Rpd 41373 Form

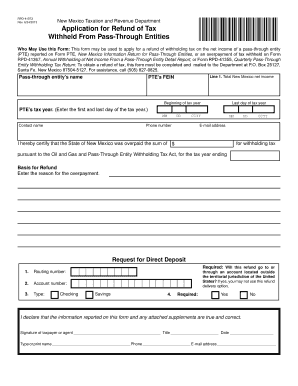

What is the RPD 41373?

The RPD 41373 is a form issued by the New Mexico Taxation and Revenue Department. It serves as a declaration of the status of a business entity for tax purposes. This form is essential for businesses operating within New Mexico to ensure compliance with state tax regulations. By accurately completing the RPD 41373, businesses can clarify their tax obligations and maintain good standing with state authorities.

How to use the RPD 41373

To effectively use the RPD 41373, businesses must first gather the necessary information about their entity type, ownership structure, and tax identification numbers. The form requires details such as the business name, address, and the type of business entity, whether it is a corporation, partnership, or sole proprietorship. Once the information is compiled, it can be entered into the form, ensuring all fields are completed accurately to avoid delays or issues with processing.

Steps to complete the RPD 41373

Completing the RPD 41373 involves several key steps:

- Gather all necessary documentation, including your business identification number and ownership details.

- Fill out the form with accurate information regarding your business entity type and structure.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method, whether online or by mail, as specified by the New Mexico Taxation and Revenue Department.

Legal use of the RPD 41373

The RPD 41373 is legally binding when completed and submitted correctly. It is crucial for businesses to understand that any inaccuracies or false representations on the form can lead to penalties or legal repercussions. Compliance with the form's requirements ensures that businesses fulfill their tax obligations and avoid potential audits or fines from state authorities.

Key elements of the RPD 41373

Several key elements must be included in the RPD 41373 for it to be valid:

- Business name and address

- Tax identification number

- Type of business entity

- Owner or responsible party's information

Each of these elements plays a critical role in identifying the business and ensuring accurate tax reporting.

Who Issues the Form

The RPD 41373 is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for overseeing tax compliance and administration within New Mexico. Businesses should refer to the department's resources for any updates or changes to the form or its requirements.

Quick guide on how to complete rpd 41373

Effortlessly Prepare Rpd 41373 on Any Device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Rpd 41373 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Rpd 41373 effortlessly

- Locate Rpd 41373 and click on Get Form to initiate.

- Utilize our provided tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your amendments.

- Select how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Banish the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Rpd 41373 while ensuring outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41373

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rpd 41373 and how does it integrate with airSlate SignNow?

The rpd 41373 is a specific document format used within the airSlate SignNow platform. It facilitates seamless electronic signing and document management. By leveraging rpd 41373, businesses can ensure their documents remain compliant and easily accessible.

-

How much does it cost to use airSlate SignNow with rpd 41373?

airSlate SignNow offers competitive pricing options for users working with rpd 41373. Plans start at a monthly subscription that accommodates various business needs. Contact airSlate's sales team for custom quotes based on your volume and specific requirements.

-

What features does airSlate SignNow offer for rpd 41373 documents?

airSlate SignNow provides robust features for managing rpd 41373 documents, including templates, team collaboration tools, and secure storage. Additionally, it enhances workflows with automated reminders and tracking capabilities, ensuring a smooth signing process.

-

What are the benefits of using airSlate SignNow for rpd 41373?

Using airSlate SignNow for rpd 41373 offers numerous benefits, including improved efficiency and reduced turnaround time for document signing. The platform's user-friendly interface allows organizations to streamline their document workflows, enhancing productivity and compliance.

-

Are there any integrations available for rpd 41373 with airSlate SignNow?

Yes, airSlate SignNow supports multiple integrations with software solutions that can handle rpd 41373 documents seamlessly. This enables users to connect their existing applications, such as CRMs or project management tools, enhancing overall workflow efficiency.

-

Is airSlate SignNow suitable for all business sizes when dealing with rpd 41373?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, including those handling rpd 41373 documents. Its scalable features make it an ideal solution for startups, mid-sized companies, and large enterprises alike.

-

Can I customize templates for rpd 41373 documents in airSlate SignNow?

Yes, airSlate SignNow allows users to customize templates for rpd 41373 documents according to their specific needs. This feature helps ensure that all necessary fields are included, improving the signing experience for all parties involved.

Get more for Rpd 41373

Find out other Rpd 41373

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format