It 8879 Form

What is the It 8879

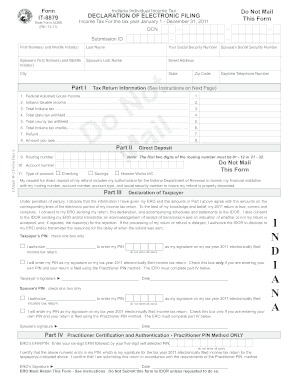

The It 8879 form, also known as the IRS e-file Signature Authorization, is a critical document used by taxpayers in the United States to authorize an electronic return. This form is particularly important for those who file their taxes electronically through a tax professional or software. By signing the It 8879, taxpayers confirm that the information provided in their tax return is accurate and complete, allowing the tax preparer to submit the return on their behalf.

How to use the It 8879

Using the It 8879 form involves a straightforward process. Taxpayers must first complete their tax return using approved software or through a tax professional. Once the return is prepared, the taxpayer must review the information for accuracy. After confirming that all details are correct, the taxpayer will sign the It 8879 form. This signature can be done electronically, ensuring a seamless transition to e-filing. The signed form must then be submitted to the tax preparer, who will use it to file the return electronically with the IRS.

Steps to complete the It 8879

Completing the It 8879 form requires attention to detail. Here are the essential steps:

- Prepare your tax return using tax software or with the help of a tax professional.

- Review the completed tax return for accuracy.

- Fill out the It 8879 form with your personal information, including your name, Social Security number, and the tax year.

- Sign the form electronically or manually, depending on the method used.

- Submit the signed It 8879 to your tax preparer.

Key elements of the It 8879

The It 8879 form includes several key elements that ensure its validity and compliance with IRS regulations. These elements include:

- Taxpayer Information: This section requires the taxpayer's name, Social Security number, and address.

- Tax Preparer Information: Details about the tax professional or software used to prepare the return.

- Signature Section: The taxpayer must sign and date the form to authorize the electronic filing.

- Confirmation of Accuracy: A statement confirming that the taxpayer has reviewed the return and that all information is correct.

Legal use of the It 8879

The legal use of the It 8879 form is governed by IRS regulations regarding electronic signatures. When properly signed, the It 8879 serves as a legally binding document that allows for the electronic submission of tax returns. It is essential that taxpayers understand the implications of signing this form, as it confirms their responsibility for the accuracy of the tax return filed. Compliance with IRS guidelines ensures that the electronic signature holds the same weight as a traditional handwritten signature.

Filing Deadlines / Important Dates

Filing deadlines for the It 8879 are aligned with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file, which can extend the deadline to October 15. It is crucial to complete the It 8879 and submit it to the tax preparer before these deadlines to ensure timely filing.

Quick guide on how to complete it 8879

Effortlessly prepare It 8879 on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Manage It 8879 on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign It 8879 without hassle

- Locate It 8879 and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form, either via email, SMS, or invitation link, or download it to your computer.

Forget about missing or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign It 8879 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 8879

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an 8879 form?

The 8879 form is an IRS e-file signature authorization document that allows taxpayers to electronically file their tax returns. By using airSlate SignNow, you can easily send and eSign the 8879 form, streamlining the tax filing process without the need for paper.

-

How does airSlate SignNow simplify the process of using an 8879 form?

airSlate SignNow simplifies the use of the 8879 form by providing a user-friendly platform for document management. Users can quickly prepare, send, and eSign the 8879 form, making it more efficient to ensure all tax-related documents are processed accurately and on time.

-

Is there a cost to use the airSlate SignNow service for the 8879 form?

Yes, airSlate SignNow has a range of pricing plans tailored to different business needs. These plans include features like unlimited templates and cloud storage, making the process of managing the 8879 form cost-effective for your organization.

-

What benefits does airSlate SignNow offer for managing the 8879 form?

By utilizing airSlate SignNow for the 8879 form, businesses benefit from faster turnaround times and improved accuracy in eSigning. Additionally, the platform provides secure storage and tracking of your document, ensuring compliance and peace of mind.

-

Can I integrate airSlate SignNow with my existing software for the 8879 form?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easy to manage and eSign the 8879 form seamlessly within your existing workflow. This functionality enhances productivity and reduces the risk of errors in your tax submissions.

-

What features should I look for in an eSignature solution for the 8879 form?

When considering an eSignature solution for the 8879 form, look for features like ease of use, compliance with IRS regulations, secure document storage, and the ability to customize workflows. airSlate SignNow provides all these features, making it a top choice for businesses.

-

Is airSlate SignNow user-friendly for first-time users of the 8879 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for first-time users to navigate and use the platform effectively. With step-by-step guides and an intuitive interface, anyone can quickly learn how to eSign and manage the 8879 form.

Get more for It 8879

Find out other It 8879

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors