically takes a few business days. Applicants may receive updates via email or phone regarding their loan status. Understanding this timeline helps manage expectations and prepares applicants for the next steps in securing their loan.

Quick guide on how to complete window works lendmark bapplicationb for bcreditb

Complete Window Works Lendmark BApplicationb For BCreditb effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Window Works Lendmark BApplicationb For BCreditb on any device with airSlate SignNow's Android or iOS apps and simplify any document-based task today.

The easiest way to modify and eSign Window Works Lendmark BApplicationb For BCreditb without breaking a sweat

- Find Window Works Lendmark BApplicationb For BCreditb and click Get Form to commence.

- Use the tools we provide to complete your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click the Done button to secure your changes.

- Choose how you wish to send your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any chosen device. Modify and eSign Window Works Lendmark BApplicationb For BCreditb to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the window works lendmark bapplicationb for bcreditb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the main lendmark loan requirements PDF that I need to be aware of before applying?

Before applying for a lendmark loan, it's essential to review the lendmark loan requirements PDF. This document typically includes age, income, and identification verification criteria that applicants must meet to qualify. Understanding these requirements can streamline your application process.

-

Where can I find the lendmark loan requirements PDF for detailed information?

You can typically obtain the lendmark loan requirements PDF on the official lendmark website or through authorized lenders. This PDF provides crucial insights into eligibility, necessary documentation, and application processes, ensuring you're well-prepared before applying.

-

What features does the lendmark loan requirements PDF highlight about the application process?

The lendmark loan requirements PDF highlights various features of the loan application process, such as online submission options and required documentation. It often outlines the steps you need to take to expedite your application. By understanding these features, you can efficiently navigate the process.

-

Are there any fees associated with the lendmark loan that are mentioned in the PDF?

Yes, the lendmark loan requirements PDF typically details any associated fees, including origination fees or late payment penalties. Understanding these costs upfront can help you make informed financial decisions before applying for your loan.

-

How can I use the information in the lendmark loan requirements PDF to improve my chances of approval?

By carefully reviewing the lendmark loan requirements PDF, you can prepare the necessary documents and ensure that you meet all eligibility criteria. This proactive approach can signNowly enhance your chances of loan approval, as it demonstrates your preparedness and understanding of the requirements.

-

What benefits does understanding the lendmark loan requirements PDF provide to prospective borrowers?

Understanding the lendmark loan requirements PDF provides several benefits, including clarity on eligibility and preparation for the application process. This knowledge can reduce stress and the likelihood of application errors, leading to a smoother borrowing experience.

-

Does the lendmark loan requirements PDF mention acceptable credit scores for approval?

Yes, the lendmark loan requirements PDF usually mentions acceptable credit score ranges for loan approval. Knowing this information allows you to assess your credit standing beforehand and take necessary actions to improve your score if needed.

Get more for Window Works Lendmark BApplicationb For BCreditb

Find out other Window Works Lendmark BApplicationb For BCreditb

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now